Audio By Carbonatix

Deloitte is anticipating further cuts in the policy interest rate of the Bank of Ghana in 2026.

However, it warns of excessive easing, saying it could risk reversing the progress made in controlling inflation.

“While these reductions are anticipated to alleviate financing constraints and stimulate credit and economic demand, excessive easing could risk reversing the progress made in controlling inflation”, the professional services firm disclosed in its West Africa in Focus 2025 report.

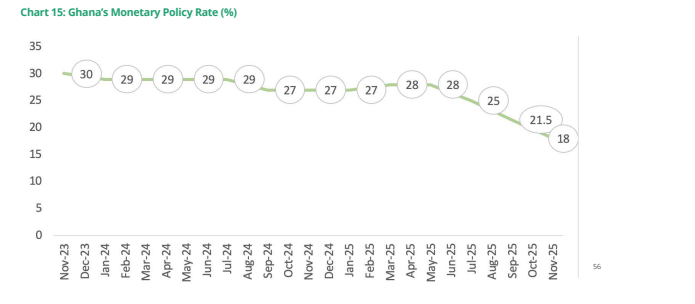

In 2025, the Bank of Ghana cut its policy rate by 10 percentage points, closing 2025 at 18% per annum. Despite the rate cuts, the interest rate environment (MPR) remained slightly elevated but contributed to the strengthening of the cedi and eased inflationary pressures.

Other nominal interest rates also dropped sharply. For instance, the 364-day Treasury Bill rate fell to 13.06% as of November 2025 from 30.07% a year ago.

Some policy decisions implemented by the Bank of Ghana in 2025 included the adjustment of the net open position to between 0% to +/-10% from +/-5%, Cash Reserve Ratio (CRR) for all banks to be kept in their respective currencies, and the commencement of forex intermediation under the Domestic Gold Purchase Programme.

Meanwhile, Deloitte says the key risks to Ghana's inflation outlook include higher tariffs on utilities such as electricity and water, as well as persistently high domestic food prices.

Additionally, it stated that a possible fall in gold prices could impact the stability of the local currency and imported inflation. However, these risks could be mitigated by the high interest rates and fiscal discipline.

Latest Stories

-

GHS enforces uniform, name tag policy after Mambrobi baby theft incident

8 minutes -

Strong currency, but expensive power – AGI president explains why prices stay high

1 hour -

Tems, Burna Boy become African artistes with most Billboard Hot 100 entries

2 hours -

Lawyer fires back at Davido over social media harassment after custody case

2 hours -

Rapists should be castrated, burnt alive – Simi

2 hours -

Air Algérie Group and Africa Prosperity Network sign deal to advance ‘Make Africa Borderless Now!’ agenda

3 hours -

Africa Prosperity Network, Ethiopian Airlines explore partnership to advance ‘Make Africa Borderless Now!’ agenda

4 hours -

Trump’s Board of Peace members pledge $7bn in Gaza relief

4 hours -

Police retrieve five weapons, kill suspect in a shootout

4 hours -

Court fines driver over careless driving

5 hours -

Pharmacist arrested for alleged assault on medical officer over drugs

5 hours -

Not all women in leaked footage had intimate encounters with Russian suspect – Sam George

5 hours -

Ghana to prosecute Russian national in absentia over leaked footage – Sam George

5 hours -

Cats may hold clues for human cancer treatment

5 hours -

Emma Ankrah: The little miracles of growing up

6 hours