Audio By Carbonatix

Intel shares have jumped after Japanese technology investment giant Softbank said it is buying a $2bn (£1.5bn) stake in the US computer chip maker.

The announcement came just hours after new reports that the Trump administration is in talks to take a stake of around 10% in Intel by converting government grants into shares.

The potential deal, which was first reported last week, aims to help Intel build a flagship manufacturing hub in Ohio. At the time, a White House spokesman told the BBC that the reports "should be regarded as speculation" unless officially announced.

The BBC has contacted the White House and Intel for comment.

Under the deal announced on Monday, Softbank will pay $23 per share for Intel.

"The investment comes as both Intel and SoftBank deepen their commitment to investing in advanced technology and semiconductor innovation in the United States," the two companies said in a joint statement.

Intel shares rose by more than 5% in after-hours trade in New York on Monday.

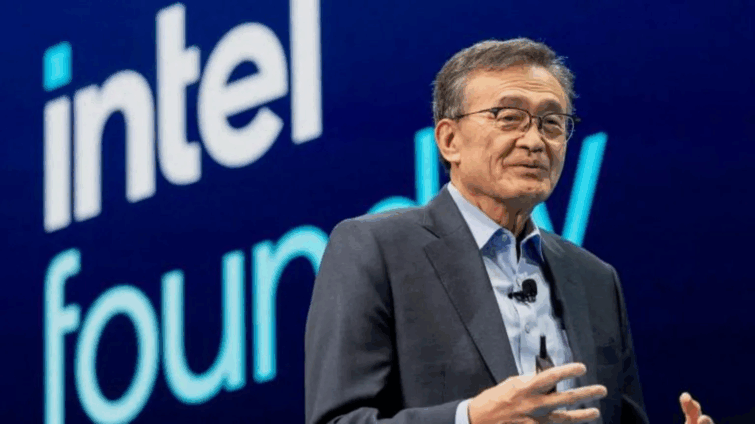

Last week, US President Donald Trump and members of his cabinet met Intel chief executive Lip-Bu Tan.

The meeting came just days after Trump called for Mr Tan to resign, accusing him of being "highly conflicted" due to his earlier ties to China.

The developments came as the US chip industry is under intense scrutiny by the White House.

Some analysts have described Intel's potential deal with the US government as a lifeline for the firm.

Intel is one of the few US firms capable of manufacturing high-end semiconductors at scale.

But globally, it has lost out to rival chip manufacturers like Samsung and TSMC.

On Thursday, the company declined to comment on the reported discussions and said it was "deeply committed to supporting President Trump's efforts" to strengthen manufacturing and technology in the US.

Such an agreement would mark a "major escalation" in what seems to be an attempt by the Trump administration to reshape the US government's role in the private sector, said political scientist Sarah Bauerle Danzman from Indiana University.

But the potential move sets a "concerning precedent" as it raises questions about whether companies may be pushed to follow political agendas, she said.

It also signals Washington's determination to ensure Intel succeeds and that the supply chain for computer chips is protected, said Dan Sheehan from Telos Wealth Advisors.

"[The Government's] agenda is clear: Accelerate domestic production, reduce dependence on Asia, and position Intel at the centre of the AI and national security landscape," he said.

SoftBank's investment is a "clear vote of confidence" in Intel's turnaround, he added.

Last week, Nvidia and AMD agreed to pay the US government 15% of their Chinese revenues as part of an unprecedented deal to secure export licences to China.

Latest Stories

-

Chinese community in Ghana marks ‘Year of the Horse’ with grand new year festival

4 minutes -

When regional instability becomes national risk: Ghanaian tomato traders killings

20 minutes -

Photos: President Mahama meets Tanzania President Suluhu Hassan

33 minutes -

Mahama calls for cessation of Iran-US-Israel conflict, urging return to dialogue

53 minutes -

Fuel prices could rise if Middle East conflict escalates – ACEP Boss

57 minutes -

Elsie Addo Awadzi: Leadership reflections, one year on; 7 lessons from 7 years in public office

1 hour -

Finance Minister announces expiration of DDEP-induced restrictions on domestic bond issuance

1 hour -

Gov’t urged to aid private nursing training colleges to ease burden on public ones

1 hour -

Kumasi Mayor vows to keep Kejetia Market free from highly inflammable materials

2 hours -

Ghana safe from fuel supply disruptions amid Middle East tensions – Dr Oppong

2 hours -

Ghana Development Awards 2026 set to celebrate excellence in nation-building and economic recovery

2 hours -

IMANI opens applications for 12th SYPALA summer seminar

2 hours -

Khamenei’s wife dies after suffering injuries in air strike – Iranian media

3 hours -

Modernising customs operations: Leveraging advanced technology to combat fraud and inefficiencies

3 hours -

Accra Professional Ladies Open returns after three-year hiatus to mark International Women’s Day

3 hours