The Minister of Finance, Ken Ofori-Atta, has indicated that the Domestic Debt Exchange Programme has been successfully completed, providing much-needed breathing space.

This quells any speculation that the DDEP has not ended.

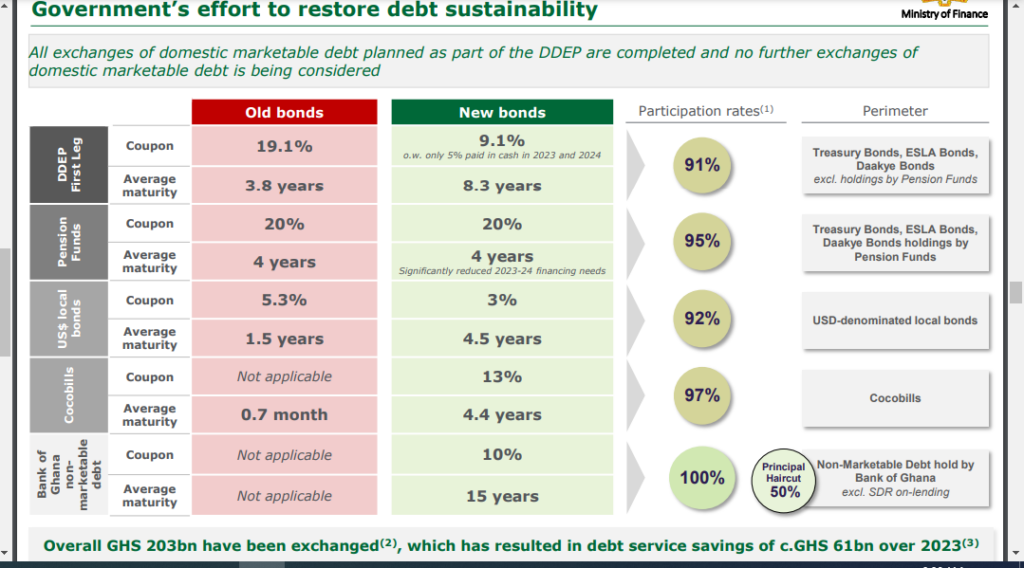

Updating investors in London about Ghana’s debt exchange programme, Mr. Ofori-Atta said the success of the Comprehensive Domestic Debt Exchange Programme illustrates the commitment of the Ghanaian people to contribute to the Government’s effort to restore debt sustainability.

“All exchanges of domestic marketable debt planned as part of the DDEP are completed and no further exchanges of domestic marketable debt is being considered”, he stressed.

¢61bn savings made

Overall ¢203 billion have been exchanged, which has resulted in debt service savings of ¢61 billion over 2023.

The Finance Minister said the Domestic Debt Exchange Programme and the fiscal efforts significantly contributed to restoring debt sustainability, adding, the remaining leg will be the contribution of External Creditors.

Economy gradually returning to growth path

Mr. Ofori-Atta also said Ghana’s economy is gradually returning to a path of growth and stability.

According to him, the implementation of the International Monetary Fund (IMF) programme is well on track,

The IMF Programme is a three years programme, from 2023 to 2026 which the country will get a $3 billion Economic Credit Facility.

Mr. Ofori-Atta, said, Ghana has so far completed a comprehensive stock-take of payables accumulated, designed a payable clearance plan and laid out a reform plan to reduce future accumulation of arrears.

Again, he pointed out that the country has finalized a strategy to strengthen the financial sector and rebuild financial institutions' buffers after the implementation of the Domestic Debt Exchange Programme.

Latest Stories

-

Government should resource record labels – Seven Xavier

3 mins -

I need majority in parliament to successfully complete my term – Akufo-Addo pleads

6 mins -

Next NDC government will not recognise illegal contracts signed by current administration – Sammy Gyamfi

15 mins -

Premier League clubs vote in favour of spending cap plans

26 mins -

Nigeria’s fuel crisis brings businesses to a halt

28 mins -

King Promise impresses fans at sold out show in Singapore

32 mins -

Ejisu by-election to proceed after plaintiff withdraws injunction application

42 mins -

CSOs and NGOs unite to push for priority demands at INC-4

45 mins -

Fuel tanker bursts into flames on Kumasi-Accra highway

51 mins -

EC’s stolen BVR kits, laptops: One granted bail, three still on remand

1 hour -

2 Things: Sista Afia releases first song off her upcoming album

1 hour -

GHS to embark on COVID-19 vaccination campaign starting May 4

2 hours -

CAF Confederation Cup: I’ve learned valuable lessons that will help future generations – Karim Zito

2 hours -

Create partnership with Ghanaian businesses – K.T. Hammond tells U.S. business leaders

2 hours -

5 dead, over 14 injured in gory accident near Obuasi

2 hours