Audio By Carbonatix

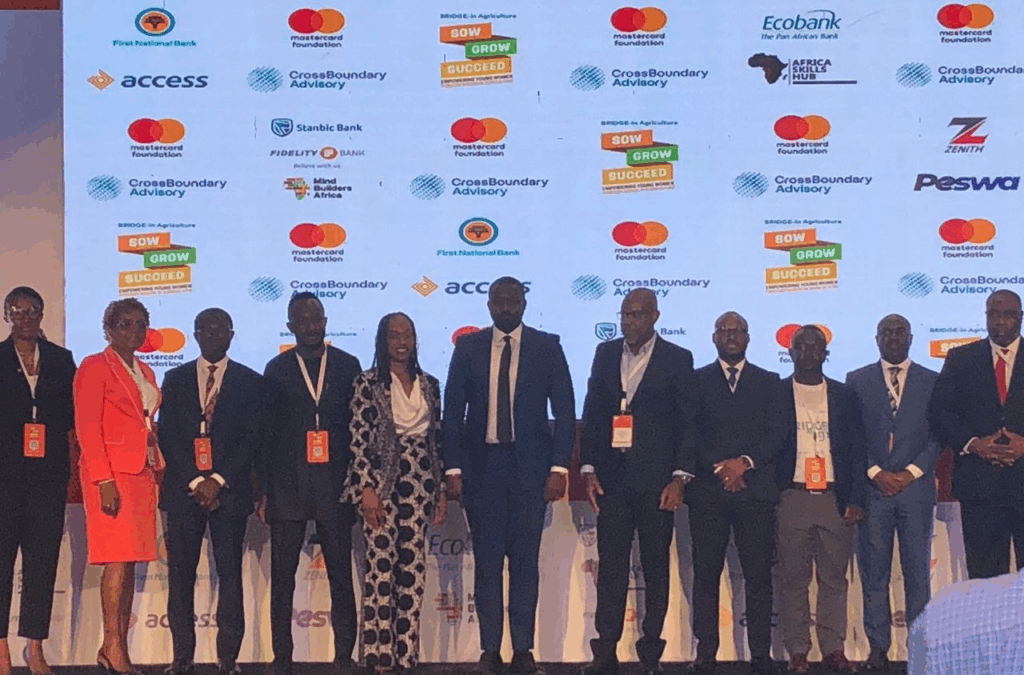

A new $87 million push has been launched to transform Ghana’s agricultural landscape, fuelled by a bold collaboration between the Mastercard Foundation and CrossBoundary Advisory.

