Audio By Carbonatix

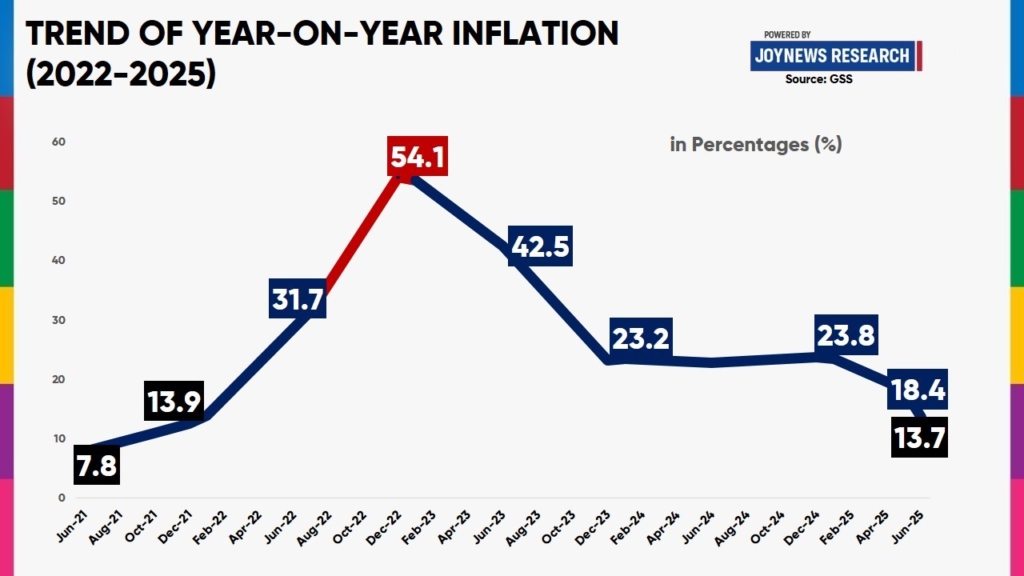

Ghana’s inflation rate has dropped significantly to 13.7% in June 2025, down from 18.4% in May. That’s a steep 25.5% decline, and the lowest figure recorded since late 2021.

It also marks the sixth consecutive month of disinflation, continuing a downward trajectory from 23.5% in January. Just 18 months ago, in December 2022, inflation peaked at a staggering 54.1%.

By all accounts, this is a promising development. So why do prices in markets and retail shops still feel high?

Disinflation deflation

The short answer: Disinflation is not the same as deflation. What we’re witnessing is a slowdown in the rate at which prices are increasing, not a decline in prices.

A lower inflation rate means that prices are rising more slowly than before, not that they’re reversing.

Take a basic example: if the price of kenkey rose from GHS 3 to GHS 7 during the height of inflation, a decline in the inflation rate doesn’t mean it will drop back to GHS 3. Prices tend to be "sticky" downwards—a well-known economic phenomenon.

Once they go up, they rarely come down with the same speed or ease. This stickiness is partly due to structural factors. Businesses still bear fixed costs like rent, salaries, and logistics that don’t drop just because inflation does.

There’s also strategic caution. Businesses fear that lowering prices may signal instability, confuse customers, or even trigger a damaging price war.

So prices often stay put unless companies are compelled by market competition or significant cost savings to adjust downward.

But aren’t economic conditions improving?

To be fair, the broader economic environment has seen tangible improvements. The cedi has strengthened. Global and domestic fuel prices have eased. Transport fares have even dropped by 15% in recent weeks.

Yet many retailers argue that they are still selling off inventory acquired when the cedi was weaker and fuel was pricier.

In other words, the high input costs from months past are still baked into the prices of goods currently on shelves. Until that stock is depleted and replaced at a lower cost, consumers are unlikely to see major relief.

But this rationale may be wearing thin.

