Audio By Carbonatix

Dr. David Ofosu-Dorte, Senior Partner at AB & David Africa, has delivered a sobering prediction for Africa’s fiscal future, warning that the continent’s debt crisis will persist as long as governments insist on "controlling and financing everything" themselves.

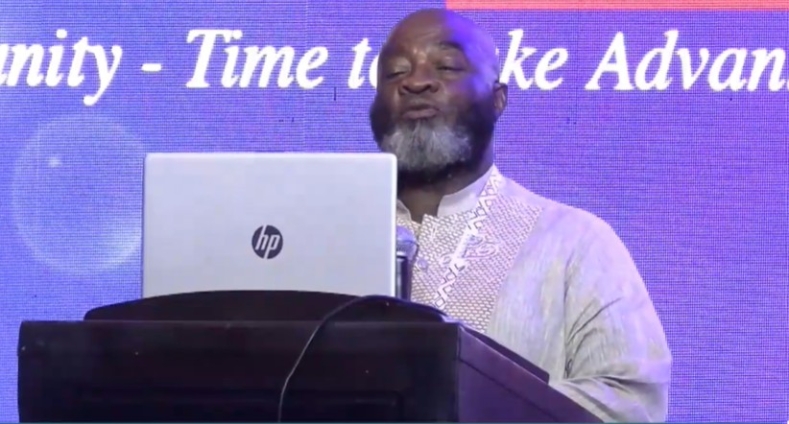

Speaking at the Crystal Ball Africa 2026 forum held at the Labadi Beach Hotel on January 22, the seasoned transactions lawyer argued that the path to sustainable growth lies in "ring-fencing" debt for self-liquidating projects and creating a sanctuary for private capital, which he claims is currently "afraid" of state interference.

The 70% Debt-to-GDP Red Line

Under the sub-topic "2026 Crystal Ball Predictions", Dr. Ofosu-Dorte addressed the looming spectre of debt distress that has haunted several African economies—including Ghana—over the years. He emphasised that the Debt-to-GDP ratio should ideally never cross the 70% to 80% threshold, provided the borrowed funds are utilised efficiently.

“So for us to have the confidence, we should be able to pay back the money and we should not cross the 80 or 70 [Debt to GDP ratio]. That's what we need to do. But why do we get there? We get there because very often when we borrow the money, we are not borrowing the money for things that we can pay back.”

More Money Chasing Projects Than Projects Chasing Money

In a direct challenge to the narrative of capital scarcity, Dr. Ofosu-Dorte asserted that the global market is actually flush with liquidity. However, this capital remains on the sidelines because governments frequently monopolise "bankable" projects that could otherwise be handled by the private sector.

“There is much more money chasing projects than projects looking for money. That's a fact. I play in that space. I'm a transactions lawyer. But when governments want to control everything, you see that money is always afraid of government—and especially the history.”

The "Ring-Fencing" Strategy

The solution, according to the legal expert, is a radical shift toward Public-Private Partnerships (PPPs) and the "ring-fencing" of project revenues.

He echoed sentiments shared by earlier speakers from Ecobank, suggesting that if a project can generate its own repayment—such as a toll road or a power plant—it should not sit on the government's balance sheet.

“If you ring-fence the money and there is certainty that you will pay it back, you won't cross [70 to 80] debt to GDP. Secondly, we should reduce the extent to which governments want to do projects and finance everything themselves.”

2026 Outlook: Breaking the Cycle of Impunity

The comments come at a time when West African nations are under pressure from the IMF and World Bank to implement "Debt Sustainability Analyses" (DSA).

Dr. Ofosu-Dorte’s "Crystal Ball" suggests that 2026 must be the year African leaders transition from "State-led" to "Market-led" infrastructure development to avoid another cycle of defaults.

| Economic Metric | 2026 Target/Guidance | Analysis |

| Debt-to-GDP | <70% - 80% | The "Confidence Threshold" for investors. |

| Financing Model | Private-Sector Led | Move bankable projects off the state budget. |

| Project Selection | Self-Liquidating | Only borrow for what can "pay itself back." |

| Investment Climate | State Withdrawal | Reducing government control to lure "timid" money. |

About Crystal Ball Africa

The Crystal Ball Africa 2026 programme, organised by AB & David Africa, brings together top-tier analysts, lawyers, and economists to project the year's trends under the theme: "The Africa Opportunity - Time to take advantage."

The 2026 edition focused heavily on digital order, energy surplus (specifically referencing Ethiopia), and the "convergence" of global events that will drive African transformation.

Latest Stories

-

Future NPP government will purge judiciary of NDC polarisation – Kabiru Tiah

3 minutes -

Interior Minister commends seamless and transparent security services recruitment

23 minutes -

Speed welcomed to Ghana with new name Barima Kofi Akuffo

36 minutes -

Managing market expectations vital for currency stability – BoG

1 hour -

BoG flags sustainability concerns over Domestic Gold Purchase Programme

1 hour -

Dr. Ofosu-Dorte slams overreliance on public funding for projects

1 hour -

When Bel Cola’s santa stepped out, Christmas couldn’t wait

2 hours -

Dr. Ofosu-Dorte urges Mahama to lead radical African transformation

2 hours -

We’ll fight for welfare, dignity of Ghanaians abroad – Foreign Affairs Minister

2 hours -

Hidden dangers of fibroids: Expert reveals what increases your risk

2 hours -

NPP figures and NDC stalwart challenge delegate-based party systems at Supreme Court

2 hours -

Jacobu youth clash: Ashanti Regional Minister vows arrests after fatal police shooting

2 hours -

Power is the new oil: Dr. Ofosu-Dorte issues AI-driven energy warning for Africa

2 hours -

Peace Council lauds NPP’s peace pact, urges compliance by presidential hopefuls, supporters

2 hours -

Reproductive mental health underreported among Ghanaian women- Gynaecologist

2 hours