Audio By Carbonatix

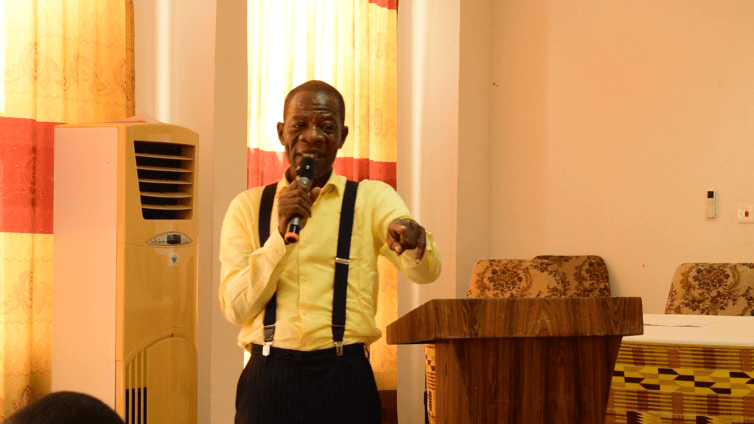

The Head of Domestic Corporates, GCB Bank, Patrick Mawuli Morttey, has urged farmers across the country to form cooperative groups to enable them secure credit facilities to invest into their production.

He lamented that various factors had contributed to the decline in the Agribusiness share of the credit by banks in the country, which saw a reduction from 5.2% in 2020 to 3.4% in 2021.

He was speaking at the Agribusiness Forum in Ho, organized on the sleeves of the 5th Volta Trade and Investment Fair to provide a platform for financial institutions, farmers, and relevant stakeholders to digest how to access credits and markets for their produce.

Mr. Morttey outlined high risk perception and the lack of adequate risk management tools, proposals not of strategic importance to commercial banks, high service delivery and monitoring costs.

He also stated low levels of education and lack of financial literacy among farmers, and inability to provide documentation required for loans as some factors that deter banks from issuing loans to small scale farmers.

Others include lack of capacity in agribusiness financing, inability to provide registered collateral required by the commercial bank to secure credit, rain-fed agriculture with attendant weather and climate risks and small size of farms largely as a result of the land tenure system making farming not viable as a commercial venture.

He, therefore, advised the farmers to form co-operatives to enhance the capacity to secure credit facilities, embrace more scientific approaches, and engage in value chain financing in their farming businesses.

The Volta Regional Director of the Ghana Export Promotion Authority, Chris Amponsah Sackey, indicated that his outfit is implementing some programmes aimed at improving exports sales in the Volta Region.

He emphasised that the programmes are tailored to create jobs and wealth for young people.

Mr. Sackey outlined the Youth in Export programme, Volta Oti Vegetable Export Expansion Programme, Cocoanut Revitalisation Programme among others as programmes being implemented in partnership with the Department of Agric, financial institutions, agriculture machinery companies and other stakeholders.

He, therefore, urged the youth to take advantage of the programmes to enhance their capacities which is a requirement for the growth of their businesses.

He also reiterated they need to form or join farmer cooperative groups to enable them access the necessary logistics and supports in their field of work.

CEO of Maphlix Trust Ghana Limited, Felix Yao Kamassah, elaborated the prospects of agribusiness and urged the young farmers to invest in mechanised farming.

He also advised them to take advantage of the numerous opportunities available to support their agribusinesses.

Latest Stories

-

Mahama to open African Court judicial year in Arusha, mark 20th anniversary

4 minutes -

Ghana begins partial evacuation of Tehran Embassy as Middle East tensions escalate

19 minutes -

EPA tightens surveillance on industries, moves to cut emissions with real-time monitoring system

34 minutes -

Police conduct show of force exercise ahead of Ayawaso East by-election

2 hours -

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

3 hours -

AI to transform 49% of jobs in Africa within three years – PwC Survey

3 hours -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

3 hours -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

4 hours -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

4 hours -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

4 hours -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

4 hours -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

4 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

4 hours -

GHATOF leadership pays courtesy call on Chief of Staff, Julius Debrah

5 hours -

KiDi unleashes first single of the year ‘Babylon’

5 hours