Audio By Carbonatix

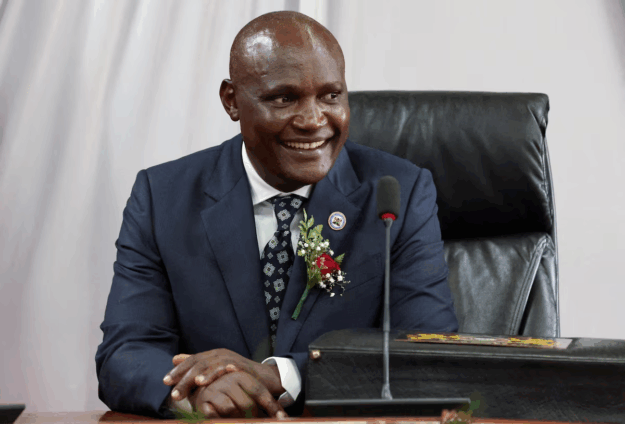

Kenya has completed converting three railway construction dollar-denominated loans from China into yuan in order to save on interest payments, its Finance Minister John Mbadi said on Tuesday.

The swap, which allows the floating, dollar-based interest rates across the three loans from China Exim Bank to drop into their lower, yuan-based rates, will save the country about $215 million a year, Mbadi told reporters.

The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here.

"It kicks off immediately, and it is a saving in our fiscal space," Mbadi told journalists at a briefing, without providing a figure for the outstanding loan amounts that were converted.

The East African nation borrowed three loans amounting to $5 billion in 2014 and 2015 for the construction of a modern railway line from the port city of Mombasa to a station near the Rift Valley town of Naivasha in the hinterland.

The outstanding loans stood at a total of $3.5 billion by June last year, figures from the finance ministry showed. China has not commented on the currency switch.

Apart from the financial relief, Kenyan officials attribute the currency switch to the fact that the East African nation's debt is concentrated in dollars, exposing the government to higher currency and interest rate risks.

About 68% of the stock of Kenya's external debt is denominated in dollars, according to government officials.

President William Ruto's government has been trying to cut its overall debt, which stands close to 70% of gross domestic product, in order to make repayments more manageable.

The government has revamped its debt management strategy to smooth out its maturity curve and lighten the pressure on public coffers.

It has also been turning to securitisation of revenue to raise funds for key projects like the extension of the railway from Naivasha to the Ugandan border, and the upgrading of its main airport in Nairobi.

A team from the International Monetary Fund is currently in Kenya for talks on a new Fund-supported programme after the expiry of the last one in April.

Mbadi said the talks were going well.

"We need the IMF," he said. "Yes, our economic conditions have improved, but we must not lose sight that we need more concessional loans and they come from multilaterals like the IMF and the World Bank."

Latest Stories

-

Fourth edition of SBE Cup set to uncover Ghana’s next football stars on March 16

2 minutes -

Doctor raises concern over rising UTI cases among children from affluent homes

3 minutes -

Regular check-ups key to early diagnosis of medical condictions – Little Angels Trust founder

5 minutes -

Four injured Ghanaian soldiers responding to treatment, likely to be managed in Lebanon — GAF

10 minutes -

Temporary traffic changes announced on Accra–Tema Motorway for major construction works

12 minutes -

New UCC E-Campus to be launched in August 2026; set to admit 10,000 students annually

15 minutes -

IMCC engages Roads Ministry on strengthening devolved sector functions

17 minutes -

One dead in crash at Teacher Mantey on Accra–Kumasi highway

26 minutes -

Istanbul’s ex-mayor to stand trial on corruption charges

26 minutes -

Contractors supplying school feeding programme import rice instead of buying from local farmers — Dr Nyaaba

30 minutes -

Nkoko Nkitinkiti initiative to cut Ghana’s poultry imports — John Dumelo

38 minutes -

The mirage of president’s special initiatives—Mahama’s “legacy projects” or another monument of waste?

53 minutes -

Thousands face long queues at airports in Houston and New Orleans

55 minutes -

‘Night turned into day’: Iranians tell of strikes on oil depots

1 hour -

Prof. Douglas Boateng commends govt’s value for money agenda, urges passage of Procurement Bill

1 hour