The Ghana Incentive-Based Risk-Sharing System for Agricultural Lending (GIRSAL) through its Technical Assistance Facility (TAF) is partnering with the National Banking College (NBC) under its ‘Agriculture and Agribusiness Lending Course for Staff of Financial Institutions’ to train staff of financial institutions on agriculture financing.

The TAF is a key pillar of GIRSAL’s strategy and aims at strengthening the institutional capacity of staff of participating financial institutions in assessing loan applications from agribusinesses and hence help reduce the risk associated with lending to farmers and agriculture projects.

This initiative is supported by Alliance for a Green Revolution in Africa (AGRA).

Training Modules

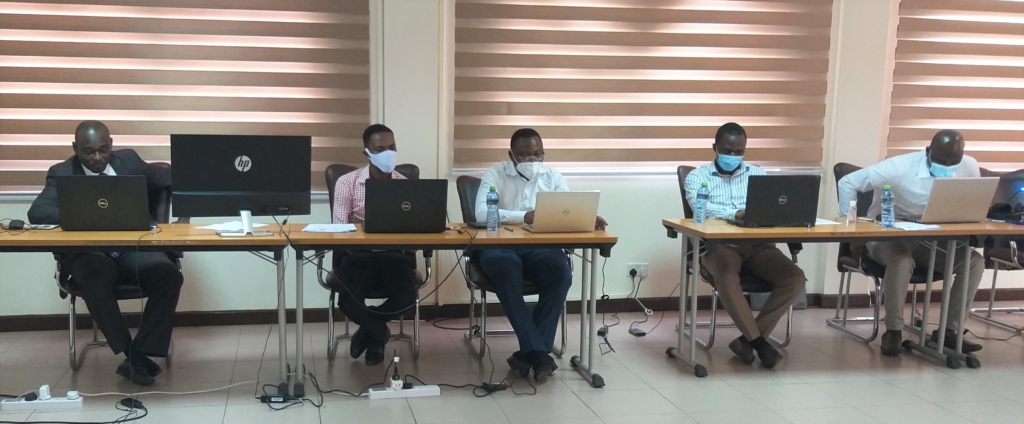

Due to the COVID-19 pandemic, the first batch of the training program was conducted virtually between August 11 and September 18, 2020, and was attended by 33 participants from 12 financial institutions.

The training combined classroom training, case studies and a field trip to an agribusiness. The 3-module training program was facilitated by well-experienced industry resource persons.

Modules 1 and 2 of the course covered the agribusiness environment, value chains in Ghana, and agricultural loan appraisal techniques, and targeted agriculture desk officers, relationship managers, credit risk officers and credit analysts.

Module 3 covered managing agriculture loan portfolios, with lessons ranging from agriculture insurance to commodity finance.

It targeted senior management and portfolio managers. The next round of the training is scheduled for the end of the year.

Field Trip to Golden Exotic Ltd

Participants visited Golden Exotics Ltd Banana plantation at Asutsuare (the largest banana plantation in Ghana) where they engaged the management on operational and financing challenges and opportunities.

There was also an interactive simulated credit application assessment session to identify, analyze, evaluate, and propose mitigation measures to value chain risks.

The field visit helped participants translate the classroom training to practical on-field operations of a typical agribusiness.

It also allowed participants to observe the good agronomic practices, post-harvest operations and learn the challenges and opportunities of large-scale farming operations as well as its financing and market environment.

The trip produced positive feedback from the participants who found it very educative and insightful and admitted the modules are very relevant to their work.

Latest Stories

-

Which will you vote for in 2024 Election: Honesty, Character, or Campaign Promises?

3 hours -

The ball is in Iran’s court after US pressure pays off

4 hours -

‘Japa’ sweeps Nigeria’s hospitals

4 hours -

Obuasi: Catholic Voices GH choral peace concert unites NPP, NDC

4 hours -

Lordina Supports NDC campaign in Ketu North with donation of medical equipment to Afife Health Centre

4 hours -

MTN Foundation delivers crucial technology tools to Eastern Regional Hospital

4 hours -

Galien Forum Africa: Enhaning African women’s role in climate and environmental crises

10 hours -

7th Galien Africa Forum ends with emphasis on health, innovation, and climate action in Africa

10 hours -

Ruthless Barcelona thrash Real Madrid to go 6 points clear

11 hours -

National Farmers’ Day scheduled for November 8

11 hours -

Samson’s Take: Why over 75% vote but only 5% join protests

12 hours -

Krachi East Chiefs applaud Bawumia for campaigning on issues with evidence

13 hours -

National Security Ministry dismisses Reuters’ claims that militants are using Ghana as logistical base

13 hours -

BOST and its CEO win big at 8th Ghana Energy Awards

15 hours -

Accused person in protest over alleged $3m BOST scandal discharged

15 hours