Audio By Carbonatix

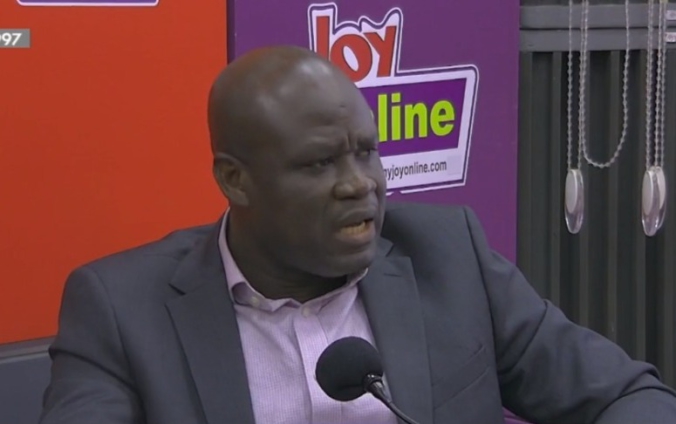

Chief Executive Officer of the Ghana National Chamber of Commerce and Industry, Mark Badu-Aboagye, has urged government not to introduce new taxes as part of the IMF deal.

According to him, businesses are yet to feel the impact of the recently added taxes introduced early this year and the addition of new taxes could worsen an already dire situation.

He noted that currently, businesses are paying about 25 different taxes in levies and charges and that any attempt to generate more tax revenue should not be about adding more taxes but instead widening the tax bracket.

He explained on JoyNews’ PM Express, that while Ghana has a population of 15 million supposed tax payers, only 5 million actually pay their taxes.

Thus increasing taxes will place an unnecessary burden on the captured 5 million further leading to business collapse and a worsening of the economic quandary the country is in.

“I will be very worried to see more taxes, because the impact of the three taxes are now going to be felt. The likelihood that it will push prices up is also there. I get worried when they say that businesses are not paying taxes. I get so much worried. Because if a business is paying about 25 different taxes in levies and charges and you’re saying that they’re not paying taxes I get worried.

“What we have failed to do, when we are comparing our GDP to taxes to other countries is to look at the number of people who are supposed to pay taxes and those who are paying. In Ghana, out of the 15 million, only 5 million are paying. And because they know where you are, and they know where the other businesses are, it’s easy for them to go to them and tax them.

“Just do the same comparison with other countries and look at those who are supposed to pay taxes and those who are paying that is when you will be comparing oranges to oranges. But you can’t just compare apples to oranges and sit down and say Ghanaian businesses are not paying taxes,” he said.

He said the only solution to this is for the tax collection agency and the government to widen the tax bracket and ensure compliance in order to generate the needed revenue.

He said if the government fails to widen the tax bracket and instead increases taxes, the IMF deal will have very little impact in the economy as businesses will still not have enough capital to grow.

“If you calculate the corporate tax, and then add on this growth and sustainability taxes, this excise taxes, these levies and charges, you’re paying around 50%. How can somebody sit down and say businesses are not paying taxes?

“They have to look at how to expand the tax net and also ensure that people are compliant and not always introducing new taxes. So if they’re bringing taxes, they should look at the effect of that tax on businesses. You’ve gotten the IMF funding, but will be the impact of these taxes on businesses.”

Latest Stories

-

Interior Minister receives Gbenyiri Mediation report to resolve Lobi-Gonja conflict

21 minutes -

GTA, UNESCO deepen ties to leverage culture and AI for tourism growth

35 minutes -

ECG completes construction of 8 high-tension towers following pylon theft in 2024

58 minutes -

Newsfile to discuss 2026 SONA and present reality this Saturday

1 hour -

Dr Hilla Limann Technical University records 17% admission surge

1 hour -

Meetings Africa 2026 closes on a high, Celebrating 20 years of purposeful African connections

1 hour -

Fuel prices to increase marginally from March 1, driven by crude price surge

2 hours -

Drum artiste Aduberks holds maiden concert in Ghana

2 hours -

UCC to honour Vice President with distinguished fellow award

2 hours -

Full text: Mahama’s State of the Nation Address

2 hours -

Accra Mayor halts Makola No. 2 rent increment pending negotiations with facility managers

2 hours -

SoulGroup Spirit Sound drops Ghana medley to honour gospel legends

3 hours -

ECG reinforces ‘Operation Keep Light On’ in Ashanti Region

3 hours -

UK remains preferred study destination for Ghanaians – British Council

3 hours -

Ghana Medical Trust Fund: Maame Samma Peprah ignites chain of giving through ‘Kyerɛ Wo Dɔ Drive’

3 hours