Audio By Carbonatix

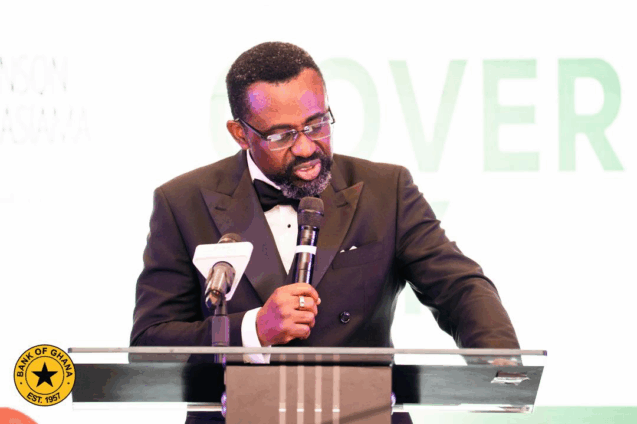

Governor of the Bank of Ghana (BoG), Dr Johnson Asiama, says a new wave of legislative and policy reforms will serve as a critical firewall against any return to the kind of financial crisis that plunged Ghana into economic distress just three years ago.

Speaking at the listing of First Atlantic Bank on the Ghana Stock Exchange, Dr. Asiama said recent amendments to the Bank of Ghana Act, approved by Parliament, are central to restoring confidence and strengthening the independence of the central bank.

He noted that the reforms are designed to prevent a repeat of the excesses and structural weaknesses that culminated in the Domestic Debt Exchange Programme.

He added that complementary reforms introduced by the Ministry of Finance are reinforcing Ghana’s macroeconomic framework and laying the groundwork for a more resilient and disciplined financial system.

Reflecting on the recent past, Dr Asiama recalled what the World Bank described as a “homegrown crisis,” when inflation surged to 54.1 per cent at the end of 2022, and the cedi lost more than half of its value between 2022 and 2023.

At the time, foreign exchange reserves fell to less than half a month of import cover, the lowest level recorded in decades.

“The crisis battered confidence across the financial system,” he said, pointing to the severe impact on capital markets amid fiscal stress and extreme exchange-rate volatility.

While the Domestic Debt Exchange Programme was unavoidable, he noted that it placed heavy strain on banks, institutional investors and capital markets, exposing deep vulnerabilities in Ghana’s narrowly structured financial system and severely testing balance sheets.

“The lesson is clear,” Dr Asiama said. “Sustainable stability requires strong institutions, diversified funding, deep markets and shared ownership, not just short-term fixes.”

He stressed that Ghana’s recovery is now “real, measurable and meaningful.”

Inflation has dropped sharply to 6.3 per cent as of the end of November 2025 and could fall closer to 5 per cent by year-end, potentially the lowest level in many years. The cedi has also appreciated by more than 24 per cent year-to-date, supported by tighter monetary policy, stronger external buffers and improved fiscal discipline.

Dr Asiama cautioned against overreading the currency’s performance, noting that the gains follow a 19 per cent depreciation the previous year and largely represent a correction rather than an unsustainable surge.

“This is not a real appreciation to be concerned about,” he said, stressing that the currency’s strength is anchored in improved macroeconomic fundamentals.

Gross international reserves have climbed above US$11 billion, providing close to five months of import cover, while GDP growth reached 6.3 per cent in the first half of 2025, with non-oil growth nearing 8 per cent.

“These outcomes reflect discipline and coordination across policy institutions,” the Governor said, adding that Ghana’s recovery must now be consolidated through sustained reform.

Latest Stories

-

Mahama to open African Court judicial year in Arusha, mark 20th anniversary

2 minutes -

Ghana begins partial evacuation of Tehran Embassy as Middle East tensions escalate

16 minutes -

EPA tightens surveillance on industries, moves to cut emissions with real-time monitoring system

31 minutes -

Police conduct show of force exercise ahead of Ayawaso East by-election

2 hours -

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

3 hours -

AI to transform 49% of jobs in Africa within three years – PwC Survey

3 hours -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

3 hours -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

4 hours -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

4 hours -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

4 hours -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

4 hours -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

4 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

4 hours -

GHATOF leadership pays courtesy call on Chief of Staff, Julius Debrah

4 hours -

KiDi unleashes first single of the year ‘Babylon’

5 hours