Audio By Carbonatix

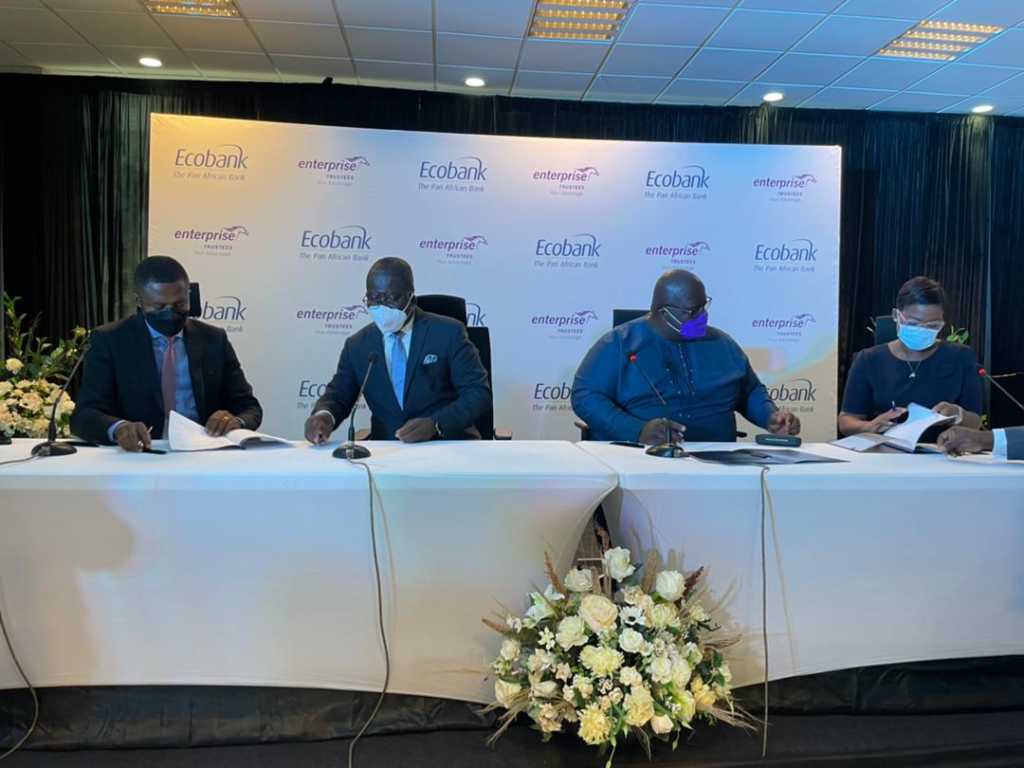

Ecobank Ghana and Enterprise Trustees have signed a partnership agreement to make meaningful contribution towards helping pension contributors acquire affordable homes.

The partnership also seeks to offer customers of both institutions a whole new experience with unending benefits.

Speaking at the signing ceremony, Managing Director of Ecobank Ghana, Dan Sackey said the partnership will enable Enterprise Trustees to make available to all workers, whose pension funds reside at Enterprise, a package that enables them to attract mortgages from Ecobank with zero down payments.

“Under this agreement, Enterprise Trustees will make available to all workers, whose pension funds reside at Enterprise, a package that enables them to attract mortgages from Ecobank with zero down payments. The bank will disburse the mortgage loan to the beneficiaries, who will pay monthly instalments over a 15-year period”, he noted.

He further added that, “this is a novelty for the Ghanaian financial services market, which should be embraced by workers. A regular mortgage will require the borrower to make available at least 20% down payment, but this innovative partnership offers a product that requires the borrower to make no deposit whatsoever. All that the borrower needs to do is to identify the house and Ecobank will provide the funding.”

“With this offer, there is really no excuse for Enterprise Trustees Tier 3 contributors not to own their own homes. There is also no excuse for not accessing the requisite funding for their various projects”, he pointed out.

On his part, Managing Director of Enterprise Trustees, Joseph Ampofo indicated that this new partnership will help workers build an enviable fund towards their retirement.

“It’s been 10 years of running schemes, enabling contributors to build up funds towards their future retirement. This is a collaboration between two industry giants Ecobank Ghana and Enterprise Trustees. We are optimistic that our shared value of Excellence will be our guiding principle as we work together for the betterment of Ghanaian workers to own homes through a unique mortgage solution”, he added.

Latest Stories

-

Middle East turmoil threatens to derail Ghana’s single-digit gains

4 minutes -

Free-scoring Semenyo takes burden off Haaland

5 minutes -

Explainer: Why did the US attack Iran?

12 minutes -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

43 minutes -

Crude oil price crosses $91 as Strait of Hormuz blockade chokes 22% of global supply

1 hour -

Dr. Hilla Limann Technical University records 17% admission surge; launches region’s first cosmetology laboratory

2 hours -

Over 50 students hospitalised after horror crash ends sports tournament

2 hours -

Accra–Dubai flights cancelled as Middle East tensions deepen

3 hours -

See the areas that will be affected by ECG’s planned maintenance from March 1-5

3 hours -

Kane scores twice as Bayern beat rivals Dortmund

4 hours -

Lamine Yamal hits first hat-trick in Barcelona win

4 hours -

Iran says US and Israel strikes hit school killing 108

4 hours -

What we know so far: Supreme Leader Khamenei killed, Trump says, as Iran launches retaliatory strikes

5 hours -

Trump says Iran’s Supreme Leader Ali Khamenei dead after US-Israeli attacks

5 hours -

Ghana cautions nationals against non-essential travel to and from the Middle East as tensions escalate

6 hours