Audio By Carbonatix

Government is considering the reintroduction of the Electronic Transaction Levy percentage charge from 1.75 % to 1.5%.

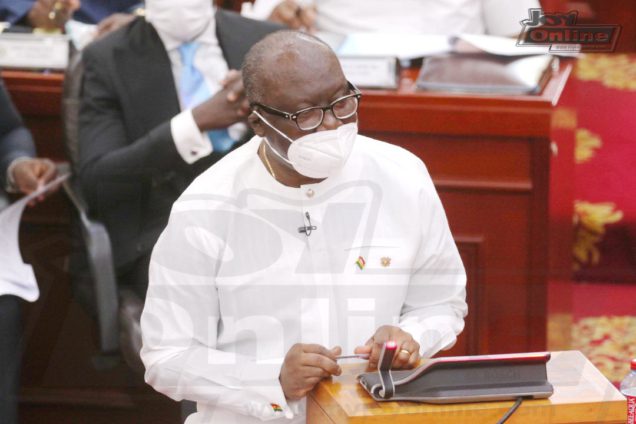

This comes after the Deputy Majority Leader, Alexander Afenyo-Markin revealed that the Finance Minister, Ken Ofori-Atta, will withdraw the controversial E-levy in Parliament and re-introduce same.

Mr Markin made this known whiles presenting the business statement for next week to the House.

He said the e-levy will be withdrawn by government on Tuesday February 15, 2022.

He also noted that it will further be reintroduced after it has been reviewed on Friday, February 18, 2022.

Members of Parliament were however encouraged to “participate fully in the consideration of the Bill for the passing of a good piece of legislation for the benefit of all.”

Earlier, government had hoped to get the buy-in of the NDC MPs for the Bill to be passed.

This was after telecommunication companies agreed to reduce their 1% charge on transactions by 0.25%.

If this was upheld, the rate would be reduced from 1.75% levy to 1.5%.

But it was rejected by the Minority.

About E-levy

Finance Minister Ken Ofori-Atta, presenting the 2022 budget on Wednesday, November 17, announced that the government intends to introduce an Electronic Transaction Levy (e-levy).

The levy, he revealed, is being introduced to “widen the tax net and rope in the informal sector”. This followed a previous announcement that the government intends to halt the collection of road tolls.

The proposed levy, which was expected to come into effect in January, 2022, is a charge of 1.75% on the value of electronic transactions. It covers mobile money payments, bank transfers, merchant payments, and inward remittances. There is an exemption for transactions up to GH¢100 per day.

Explaining the government’s decision, the Finance Minister revealed that the total digital transactions for 2020 were estimated to be over GH¢500 billion (about $81 billion) compared to GH¢78 billion ($12.5 billion) in 2016. Thus, the need to widen the tax net to include the informal sector.

Although the government has argued that it is an innovative way to generate revenue, scores of citizens and stakeholders expressed varied sentiments on its appropriateness with many standing firmly against it.

Even though others have argued in support of the levy, a section of the populace believe that the 1.75% e-levy is an insensitive tax policy that will deepen the already prevailing hardship in the country.

Latest Stories

-

Between faith and rights: A nuanced strategic view on the debate over an Islamic widow’s political ambition

5 minutes -

At worst, Baba Jamal should have been fined – Vitus Azeem

11 minutes -

Gender Minister visits the 31st December Women’s Day Care Centre and the Makola clinic

13 minutes -

Ayawaso East NDC primary: Why feed people for votes? Are they your children? – Kofi Kapito

18 minutes -

Ziavi Traditional Area begins funeral rites for Togbega Ayim Kwaku IV

26 minutes -

Photos: Mahama swears in Presidential Advisory Group on Economy

27 minutes -

Ghana intensifies boundary pillar construction with Côte d’Ivoire

27 minutes -

NHIA settles December–January claims worth GH¢400m for service providers

32 minutes -

Mahama warns economic advisers of ‘rough road ahead’ amid debt distress

32 minutes -

EC engages political parties in preparatory meeting for March 3 Ayawaso East by-election

35 minutes -

Forgiveness key to restoring broken relationships – Rev. Daniel Annan

36 minutes -

Joy Prime partners ALM for 2026 African Leadership Awards in Accra

43 minutes -

Retaining Baba Jamal shows NDC condones vote-buying – Vitus Azeem

46 minutes -

AG ordered to disclose Ghana-US deportation agreement to Democracy Hub

50 minutes -

Richard Osei-Anim joins Ishmael Yamson & Associates as Senior Partner to lead AI Global Practice

57 minutes