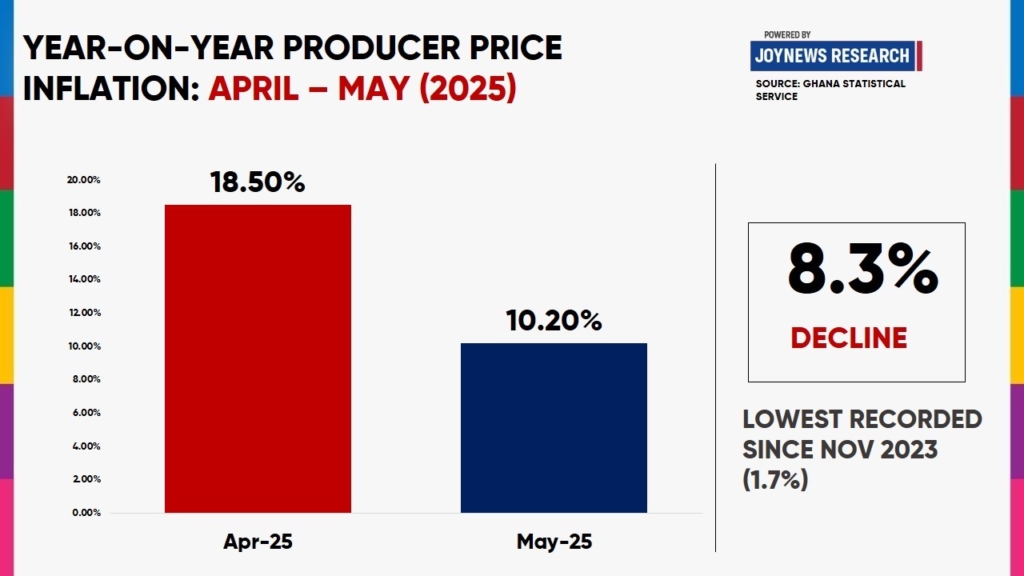

Data from the Ghana Statistical Service shows the Producer Price Index (PPI), which measures the average change over time in the selling prices received by domestic producers, fell by 8.3% between April and May 2025.

This decline suggests that production costs are beginning to ease more substantially. If the downward trend continues, the pressure on final consumer prices should start to ease as well.

The real question now is: How long will it take for these cost savings to trickle down to consumers? And at what point do retailers lose the justification to maintain elevated prices?

Until then, the gap between falling inflation and persistently high prices will remain a source of public frustration, even as economists cautiously celebrate the numbers.

Latest Stories

-

DWM honours Nana Konadu Agyeman-Rawlings as it renews pledge for gender equality

12 minutes -

See the areas that will be affected by ECG’s planned maintenance on Tuesday, March 10, 2026

29 minutes -

CID recovers over 100 tonnes of stolen ECG cables in Tema raid

31 minutes -

Police identify fifth suspect in killing of Liberian national at Sakumono

37 minutes -

Pastor arrested in Cape Coast for child sexual abuse and production of indecent materials

39 minutes -

Dr Agnes Naa Momo Lartey to address the 70th Session of the Commission on the Status of Women

45 minutes -

Osei Assibey Antwi faces 21 counts as state files amended charge sheet

48 minutes -

Gender Ministry marks 2026 IWD with renewed call for equality

51 minutes -

IWD: Media must be deliberate in ending stereotypes about women – Joy Brands Projects Coordinator

52 minutes -

Awutu Senya East MP urges gov’t to boost malaria vaccination funding amid global cuts

60 minutes -

Petrine Addae launches ‘Single and Being – Trust the Faithful God’

1 hour -

McDan donates GH¢200,000 to Volta Youth Development Fund, hails region as Ghana’s human skill hub

1 hour -

Nana Osowa Abena Korama-I aka Mrs Juliana Ackom

1 hour -

Invest in Ghana’s garment industry for job creation – Expert urges gov’t

1 hour -

Anny Osabutey: What is Daddy Lumba’s crime

1 hour