Audio By Carbonatix

Fitch Solutions has indicated that the banking sector loans will fall considerably in 2023, whilst deposit growth will decline marginally.

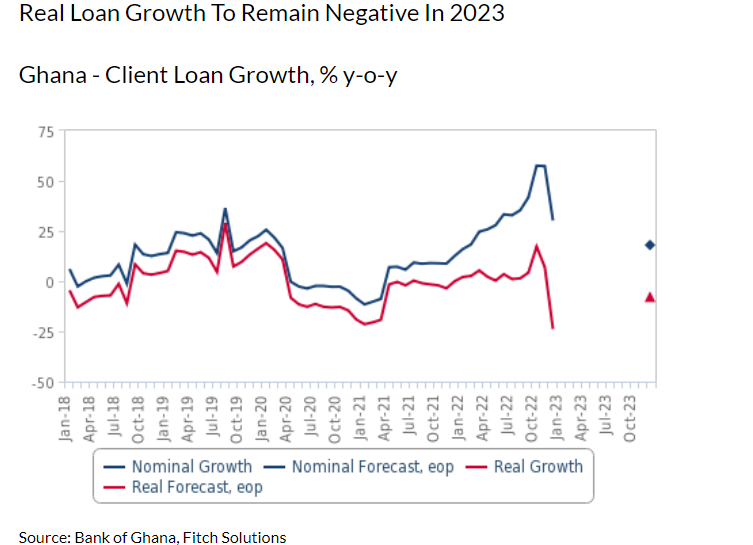

It said Ghana’s client loan growth will ease from 30.2% year-on-year in 2022 to 18.0% in 2023.

This is a result of the challenging macroeconomic backdrop, as banks remain uncertain about the possible fallout from the domestic debt restructuring, as well as base effects from very strong loan growth in 2022.

“Whilst our nominal client loans growth forecast will still be in double digits in 2023, skewed by still elevated inflation, our real client loan growth forecast will be much weaker at -7.7% by year-end”, it stated.

“On top of inflation, further interest rate hikes, a weakening currency and a slowdown in economic momentum will continue to act as headwinds to loans growth in 2023.

Deposits growth to fall marginally

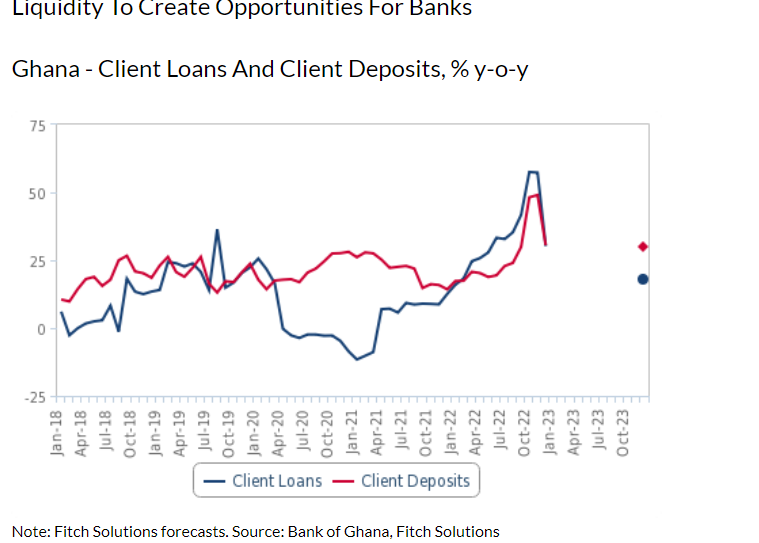

On the liabilities side, Fitch Solutions forecasts deposit growth of 30.0% year-on-year in 2023, down marginally from 30.5% in 2022.

A key driver of this strong growth, it said, is the expected depreciation of the cedi in 2023 which will inflate the value of deposits in foreign currency, which account for 28.4% of total deposits, as of December 2022.

Another factor is higher interest rates – the Bank of Ghana (BoG) has hiked the policy rate by a cumulative 1,450 basis points since late 2021.

However, it added that growth in deposits will be held back by the worsening economic environment, as locals will likely have to tap into their savings to compensate for the loss in income.

Latest Stories

-

Azumah Nelson Sports Complex, other youth centre to be completed by end of 2026 – NYA CEO

2 minutes -

Ghana leads discussions on responsible mining at Africa Mining Indaba

16 minutes -

We need renovation — Ashaiman traders protest over redevelopment plan

21 minutes -

Four arrested after clash with NAIMOS team at illegal mining site in Nzema East

23 minutes -

Energy Commission–PURC merger: Energy Minister assures PSWU of broad consultation

27 minutes -

Police officer shot dead during suspected armed robbery attack on Zebilla–Widnaba road

33 minutes -

Lands Ministry vows action on JoyNews Amansie galamsey exposé

37 minutes -

Asante Kotoko charge caretaker coach to emulate Di Matteo at Chelsea

37 minutes -

Ablekuma South MP assures Korle Bu Polyclinic of support for infrastructure upgrade

38 minutes -

Power outage hits Northern, Middle and Western regions following transmission fault

38 minutes -

Vote-buying must attract harsh sanctions to safeguard elections — Mary Addah

42 minutes -

Daboase Water Treatment Plant set for completion in May 2026 – Housing Minister

53 minutes -

Nyaho Tamakloe slams ‘culture of corruption’; accuses courts of shielding ‘crooks’

58 minutes -

MoFA, Premix Secretariat roll out reforms to protect community funds after audit findings

1 hour -

Transparency International demands ‘harsh and punitive’ sanctions for vote buying

1 hour