China's factory activity grew at a slower pace in August as floods across southwestern China disrupted production, but the services sector expanded at a solid rate in a boost to the economy as it continues to recover from the coronavirus shock.

The world's second-biggest economy has largely managed to bounce back from the pandemic, though intensifying tensions with the United States over a range of issues and the global demand outlook remain risk factors.

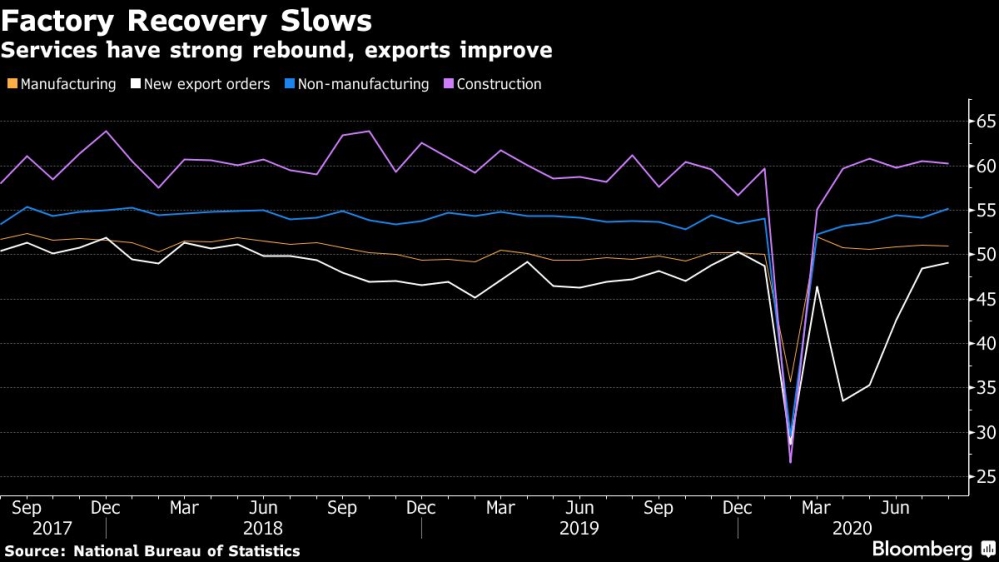

The official manufacturing Purchasing Manager's Index (PMI) fell slightly to 51 in August from 51.1 in July, data from the National Bureau of Statistics showed on Monday. The survey remained above the 50-point mark that separates growth from contraction on a monthly basis.

Analysts had expected it to pick up a touch to 51.2.

China's vast industrial sector is steadily returning to the levels seen before the pandemic paralysed many parts of the economy, as pent-up demand, stimulus-driven infrastructure expansion and surprisingly resilient exports propel a recovery, but the recovery remains uneven.

A sub-index for the activity of small firms stood at 47.7 in August, down from July's 48.6, with over half of them reporting a lack of market demand and more than 40 percent of them complaining of financial strains, Zhao Qinghe, a senior statistician with the NBS, said in a statement.

China's factories are recovering, but growth remains slow @AJENews https://t.co/SPKmkVM76r stop buying junk from #china . They infected the whole world with #COVID19 and only 1 president @realDonaldTrump is blaming them also .The world need to wake up about this #ChinaVirus

— VanbelleghemPH (@phvanbelleghem) August 31, 2020

"In addition, some companies in Chongqing and Sichuan reported an impact from the heavy rains and floods, resulting in a prolonged procurement cycle for raw materials, reduced orders and a pullback in factory production."

The official PMI, which largely focuses on big and state-owned firms, also showed the sub-index for new export orders stood at 49.1 in August, improving from 48.4 a month earlier and suggesting a bottoming out in the contractionary trend after the coronavirus hit.

"The growth engine is now clear. Overseas demand will only pick up slowly and travel restrictions will only be relaxed if COVID-19 cases subside overseas. Until then China will rely more on its own for economic growth," said Iris Pang, Greater China chief economist at ING.

Economic indicators ranging from trade to producer prices all suggest a further pick-up in the industrial sector. Profits at China's industrial firms last month grew at the fastest pace since June 2018, data published on Thursday showed.

Services shine

Activity in the construction sector, a powerful domestic growth driver, also eased in August, likely due to the floods in Southern China.

But analysts are confident that as the torrential rains recede, Beijing's infrastructure push will further bolster growth.

The official non-manufacturing PMI, which includes the services and construction sectors, rose to 55.2 from 54.2 in July, the NBS survey showed.

Investment bank HSBC expects China's economy to grow by 5.4 percent in the third quarter compared with the same period last year, followed by a 6.2 percent expansion in the fourth quarter, returning China's growth to pre-coronavirus levels.

But some analysts fear that the recovery could stall, hurt by rising tensions between Washington and Beijing and if another wave of local infections returns in the winter. Moreover, the continued rise in the number of COVID-19 cases across many countries, led by India and the US, remains a risk to the outlook.

China's economy, which grew by 3.2 percent in the second quarter year-on-year, is set to expand by 2.2 percent this year - the weakest in more than 30 years.

Capital Economics senior China economist Julian Evans-Pritchard said the services sector uptick suggested an encouraging broadening out of the recovery.

"This is consistent with our view that an investment-led rebound would eventually also shore up consumer sentiment and household spending, keeping the overall economic recovery on track," he said.

Latest Stories

-

Heartbreak for KUHIS as Osei Tutu’s riddle answer sends Kumaca to Zonal Final

2 minutes -

BOST embraces renewable future with major solar energy drive

11 minutes -

New Accra–Kumasi expressway will be a completely new road not mere upgrade of existing N6 route — Agbodza

18 minutes -

Cabinet has approved reintroduction of road tolls with modernised collection – Kwame Agbodza

53 minutes -

Heal KATH project stalls for 3 months over simmering conflict between hospital CEO and project committee

1 hour -

You don’t need to go to Turkey, US or Europe for ‘Hairforestation’: UGMC is rolling out hair transplant in Ghana this year

1 hour -

Help comes to market women and farmers as CSJ tackles credit barriers, protection gaps at upcoming summit

1 hour -

50-year-old woman dies after falling into abandoned mining pit at Mpasatia

1 hour -

Accra Bar Show 2025 launched to celebrate Ghana’s hospitality and drinks industry

2 hours -

Mahama directs Road Ministry to prioritise roads under the Big Push initiative

2 hours -

JoyNews journalist Carlos Carlony recounts Military assault at McDan warehouse demolition site

2 hours -

Former MIIF CEO stopped at Airport over unauthorised travel attempt while on OSP bail

2 hours -

Christian Council of Ghana raises alarm over escalating violence in Bawku

2 hours -

NSMQ 2025: Prempeh’s zonal title drought continues as ‘Our Lady of Grace’ reaches finals

2 hours -

Titus Glover links McDan warehouse demolition to alleged personal feud with EOCO head, Raymond Archer

2 hours