Audio By Carbonatix

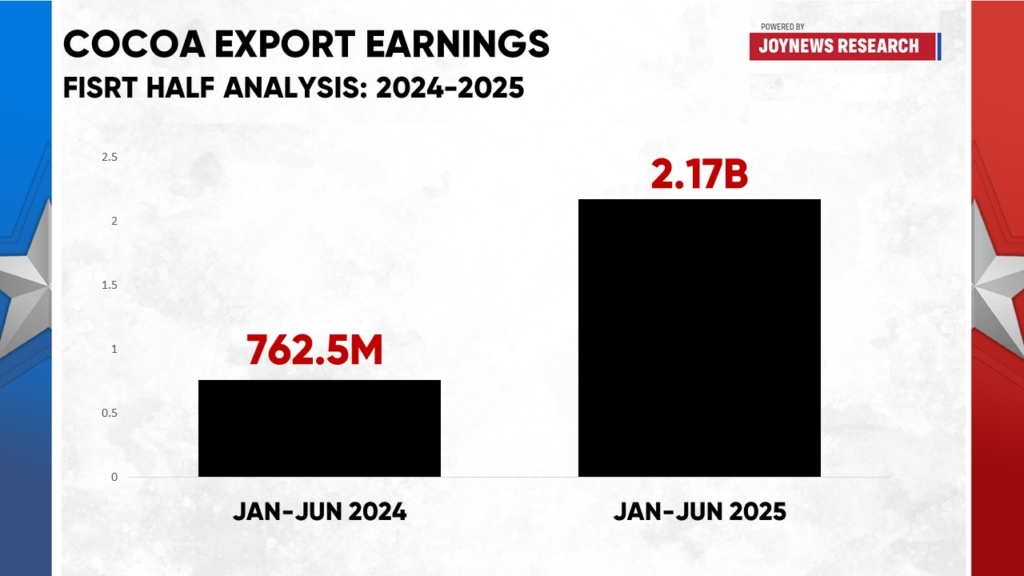

Ghana’s cocoa export earnings have seen a sharp rise in the first half of 2025, nearly tripling compared to the same period in 2024. The earnings in the first half of 2025 exceed total cocoa export earnings in the whole of 2024.

According to official data from the Bank of Ghana, the country earned $2.17 billion from cocoa exports between January and June 2025, up from $762.5 million in the first half of 2024. These feats have contributed to an increase in Ghana’s total earnings as well as its trade balance. As of June 2025, Ghana’s trade balance had increased more than threefold compared to the same time last year.

But behind this impressive growth lies a growing storm of concern about the sustainability of cocoa production in the country.

In an interview with Reuters, Ghana’s cocoa regulator, COCOBOD, signaled that the country could face a moderate decline in cocoa output this season. The warning follows reports from farmer groups about worsening conditions in key cocoa-growing districts.

The primary culprit? Climate change. Persistent rainfall, cooler-than-usual temperatures, and insufficient sunlight have created a perfect environment for fungal infections, including black pod disease, one of the most devastating threats to cocoa trees. The Ghana National Cocoa Farmers Association said the current weather pattern has severely hampered yields and raised fears of long-term damage to cocoa farms.

“We visited 72 cocoa-growing districts and saw visible signs of fungal infections on cocoa trees,” said Nana Oboadie Bonsu, president of the association. “If not addressed, this could cripple farmer incomes and disrupt the future of cocoa production in Ghana.”

COCOBOD has responded, saying they are intensifying mass spraying and disease control efforts and aim to complete nationwide fungicide distribution before the peak harvest season. Still, officials admit that “preliminary assessments suggest production may see a moderate decline compared to earlier projections.” The 2024/2025 season had targeted 650,000 metric tons, a figure that is now likely to be missed.

Read also: Explainer: Ghana’s cocoa export earnings triple in early 2025; what’s fueling the boom?

But the threat to cocoa production isn’t new, and it’s not just about weather. For years, Ghana’s cocoa industry has battled the destructive effects of illegal gold mining (galamsey), particularly in cocoa-rich regions like the Western, Ashanti, and Eastern corridors. Galamsey has left behind a trail of polluted water bodies, degraded lands, and destroyed farms, many of them cocoa plantations. In some communities, entire farms have been dug up or sold off for short-term gains, leaving once-thriving cocoa belts barren or chemically poisoned.

According to COCOBOD and environmental watchdogs, thousands of hectares of cocoa farms have been lost to illegal mining activities over the last decade. These farms are not only difficult to reclaim but also often left permanently unsuitable for cocoa cultivation due to mercury and heavy metal contamination. This has steadily undermined the country’s long-term production capacity.

Despite COCOBOD’s sustained efforts to shield cocoa lands from galamsey operations, enforcement has been weak, and some local officials have been complicit. The consequence is a dangerous erosion of the country’s productive base, one that even favorable market prices cannot offset.

Read also: Gold boom at what cost?: How galamsey is crushing Ghana’s cocoa industry

Ghana, the world’s second-largest cocoa producer, is therefore facing a double bind: strong earnings driven by high prices and shrinking output driven by environmental decay and poor farm resilience. The current revenue boom may offer temporary fiscal relief, but without bold structural interventions, from climate-smart farming to aggressive anti-galamsey enforcement, the foundation of Ghana’s cocoa economy remains dangerously exposed.

Latest Stories

-

Fire guts Saboba Hospital’s Children Ward

1 hour -

Interior Ministry extends aptitude test dates for WASSCE applicants in 2025/26 security services recruitment

2 hours -

National Investment Bank donates GH₵1m to support GAF barracks redevelopment project

3 hours -

Gomoa-East demolition: 14 suspects remanded by Kasoa Ofaakor Court

3 hours -

Divers recover bodies of seven Chinese tourists from bottom of Lake Baikal

5 hours -

From windstorm to resilience: How Wa school is growing climate protection

5 hours -

Reclaiming the Garden City: Dr. Kwame Adinkrah urges Kumasi to rein in billboard proliferation

5 hours -

Bursar of Ghanata SHS arrested for alleged diversion of student food supplies

5 hours -

Trump says he will increase global tariffs to 15%

6 hours -

Bogoso-Prestea mine records first gold pour after 24-month shutdown

6 hours -

Ghana–ECOWAS talks end with renewed push for women and youth political inclusion

6 hours -

Interior Minister receives Hudai Foundation food donation for prison inmates during Ramadan

7 hours -

UBIDS to benefit from pre-fabricated US$6.6m 1k capacity classroom project

7 hours -

Interior Minister launches Automated Fire Safety Compliance System to enhance public safety

7 hours -

Africa must lead climate intervention conversation – Experts

7 hours