Audio By Carbonatix

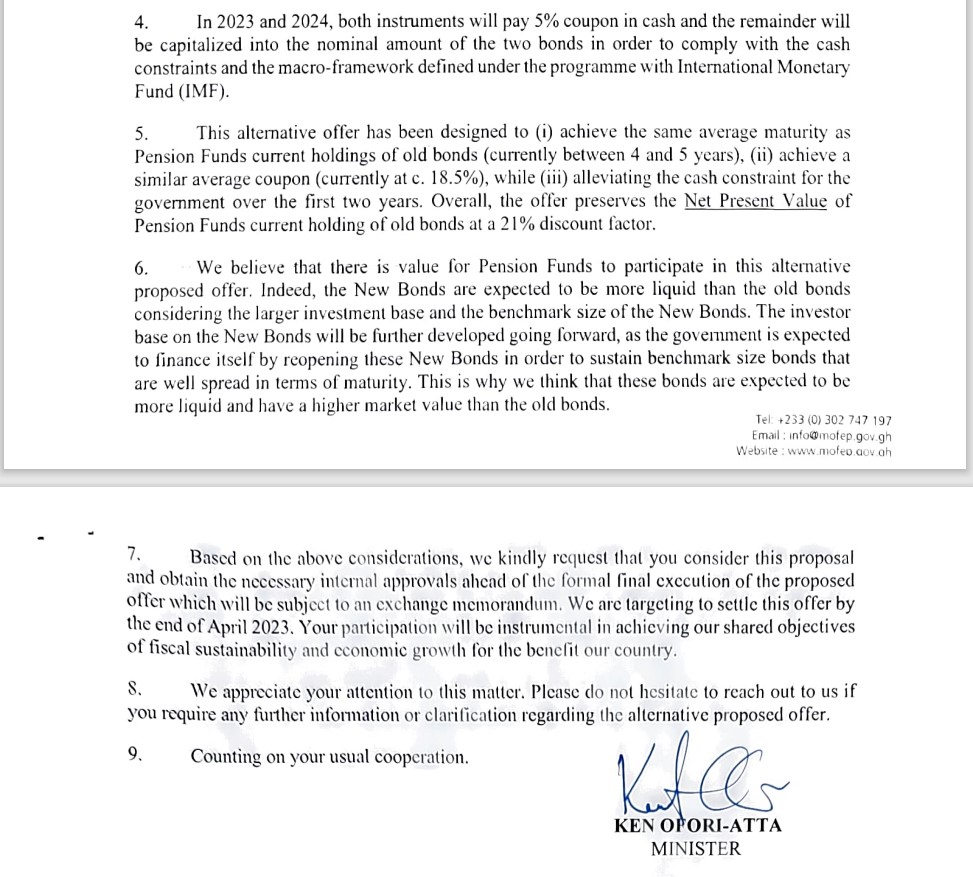

The Finance Minister, Ken Ofori-Atta has urged the Board of Trustees of pensions funds to allow for pension funds to be included in government’s new proposed debt restructuring offer.

The Minister in a signed release explained that the new proposal is aimed at alleviating the cash constraints on the government in the coming years, while fully compensating the Pension Funds for the value of their current holdings.

This comes after organised Labour rejected the inclusion of pension funds in the Domestic Debt Exchange programme.

According to the release, the new proposal has been “crafted to facilitate the execution of the MoU, addressing the Government financial needs while maintaining the value of the pension funds.”

Breaking down the new offer, the statement noted that “the proposed offer entails exchanging your current holdings of Treasury Bonds, ESLA bonds and Daakye Bonds for a menu of the currently outstanding New Bonds (issued in February 2023 and maturing in 2027 and 2028 respectively.

“New Bond 2027 and New Bond 2028 featuring an average coupon of 8.4 % with a ratio of 1.15x, thus entailing an increase in patrimonial value.

“This complemented by an additional cash payment of 10% (strip coupon). The stream of coupons to be received as part of this proposal will therefore be 21% compared to the current 18.5% of the outstanding of old bonds.”

It continued “In 2023 and 2024, both instruments will pay 5% coupon in cash and the remainder will be capitalized into the nominal amount of the two bonds in order to comply with the cash constraints and the macro-framework defined under the programme with International Monetary Fund (IMF).”

According to the statement, the alternative offer has been designed to:

- Achieve the same average maturity as pension funds current holdings of the old bonds (currently between 4 and 5 years)

- Achieve a similar average coupon (currently at 18.5%) while

- Alleviating the cash constraints for the government over the first two years.

As a result, Mr Ofori-Atta urged that the Board of Trustees of pension funds to consider the proposal, adding that government is targeting to settle the offer by end of April, 2023.

Latest Stories

-

Tragic End: Man who died after hospitals refused him treatment, buried

7 minutes -

Opanin Joseph Kofi Nti

2 hours -

Flights cancelled and new travel warnings issued after Iran strikes

3 hours -

Helicopter crash: Children’s support fund surpasses GH¢10.15m

3 hours -

MobileMoney Ltd breaks silence on viral TikTok fraud claim, urges public to dial 419

4 hours -

Blind refugee found dead in New York after being released by immigration authorities

5 hours -

Stanbic Bank Ghana leads $205m financing for Engineers & Planners

5 hours -

MobileMoney Ltd responds to viral TikTok video by Healwithdiana, advises customers to report fraud on 419

5 hours -

Mobile Money Ltd’s Paapa Osei recognised in Legal 500 GC Powerlist: Ghana 2026

5 hours -

Flights in and out of Middle East cancelled and diverted after Iran strikes

6 hours -

Dr Maxwell Boakye to build 50-bed children’s ward at Samartex Hospital in honour of late mother

6 hours -

One killed and 11 injured at Dubai and Abu Dhabi airports as Iran strikes region

6 hours -

Former MCE, 8 others remain in custody over alleged land fraud in Kumasi

6 hours -

Black Queens players stranded in UAE over Israel-Iran conflict

7 hours -

James Owusu declares bid for NPP–USA chairman, pledges renewal and unity

7 hours