Audio By Carbonatix

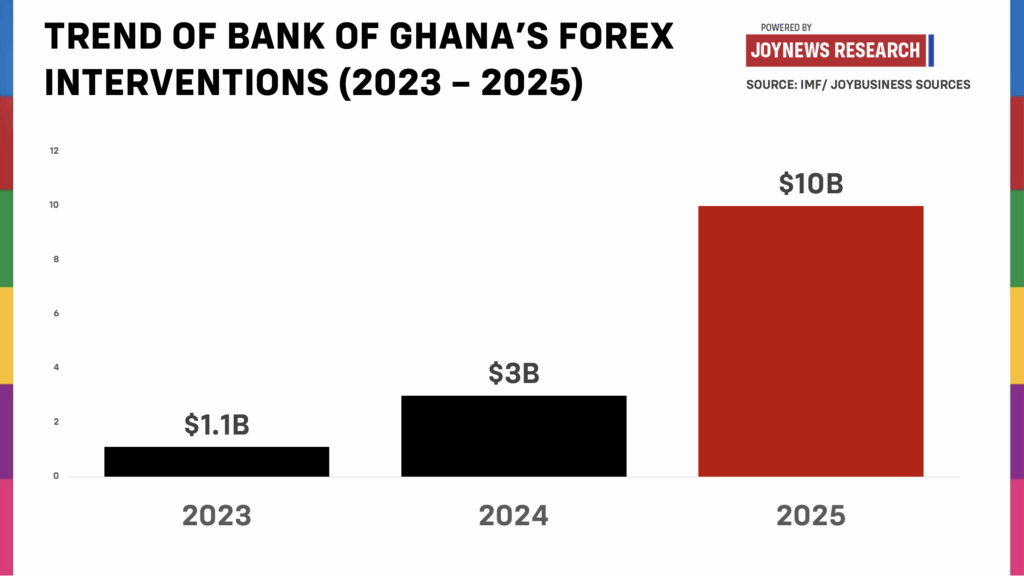

The Bank of Ghana is reported to have supplied about $10 billion to the foreign exchange market in 2025 through what it describes as a forex intermediation framework rather than a direct intervention.

Earlier in the year, the IMF raised concerns when the Bank used $1.4 billion within the first three months of 2025.

The Fund did not oppose interventions in principle. It insisted that interventions must be transparent, limited and consistent with a market determined exchange rate rather than an attempt to hold the currency at a fixed level.

The Bank of Ghana pledged to introduce a clear intermediation policy by the end of September, and it has now done so. The Bank publicly announces the amount it intends to inject each month to improve transparency and signal that the system remains guided by market conditions.

In October, the Bank announced an intervention of $1.15 billion. This was followed by $1 billion in November and $800 million in December.

Excluding the first quarter’s $1.4 billion, the Bank supplied approximately $6 billion from April to September, averaging about $1 billion each month.

When market players do not take up the full amount offered, the Bank adds the remainder to its reserves.

Ghana’s reserves now stand at $11.4 billion or 4.8 months of import cover, the highest level recorded since the economic crisis.

These developments raise three central questions. How is the Bank obtaining such large volumes of dollars. Is this pace of intervention sustainable. And do the reserves face significant risk.

Before Ghana lost access to the Eurobond market, the country could raise as much as $3 billion annually from 2019 to 2021 and about $1 billion in the years prior.

Combined with gold, cocoa and to some extent oil exports, these were the main sources of foreign exchange support for the cedi.

Once Ghana became locked out of the international capital market, the country depended heavily on gold and cocoa exports.

In 2025, gold has become the dominant factor. The return of Donald Trump to the White House and broader geopolitical tensions have pushed gold prices to unprecedented levels.

The average gold price in 2024 was about $2,300 per ounce. In 2025, prices crossed $4,000 for the first time and currently hover around $4,200.

This surge is the primary reason the Bank of Ghana has been able to intervene so aggressively in the forex market.

A second dimension to the Bank’s interventions relates to the establishment of the Ghana Gold Board. The Board was originally expected to be financed by a $279 million revolving fund from central government.

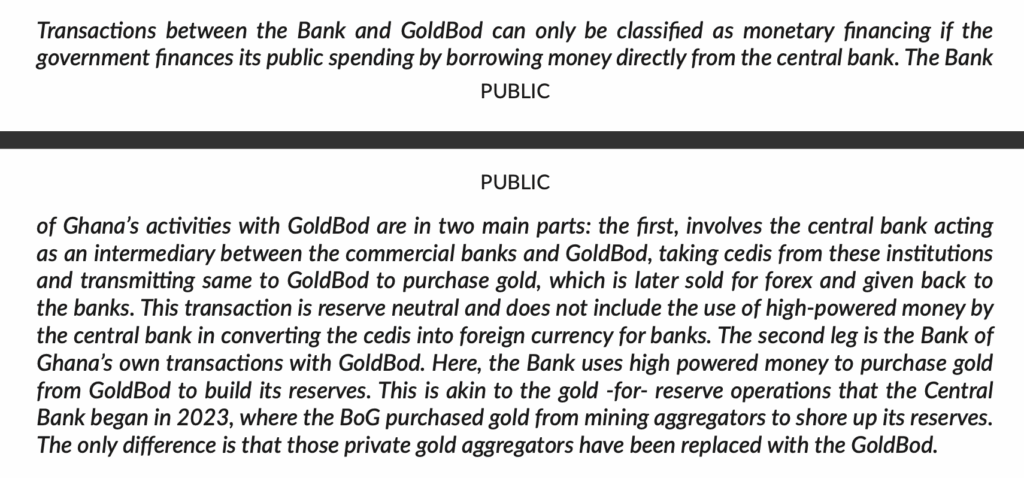

That model appears to have changed. The Gold Board is now being financed in a more complex manner through the commercial banks and the Bank of Ghana.

