Audio By Carbonatix

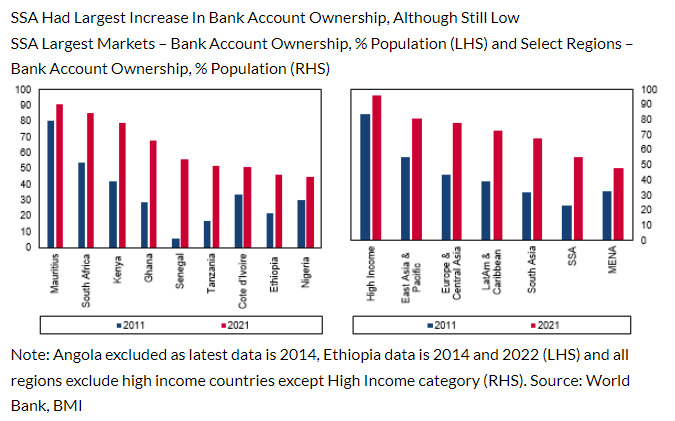

Ghana placed 4th in Sub-Saharan Africa with the largest growth in digital bank account ownership, Fitch Solutions, has revealed.

However, it described the increase as still low, compared to peers globally.

The country saw a growth of more than 40% in the digital bank account (including mobile money) between 2011 and 2022 to a little over 60%.

Mauritius placed 1st with more than 90% growth, followed by South Africa (82%) and Kenya (74%).

In 5th to 9th were Senegal (54%), Tanzania (50%), Ivory Coast (49%), Ethiopia (47%) and Nigeria (44%).

In the article “Navigating The Digital Banking Landscape In Sub-Saharan Africa”, the UK-based firm said Sub-Saharan Africa (SSA) has lagged behind other regions in banking sector development but leads in digital banking progress.

“We estimate that SSA banking assets will represent 53.0% of Gross Domestic Product in 2024, compared to the emerging markets average of 84.8%. Limited access to traditional banking has hindered broader economic participation and growth”.

Digital banking offers unprecedented opportunities for financial inclusion, fostering economic development and accelerating technology adoption. The proliferation of mobile phones, improved internet connectivity, and increasing regulatory support are key drivers of this shift.

Fitch Solutions added “We anticipate that SSA will continue to develop its digital banking capabilities, benefiting households, businesses, traditional and challenger banks, and the broader economy. This article investigates key themes and challenges associated with digital banking in SSA, a topic we previously highlighted as influential in the region’s banking development”.

It pointed out that Nigeria and Kenya stand out as the main hubs for digital banking in SSA, each showcasing unique ecosystems driven by traditional banks and innovative fintech companies. In Nigeria, key players like Kuda Bank and GTBank leverage robust mobile platforms to offer a range of financial services, targeting the unbanked and underbanked populations.

Other notable countries, it said, include South Africa with its advanced financial infrastructure, Ghana with surging mobile money usage, and Tanzania experiencing rapid mobile banking growth.

Latest Stories

-

COCOBOD CEO admits pricing gap is costing Ghana cocoa sales

3 minutes -

Solomon Owusu blames NPP for cocoa crisis, backs government’s new reform agenda

21 minutes -

‘Behind The Lens with Queen Liz’ explores the true meaning of Valentine’s Day, Love, Lust or Legacy?

2 hours -

‘I wanted to be an architect but ended up as a nurse’ – Diana Hamilton reveals

3 hours -

From wards to worship: Diana Hamilton reveals how nursing school shaped her destiny

3 hours -

Mahama demands binding deadlines for African reparations

3 hours -

This is not the time to settle political scores – Bawumia to government

5 hours -

5 definitive Valentine’s Day gifts to win your lover’s heart in Ghana

5 hours -

37% of SHS students exposed to drugs – Opare-Addo

5 hours -

NLC secures court injunction against striking tertiary unions

6 hours -

OSP says it remains guided by law after INTERPOL deletes Ofori-Atta’s Red Notice

6 hours -

Waiting in the Ring: life inside Bukom’s halted boxing scene

6 hours -

Red Notice cancellation: OSP official fires back at Ofori-Atta’s lawyers

6 hours -

Ofori-Atta saga: Red Notice ends after arrest – OSP official clarifies

7 hours -

AAG raises alarm over billboard demolitions, calls for presidential intervention

7 hours