Audio By Carbonatix

A Right to Information (RTI) request filed by Asempa FM’s Ekosiisen programme has prompted the Bank of Ghana (BoG) to release detailed data on losses incurred under its Domestic Gold Purchase and Gold-for-Reserve programmes for previous years, while leaving figures for 2025 undisclosed.

The RTI request, submitted on January 7, 2026, by Ekosiisen host Philip Osei Bonsu, sought clarity on the financial performance of the state’s Gold-for-Reserve (G4R) programme amid public debate over claims of a US$214 million loss reportedly flagged by the International Monetary Fund (IMF).

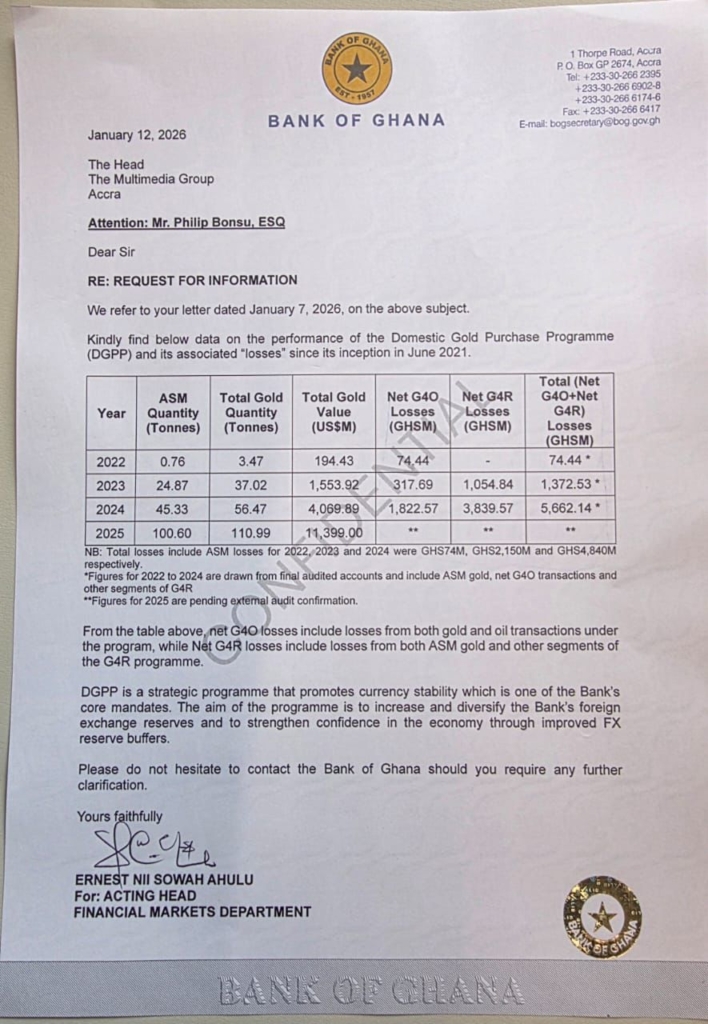

In its formal response dated January 12, 2026, the Bank of Ghana provided year-by-year data covering gold quantities purchased, total values and net losses for 2022, 2023 and 2024. However, the central bank left loss figures for 2025 blank, explaining that the year’s results are “pending external audit confirmation”.

Read Also: Asempa FM’s Ekosiisen files RTI request over State’s $214m loss from Gold-for-Reserve programme

According to the BoG’s disclosure, total net losses stood at GH¢74.44 million in 2022, GH¢1.37 billion in 2023 and GH¢5.66 billion in 2024. These losses were recorded under the Gold for Oil (G40) and Gold for Reserves (G4R) programmes, including transactions involving artisanal and small-scale mining (ASM) gold.

For 2025, the Bank disclosed that gold purchases rose sharply to 110.99 tonnes, valued at approximately US$11.4 billion, but declined to state the associated losses, citing the absence of a final audited report.

“Figures for 2022 to 2024 are drawn from final audited accounts,” the Bank noted, adding that 2025 data would only be confirmed after the conclusion of the external audit process.

The RTI request referenced Article 21(f) of the 1992 Constitution and the Right to Information Act, 2019 (Act 989), and asked the BoG to provide annual gold purchase volumes, total values and a year-by-year account of profits or losses since the programme’s inception.

The request followed the IMF’s Fifth Review Report under Ghana’s Extended Credit Facility, which cited trading shortfalls and high off-taker fees as contributing factors to an alleged US$214 million loss within the first nine months of 2025. The Bank of Ghana has described those figures as speculative.

In its response, the central bank defended the strategic intent of the programme, describing it as a core tool for currency stabilisation, reserve accumulation and confidence-building in the economy. It maintained that net G40 losses include losses from both gold and oil transactions, while net G4R losses cover ASM gold and other programme components.

The debate has been further shaped by comments from the Chief Executive Officer of the Ghana Gold Board (GoldBod), Sammy Gyamfi, who recently stated that GoldBod generated an income surplus of over GH¢960 million in 2025. He argued that reported BoG trading costs should be viewed as operational expenses rather than national economic losses, particularly against the backdrop of over US$8 billion in foreign exchange mobilised.

Until the Bank of Ghana publishes its fully audited 2025 accounts, the true financial outcome of the Gold-for-Reserve programme remains unresolved, even as scrutiny and calls for transparency continue to intensify.

Latest Stories

-

Daily Insight for CEOs: Prioritising scalable opportunities

6 minutes -

Death toll in ‘surprise’ attack in South Sudan rises to 178, local official says

8 minutes -

Chief Imam condemns killing of Iran’s supreme leader, calls for peace and respect for sovereignty

10 minutes -

Mental Resilience in Banking: Maintaining cognitive balance in high-stress financial decisions

17 minutes -

High Court dismisses bid to halt DVLA’s 2026 vehicle number plate contract

20 minutes -

The book of orphans with parents

54 minutes -

Liberia’s Ambassador to Ghana condoles family of slain Liberian, urges Justice

59 minutes -

The Kenkey Festival: 10 years of cultural projection through cuisine

1 hour -

Prayer or Poison? The deadly cost of fake prophets and miracle materials in Ghana

1 hour -

Seven decades of faith: Rev. Christie Doe Tetteh launches 70th birthday celebrations

1 hour -

Climate Evidence: Illegal logging of shea and other economic trees driving deforestation in Upper West

1 hour -

Bili Odum Writes: I am the blocker…

1 hour -

Ayawaso East by-election: I’ve advised all my supporters to stay calm and law-abiding – Baba Jamal

2 hours -

Chief of Staff’s committee completes review of 2,080 post-election public service appointments

2 hours -

Bush burning and biodiversity: Bonyanto’s 10-year model of zero-fire record

2 hours