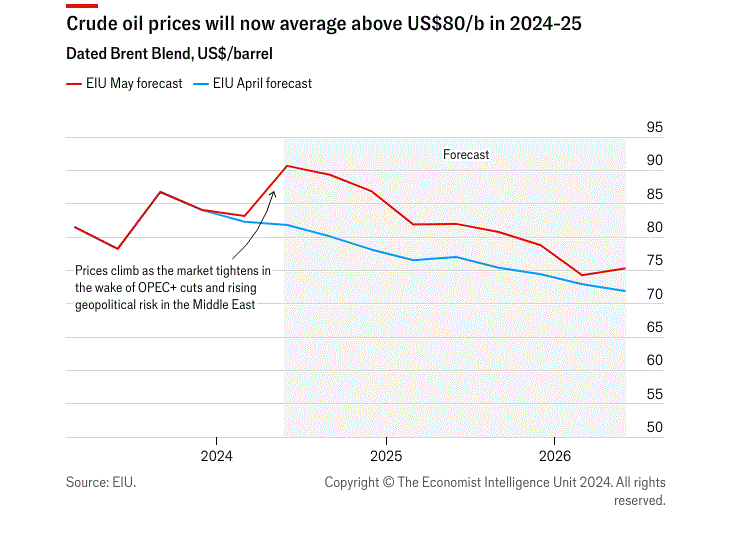

The Economist Intelligence Unit is forecasting that oil prices will remain above $80 per barrel until late 2025.

This, it said, will lift inflationary pressures in many countries at a time when their currencies are losing ground against the dollar.

Based on recent data from the International Energy Agency, the global oil market fell into deficit (with demand outstripping production) in the first quarter of 2024. Due to this evolving supply-demand dynamic and rising geopolitical pressures, we revised up our oil price forecasts, with dated Brent Blend to remain above US$80/barrel until late 2025. This will lift inflationary pressures in many countries at a time when their currencies are losing ground against the dollar.

EIU also projected that oil prices will continue to trade at nearly $90 per barrel for at least the next few months. Besides the market deficit, higher prices will also be supported by rising tensions in the Middle East as the Israel-Hamas war threatens to widen into a broader regional conflict.

“Even if disruption to oil shipments from the region remains minimal and traders shrug off concerns about military escalation, prices are set to remain high as the global market remains in deficit until late in the year [2024]. We expect that OPEC+ will strictly observe reduced output quotas and that Saudi Arabia will continue to adhere to additional, sharp voluntary cuts until at least mid-2024 and only slowly lift production towards the end of 2024 at the earliest”, it pointed out.

The EIU added that “We continue to expect US production to increase moderately in 2024 before stabilising in 2025, but the recent rise in prices is not enough to elicit a stronger supply response. The US oil rig count, at 508, is actually down by 14% from a year ago, according to Baker Hughes, an oilfield services firm, as US oil companies continue to prioritise dividends for shareholders”.

It still forecasted that global oil demand will hit record highs in 2024 and 2025, adding, demand in developed economies will decline, although North America will remain an exception to this trend.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

2 hours -

How decline of Indian vultures led to 500,000 human deaths

3 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

3 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

4 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

4 hours -

82 widows receive financial aid from Chayil Foundation

4 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

4 hours -

BoG yet to make any payment to Service Ghana Auto Group

4 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

5 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

5 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

6 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

7 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

7 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

7 hours -

Pro-NPP group launched to help ‘Break the 8’

8 hours