Audio By Carbonatix

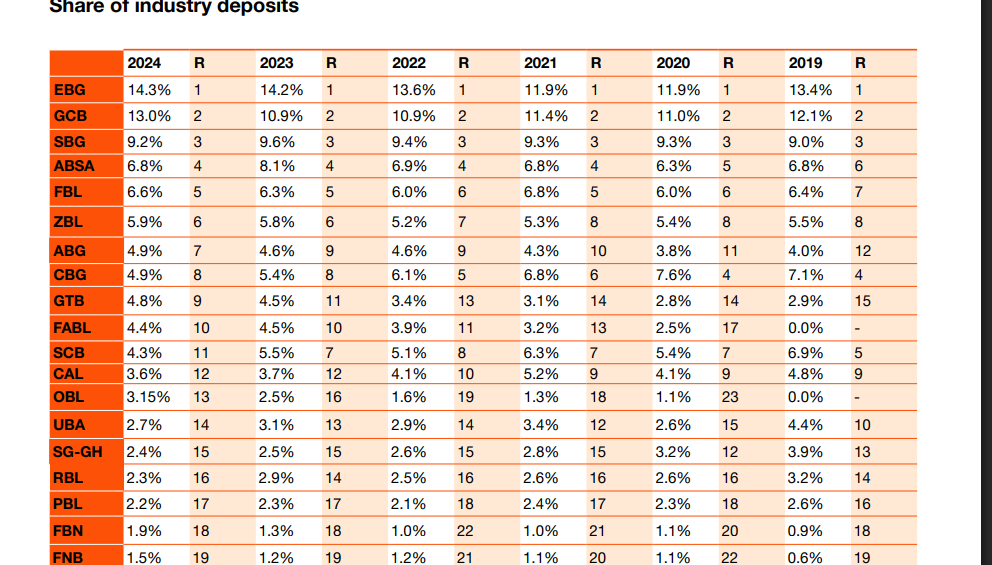

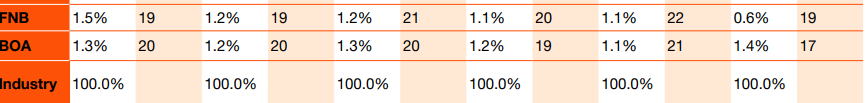

Ecobank Ghana continued its position as the biggest bank in Ghana in 2024 with a market share of 14.3%, according to the 2025 Ghana Banking Sector Survey by PwC.

It was followed by GCB Bank with a market share of 13.0% in 2024, from 10.9% in 2023.

According to the report, the expansion of the two banks highlights the high level of trust these institutions enjoy among retail and corporate clients.

Their success in deposit mobilisation can be attributed to a variety of strategic initiatives. These included leveraging an extensive physical branch network, each operating more than 250 outlets nationwide, to improve accessibility in both the urban and rural areas.

Additionally, their sustained investment in digital banking infrastructure significantly enhanced convenience for clients, particularly the younger, tech-oriented demographic. Their rollout of targeted savings and investment products further attracted clients such as SMEs and salaried professionals seeking flexible and secure financial solutions.

Standard Bank and Absa consolidated their standings as the third and fourth largest banks by total deposits, expanding their combined deposit base by GH₵6.9 billion.

In the mid-tier category, banks such as Zenith Bank, Consolidated Bank Ghana and First Atlantic Bank remained steady in the 6th, 8th, and 10th positions, respectively.

Access Bank Ghana rose from ninth to seventh place, while GT Bank improved its standing from 11th to 9th.

Conversely, Standard Chartered Bank dropped from 7th to 11th, suggesting competitive or operational headwinds.

Overall, the ten leading banks captured over 50% of the industry’s total deposits, affirming their influence in shaping sector dynamics.

Across deposit types, there was broad-based growth: current accounts surged by 37.4%, savings accounts rose by 44.2%, and both certificates of deposit and call deposits showed marked increases.

Deposits from other banks also increased sharply by nearly 50%, indicating a rise in interbank confidence and activities to support the new cost to deposit ratio requirements.

Notably, time and fixed deposits declined by 6.2%, likely driven by changing interest rate expectations and a growing preference for more flexible financial instruments.

Latest Stories

-

Ghanaians urged to embrace specialised courts for effective justice delivery

16 minutes -

Sextortion offenders face up to 25 years in jail – Judicial Secretary warns

17 minutes -

Air Pollution responsible for a third of stroke, lung cancer and neonatal deaths in Ghana — 2025 SoGA Report

1 hour -

Air pollution may directly contribute to Alzheimer’s disease – new study

1 hour -

Tinubu overhauls Police leadership as River Park case, financial scandal trail Egbetokun’s exit

1 hour -

SONA: Mahama’s macro economic claims don’t reflect reality – Bekwai MP

2 hours -

Tragic End: Man who died after hospitals refused him treatment, buried

2 hours -

I’m not his party member but NAPO supported me -Mzbel

4 hours -

Opanin Joseph Kofi Nti

4 hours -

Flights cancelled and new travel warnings issued after Iran strikes

5 hours -

Middle belt NPP MPs rally behind NAPO as 2028 running mate debate gains momentum

5 hours -

Helicopter crash: Children’s support fund surpasses GH¢10.15m

5 hours -

Musah Superior writes: Vote out NPP National Executives seeking re-election; they’ve run out of steam

5 hours -

MobileMoney Ltd breaks silence on viral TikTok fraud claim, urges public to dial 419

6 hours -

Blind refugee found dead in New York after being released by immigration authorities

7 hours