The Ghana National Chamber of Commerce and Industry (GNCCI) is warning businesses will be forced to flee the country due to the unbearable tax environment.

This warning follows the passage of three controversial taxes into law by parliament last Friday.

The taxes namely; the Income Tax Amendment Bill, the Excise Duty Amendment Bill, and the Growth and Sustainability Amendment Bill are expected to generate about GH¢4 billion annually.

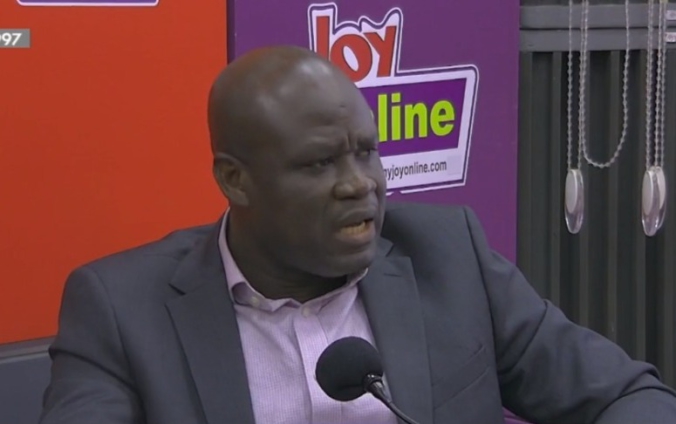

Speaking on JoyNews’ AM Show on Monday, Chief Executive of GNCCI, Mark Badu-Aboagye said businesses will leave the country due to the continuously growing tax burden.

According to him, the businesses will settle in countries that have a conducive environment for their businesses to thrive.

He stated that the passage of the taxes will result in the collapse of businesses and downsizing in some cases.

“Businesses that will not be able to survive here [Ghana] will relocate to other countries and we have seen some of them relocating. Some of them are closing down and going to the neighbouring countries because the business environment is conducive. You are losing taxes on those people that you want to get revenue from,” he pointed out.

Mr Badu-Aboagye also doubted the government's capability to realise the earmarked four billion cedis from these taxes, arguing that there will also be a high incidence of tax avoidance.

“The incidence of these taxes is on businesses and the incidence of these taxes is on consumers of products of the businesses. Now, while the taxes that they have passed, businesses are supposed to pay and as I have said earlier, you can only tax me when I make profit … if I don’t make profit how do you tax me?” he questioned.

In a related development, the Ghana Union of Traders Association (GUTA) has also reacted furiously to the passage of the taxes, insisting Parliament has failed Ghanaians.

This the PRO of GUTA, Joseph Padi explained, is because the timing for the passage of the three taxes is bad.

“In fact, Parliament has failed us, we thought they were working for us rather they were working for themselves,” he said.

According to him, the money sought by the country from the International Monetary Fund was obtained during the Covid period, and if the requested fund is the only way and must be generated internally, there are other options.

He proposed that “the leakages in the system should be closed” rather than introducing new taxes.

Latest Stories

-

Reconstruction of Agona-Nkwanta-Tarkwa road 80 per cent complete

40 seconds -

Internet penetration: 10.7 million Ghanaians offline – LONDA Report

9 mins -

USC cancels grad ceremony as campus protests against Israel’s war in Gaza continue

13 mins -

Harvey Weinstein’s 2020 rape conviction overturned in New York

20 mins -

US Supreme Court divided on whether Trump can be prosecuted

23 mins -

There’s enough justification for Affirmative Action Bill to be passed – Minka-Premo

26 mins -

Don’t allow people to manipulate you into vaccine hesitancy – Dr Adipa-Adappoe

33 mins -

Suspend implementation of Planting for Food and Jobs 2.0 for 2024 – Stakeholders

39 mins -

Parkinson’s disease no longer confined to the elderly – Public Health Physician, Dr Momodou Cham warns

43 mins -

Persons living with Parkinson’s disease appeal for support as they face stigmatization

57 mins -

36-year-old-trader sentenced for stealing employer’s money

1 hour -

9 signs you’re falling in love with someone who thoroughly enjoys emotional manipulation

1 hour -

Catholic Diocese of Keta Akatsi hosts Parkinson’s support group meeting

1 hour -

Wa Naa appeals to Akufo-Addo to audit state lands in Wa

2 hours -

5 secret ways people use ‘I love you’ as a form of manipulation

2 hours