The International Monetary Fund has stated that Ghana breached the Debt Sustainability Analysis (DSA) thresholds, a situation that led the country into debt distress.

In a statement titled “Request for an arrangement under the Extended Credit Facility Programme”, the Fund said Ghana is in debt distress. It added that the country's debt level is also unsustainable.

“Given the ongoing debt restructuring and large and protracted breaches to the Debt Sustainability Analysis (DSA) thresholds, Ghana is in debt distress, and debt is assessed as unsustainable”.

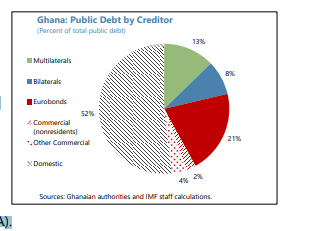

It pointed out that public debt increased to 88.1% of Gross Domestic Product by end-2022, almost evenly split between external (42.4% of GDP) and domestic (45.7% of GDP).

Again, the Fund mentioned that gross financing needs have reached about 19% of GDP.

“Under the proposed programmes baseline projections, which do not consider the possible outcome of the ongoing debt restructuring, the ratios of present value of public and external debt to GDP, and the ratios of external debt service to revenues and exports are and would remain above their LIC-DSF thresholds over the medium and long term”, it added.

Outlook subject to significant downside risks

The Fund further said that the outlook is subject to significant downside risks.

It explained that the baseline projections are predicated on successful programme execution and swift progress in implementing the authorities’ comprehensive debt restructuring and plans to address the large stock of domestic arrears, including to independent power producers (IPPs).

Notwithstanding mitigation strategies, it said that the domestic debt exchange presents significant risks to domestic financial sector stability, adding “exchange rate, credit, and liquidity risks further add to the vulnerabilities”.

“The authorities’ debt restructuring plans still leave a substantial need for T-bill [Treasury bills] issuance in the near term and expose Ghana to the uncertainty in domestic market conditions, though programme implementation and outreach may help mitigate financing risks. Domestic policy slippages represent a significant downside risk to the projections, further compounded by risks associated to the end-2024 general elections.”

Latest Stories

-

GFA commissions first set of floodlights at Ghanaman Soccer Centre of Excellence

14 seconds -

Basic public school uniform change an initiative, not a policy – Kwasi Kwarteng

3 mins -

Bawumia appeals for peace in Gonjaland, donates GHȼ100K, bull

9 mins -

Drake: AI Tupac track gone from rapper’s Instagram after legal row

21 mins -

Repainting schools, changing uniforms a misplaced priority – Joy FM listeners on rebranding of basic public schools

27 mins -

UEFA U-16 Tournament: Black Starlets bounce back with 5-1 win over Serbia

46 mins -

There’s nothing strange about changing colours for basic public schools – Education Ministry PRO

57 mins -

Diana Asamoah causes arrest of personal assistant over GH₵4k MoMo theft

1 hour -

Our mindset should breed excellence – Ace Ankomah

1 hour -

SML fully delivered on Transaction Audit Service Agreement with GRA

2 hours -

Government trying to hide something from SML/GRA contract – Arthur Kennedy

2 hours -

Don’t encourage lateness and foolishness – Ace Ankomah to UG Vice Chancellor’s award winners

2 hours -

‘Obroni wawu’ traders plan to protest over Kumasi Central Market Redevelopment delays

2 hours -

Gold Fields Ghana boosts cocoa production in Huni Valley District through Cocoa Farmers’ Support programme

2 hours -

Spanish government to oversee football federation after Luis Rubiales scandal

2 hours