Audio By Carbonatix

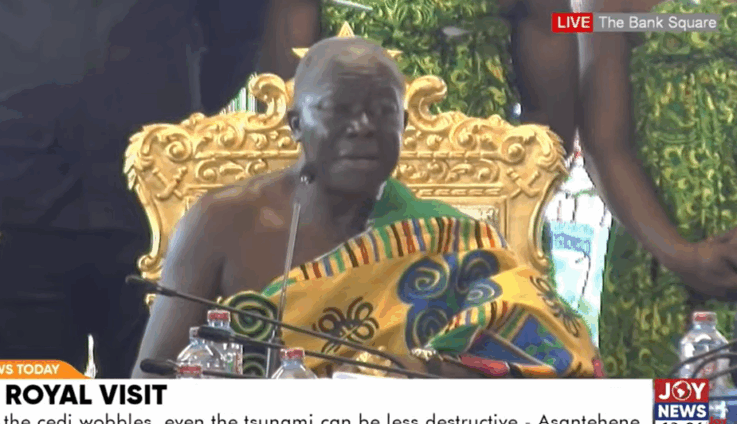

The Asantehene, Otumfuo Osei Tutu II, has challenged the Bank of Ghana (BoG) leadership to find creative ways to drastically lower interest rates to unlock domestic private investment.

The monarch argued that the current cost of credit remains a crippling barrier to building a self-sufficient economy.

Speaking during a historic courtesy call to the central bank’s headquarters on Wednesday, the Asantehene acknowledged recent improvements in inflation and exchange rate stability.

However, he stated that these early gains would remain incomplete without a decisive shift in monetary policy to make borrowing affordable for Ghanaian businesses.

- Read also: ‘We mustn’t confuse improvement, with permanency – BoG Governor cautions amid economic gains

“The challenge I leave with your creative brains," the Asantehene told the Governor, Dr. Johnson Asiamah, his deputies, and the Monetary Policy Committee, "is to fashion how you move the economy from the crippling high interest regime to the level where it becomes a stimulant of business and wealth creation.”

His comments came just moments after the Governor had cautioned against confusing recent economic improvements with permanent stability, emphasizing that a strong currency must be earned continuously through a productive real economy.

The Asantehene framed his appeal as a national economic imperative.

He dismissed the notion that government spending or significant foreign investment could alone solve Ghana’s developmental needs, particularly in an era of global uncertainty.

"No amount of investment by government on its own can scratch the surface of what we need,” he stated.

"This moment calls for a massive push to stimulate domestic private investment in industry. That cannot happen with interest at the current level.”

While noting that interest rates “have begun coming down,” the traditional ruler stressed that, based on past experience, the pace must be accelerated.

The Governor, in his earlier remarks, issued a reminder that the recent stability and strength of the Ghanaian cedi, while encouraging, should not be mistaken for a permanent achievement.

He emphasised that sustained economic discipline and productivity are the only true guarantors of long-term currency stability.

Latest Stories

-

New Horizon Fun Games: Vice President calls for stronger national commitment to inclusion

1 hour -

President Mahama commissions B5 Plus Steel Ball Mill and Manufacturing Plant to ignite industrial revolution

2 hours -

Fighters demand amnesty for cannabis convicts following massive policy shift

3 hours -

Don’t cancel the pension scheme for cocoa farmers

3 hours -

This Saturday on Prime Insight: CJ’s ‘No Prima Facie’ ruling and Burkina Faso bloodshed

4 hours -

Trump says he is considering limited military strike on Iran

5 hours -

Strategic voices of the opposition: Miracles Aboagye’s field advocacy and Akosua Manu’s communication shape NPP’s path forward?

6 hours -

Trump plans new 10% tariff as Supreme Court rejects his global import taxes

6 hours -

Ghana can supply steel to entire West Africa if domestic steel industry thrives – Mahama

6 hours -

Gyakie appreciates media houses for continued support

7 hours -

Imprisonment isn’t hopelessness – Ahafo GTA Regional Director tells inmates

8 hours -

GH¢150m allocated for Black Stars’ 2026 World Cup preparations — Ernest Norgbey

8 hours -

Strong food policies will protect the Ghanaian consumer against Non-Communicable Diseases – Groups

8 hours -

JORVAGO marks 15 years in music with new single

8 hours -

The Republic of Uncompleted Dreams…

9 hours