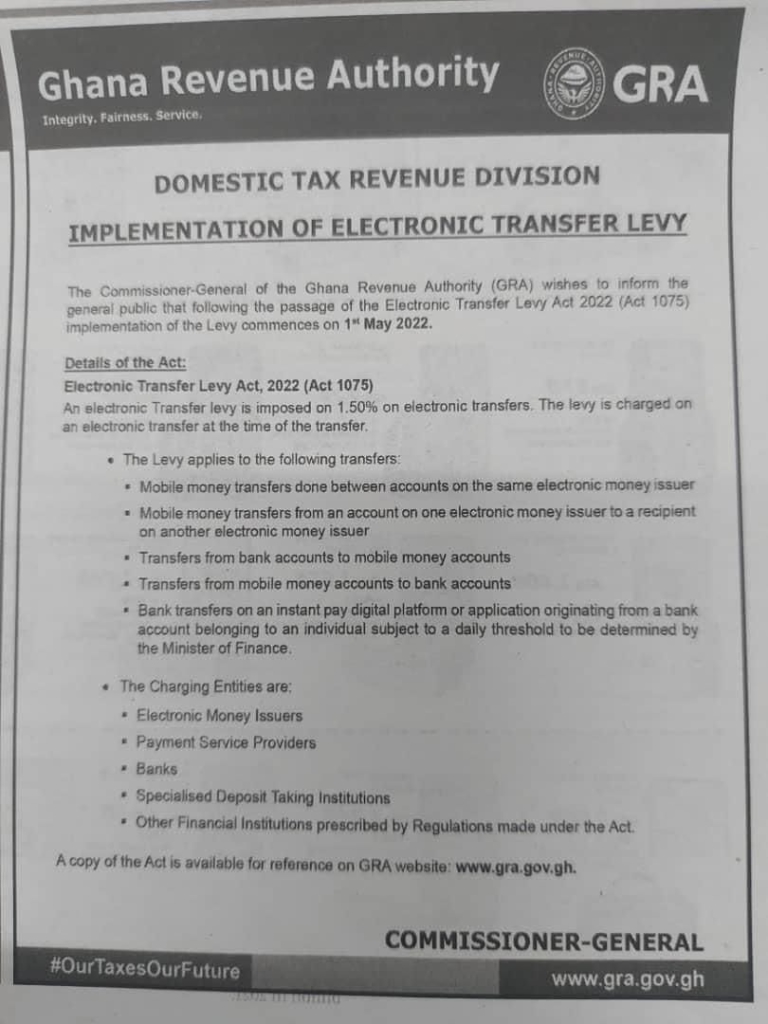

The Ghana Revenue Authority (GRA) has announced May 1st, 2022 as the implementation date for the Electronic Transaction Levy (E-Levy).

In a notice published in the newspapers, the GRA said the decision was influenced by the passage of the E-Levy Bill by Parliament.

The E-Levy will impose 1.50% on all electronic transfers.

Areas of coverage

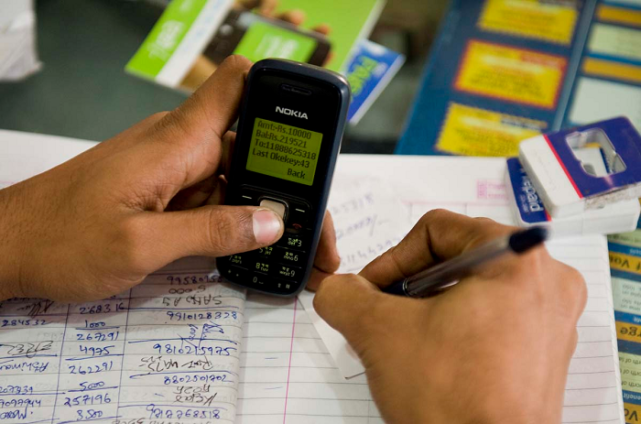

The levy will apply to mobile money transfers done between accounts on the same electronic money issuer and mobile money transfers from an account on one electronic money issuer to a recipient on another electronic money issuer.

Others are; transfers from bank accounts to mobile money accounts and transfers from mobile money accounts to bank accounts

However, bank transfers on an instant pay digital platform or application originating from a bank account to an individual subject to a daily threshold will be determined by the Minister of Finance.

The E-Levy was introduced by the government in the 2022 Budget on basic transactions related to digital payments and electronic platform transactions.

The rate would apply to electronic transactions that are more than ¢100 daily. This is different from the percentage telecommunication companies charge on mobile money transactions.

Akufo-Addo signs E-levy Bill into law

President Akufo-Addo on Thursday, March 31, 2022 signed the E-levy Bill into law.

As a result, the Bill, which was passed by Parliament on Tuesday, March 29 has now become a binding law which will be operationalised as a revenue measure across the country.

Parliament approved the controversial Electronic Transactions (E-Levy) Bill on Tuesday afternoon.

This decision was reached after the Consideration Stage was completed by a Majority-sided House on Tuesday, March 29, 2022.

It was considered under a certificate of urgency.

The Bill was adopted at a reduced rate of 1.5% from the initial 1.75% amid a Minority walkout.

The tax, which has become a subject of debate among Ghanaians is expected to rake in ¢4.5 billion in tax revenue for the country.

Latest Stories

-

Five killed in Thailand market mass shooting

12 minutes -

Three dead after sewage overflow causes German train to derail, say police

13 minutes -

Google failed to warn 10 million of Turkey earthquake severity

14 minutes -

Confronting Corruption: Professor Bawole’s thoughtful discourse on Ghana’s ethical crisis

16 minutes -

Ho: 2025 Asogli yam festival unveils adventure, culture, and celebration

44 minutes -

ECG cautions public against unauthorised meter transfers

45 minutes -

‘COA-72 not approved by FDA for HIV clinical trials’ – Manufacturer corrects misleading reports

49 minutes -

Bawku’s Unfinished Lessons: The urgent call to activate Ghana’s education in emergency plan for continued learning

57 minutes -

Law school can’t be free for all – Acting Chief Justice

1 hour -

When the Guitar Wept and Ghana Lost Her Voice: A Satirical Dirge for Daddy Lumba

1 hour -

GES releases GH¢15.8 million for WASSCE practical

1 hour -

AfCFTA success tied to SME support and light industrialisation – Economists

1 hour -

Black Queens receive hero’s welcome after WAFCON bronze finish

2 hours -

Director General of NLA picks up top leadership award

2 hours -

Minority urges calm amid renewed violence in Bawku

2 hours