In the first model, the Bank of Ghana collects cedis from commercial banks and forwards the funds to the Gold Board to purchase gold from small scale miners.

The gold is then sold and the dollar value is returned to the Bank, which then supplies the commercial banks with the dollars they require.

In the second model, the Bank of Ghana uses "high powered money" to purchase gold directly from the Gold Board.

The gold is either sold for foreign exchange which is then added to reserves or refined and added to Ghana’s gold reserves.

This second approach carries an inflation risk because the Bank injects new money into the economy for gold purchases. The Bank has been mopping up liquidity aggressively which has limited the inflationary impact, but the balance remains delicate and requires caution.

According to the Bank, the $10 billion was not used solely to support the cedi. It also supported payments to independent power producers, payments to bondholders and other debt service obligations. The ability to meet these demands depends heavily on gold prices.

A sharp fall in gold prices would leave the economy significantly exposed. Analysts at JP Morgan expect gold prices to continue rising in the short term which is positive for Ghana, yet no sustainable economy can rely indefinitely on commodity prices.

Greater focus is needed on value addition for Ghana’s raw materials, including the planned gold traceability system and the operationalization of Ghana’s gold refineries.

Non-traditional exports and the industrial sector require meaningful support so that the country can diversify its sources of foreign exchange and reduce its dependence on commodity windfalls.

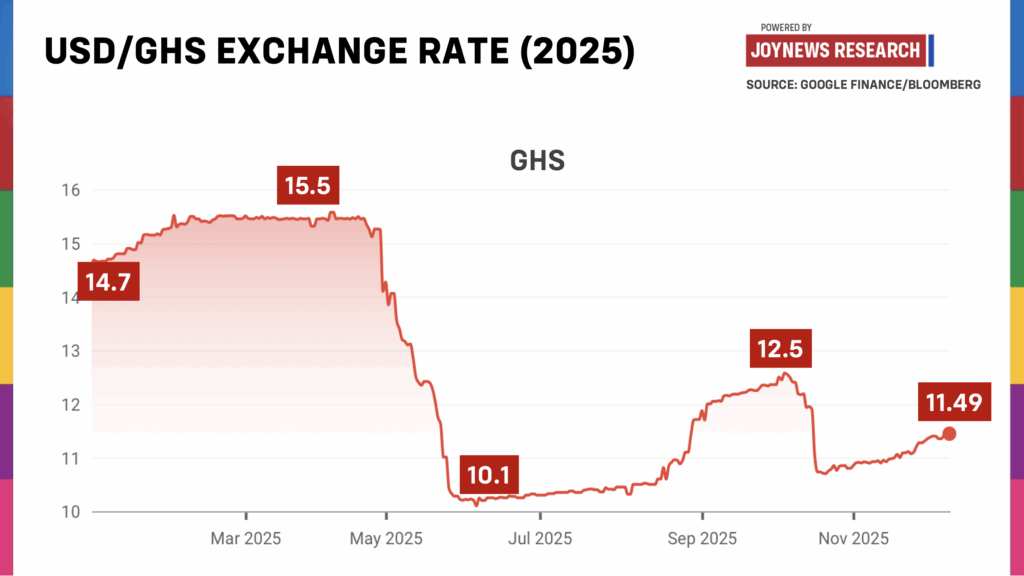

The Bank’s heavy intermediations have kept the cedi relatively strong, yet this strength sits uneasily with the weak performance of industry in the third quarter of 2025.

Defending a stronger currency has helped to stabilize inflation and reduce debt obligations, but it also undermines the competitiveness of Ghana’s exports. The mismatch underscores the need to strengthen the country’s productive base and ensure that exchange rate policy supports, rather than constrains, long term economic growth.

Ghana has benefited from a rare combination of high gold prices and renewed confidence in the Bank’s policy framework. Yet these conditions will not last forever.

The country’s long-term stability will depend less on the volume of dollars the Bank can inject and more on whether Ghana can build an economy that earns foreign exchange through productive growth.

A sustained recovery will require structural reforms that expand value addition, strengthen non-traditional exports and reduce the economy’s vulnerability to global commodity cycles.

Without that shift, no amount of intervention will shield the cedi or the broader economy when gold prices eventually turn.

Watch the full analysis on JoyNews’ Beyond the Numbers here:

Latest Stories

-

Fire guts Saboba Hospital’s Children Ward

2 hours -

Interior Ministry extends aptitude test dates for WASSCE applicants in 2025/26 security services recruitment

2 hours -

National Investment Bank donates GH₵1m to support GAF barracks redevelopment project

3 hours -

Gomoa-East demolition: 14 suspects remanded by Kasoa Ofaakor Court

4 hours -

Divers recover bodies of seven Chinese tourists from bottom of Lake Baikal

5 hours -

From windstorm to resilience: How Wa school is growing climate protection

6 hours -

Reclaiming the Garden City: Dr. Kwame Adinkrah urges Kumasi to rein in billboard proliferation

6 hours -

Bursar of Ghanata SHS arrested for alleged diversion of student food supplies

6 hours -

Trump says he will increase global tariffs to 15%

6 hours -

Bogoso-Prestea mine records first gold pour after 24-month shutdown

6 hours -

Ghana–ECOWAS talks end with renewed push for women and youth political inclusion

7 hours -

Interior Minister receives Hudai Foundation food donation for prison inmates during Ramadan

7 hours -

UBIDS to benefit from pre-fabricated US$6.6m 1k capacity classroom project

7 hours -

Interior Minister launches Automated Fire Safety Compliance System to enhance public safety

7 hours -

Africa must lead climate intervention conversation – Experts

7 hours