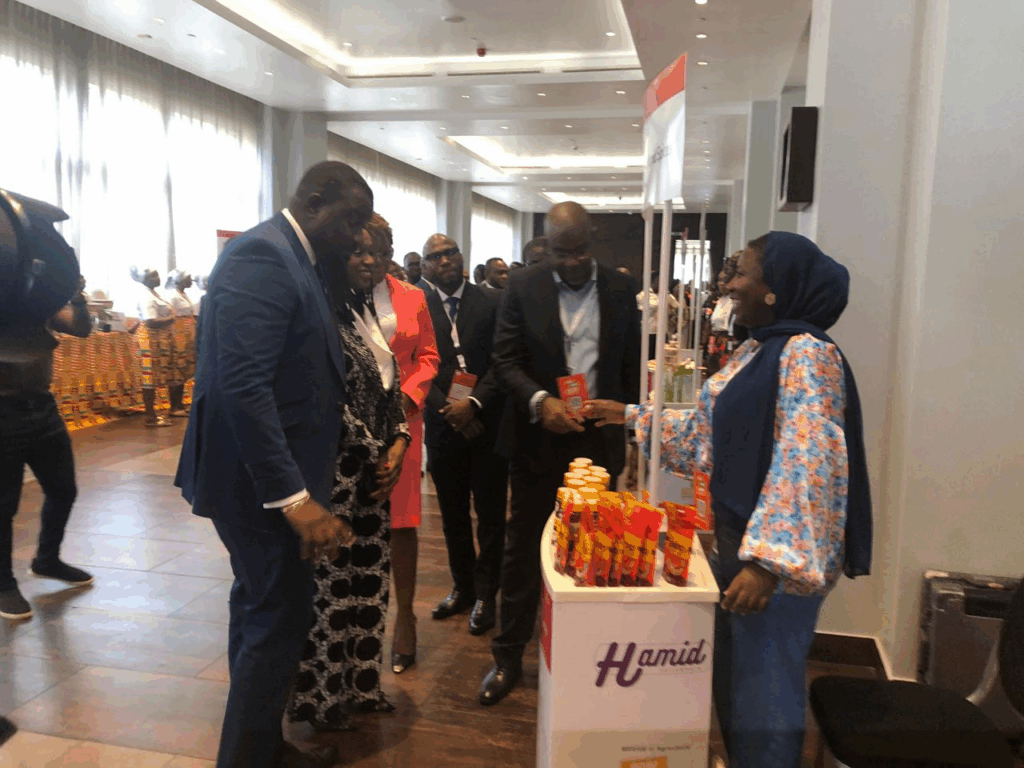

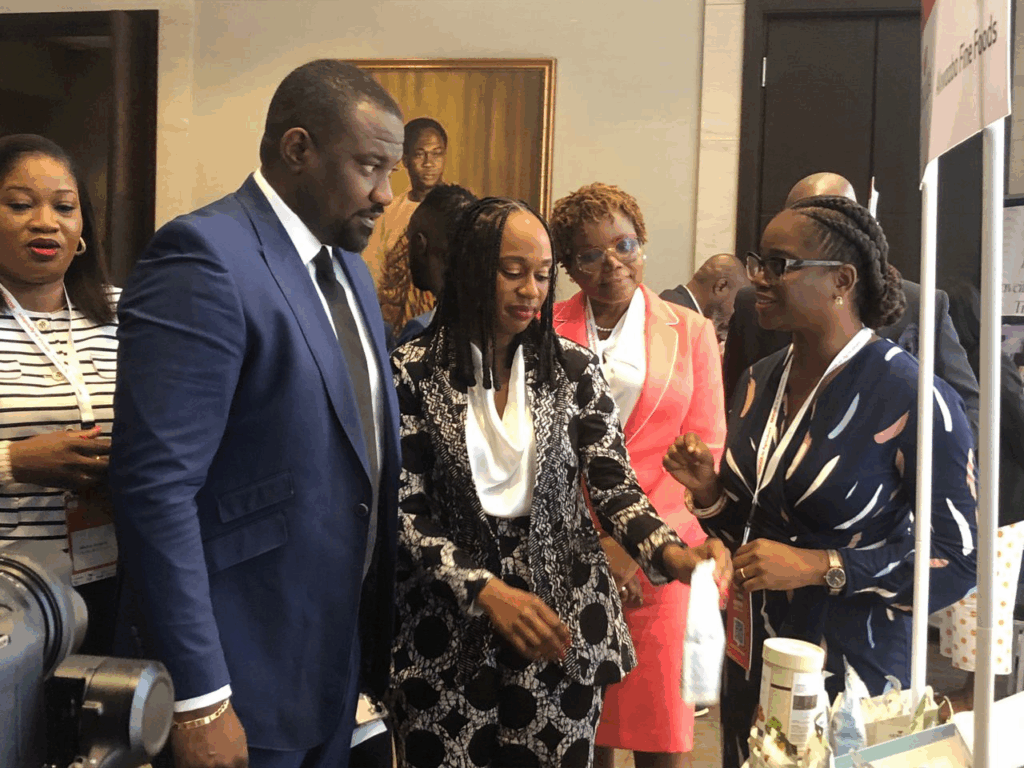

Dubbed the BRIDGE-in Agriculture Programme, the initiative promises affordable capital and technical support to Small and Medium Enterprises (SMEs) in agriculture and allied sectors.

With loan interest rates capped at just 7%, the programme offers a financial lifeline to agribusinesses, especially those led by women and youth.

It’s not just about money. Beneficiaries will also receive hands-on training to build capacity and resilience in a sector long plagued by chronic underinvestment.

Launched on Thursday, May 29, the event saw Deputy Minister for Agriculture, John Dumelo, describe the programme as a “strategic breakthrough” in Ghana’s pursuit of inclusive, technology-driven agricultural transformation.

“Agriculture employs close to 40% of Ghana’s total workforce and supports about 75% of the rural population,” Mr Dumelo stated.

“Yet, the sector still faces huge challenges—from lack of finance to climate shocks and poor infrastructure.”

He urged young people to seize the opportunity: “Start small, grow gradually, and you will become bigger one day.”

Fanta Conde, Programme Lead for BRIDGE-in Agriculture, said the initiative was crafted in 2023 as a flagship solution by the Mastercard Foundation.

The Foundation is offering partner banks 0% interest repayable grants to lend to agribusinesses at low rates, with embedded guarantees and coverage for higher monitoring costs.

Already, the programme has impacted around 86,000 Ghanaian youth between 18 and 35, linking them to new or improved work opportunities across the agriculture value chain.

Beyond financing, participants are gaining vocational and digital skills through training provided by business development firms.

These include Africa Skills Hub and Mind Builders Africa, with digital platforms supported by Peswa.

Partner banks—Access Bank, Ecobank, Fidelity Bank, First National Bank, Stanbic Bank, and Zenith Bank—are at the centre of delivery, helping ensure loans reach the hands that need them most.

With agriculture central to Ghana’s economy but held back by persistent gaps, the BRIDGE-in Agriculture Programme could be the shockwave the sector has long waited for—driving growth, innovation, and dignity in work for the next generation of farmers and agripreneurs.

Latest Stories

-

Tragic End: Man who died after hospitals refused him treatment, buried

4 minutes -

Opanin Joseph Kofi Nti

2 hours -

Flights cancelled and new travel warnings issued after Iran strikes

3 hours -

Helicopter crash: Children’s support fund surpasses GH¢10.15m

3 hours -

MobileMoney Ltd breaks silence on viral TikTok fraud claim, urges public to dial 419

4 hours -

Blind refugee found dead in New York after being released by immigration authorities

5 hours -

Stanbic Bank Ghana leads $205m financing for Engineers & Planners

5 hours -

MobileMoney Ltd responds to viral TikTok video by Healwithdiana, advises customers to report fraud on 419

5 hours -

Mobile Money Ltd’s Paapa Osei recognised in Legal 500 GC Powerlist: Ghana 2026

5 hours -

Flights in and out of Middle East cancelled and diverted after Iran strikes

6 hours -

Dr Maxwell Boakye to build 50-bed children’s ward at Samartex Hospital in honour of late mother

6 hours -

One killed and 11 injured at Dubai and Abu Dhabi airports as Iran strikes region

6 hours -

Former MCE, 8 others remain in custody over alleged land fraud in Kumasi

6 hours -

Black Queens players stranded in UAE over Israel-Iran conflict

7 hours -

James Owusu declares bid for NPP–USA chairman, pledges renewal and unity

7 hours