The Joint Business Consultative Forum has resolved to petition President Akufo-Addo on the passage of the three revenue tax amended bills passed by Parliament later today, April 5, 2023.

According to the Business Groups, the implementation of these taxes will spell doom for the Ghanaian business community, hence the need to review the taxes.

They argue that businesses are battling with excessive taxes, thereby making them less attractive and uncompetitive globally.

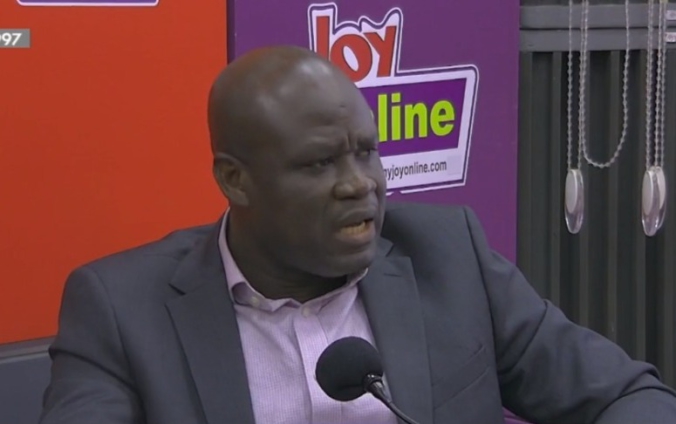

The CEO of the Ghana National Chamber of Commerce and Industry, Mark Badu-Aboagye told Joy Business it will be in the interest of government to listen to the business community.

“If they really want the monies they are looking from these taxes that they have passed [bills into law], it is the interest of government to listen to us. We are still putting the papers together, hopefully by this morning [April 6, 2023], this petition will get to the President”.

He added that they will be doing it expeditiously before the President [Akufo-Addo] appends his signature.

“We want to do it as quickly as possible for him to understand our plight before he assigns to the bills that have been passed”.

Government is hoping to rake in about ¢4 billion from the three newly introduced taxes.

Parliament on Friday controversially passed the three bills – Excise Duty, Growth and Sustainability Levy and Income Tax Amendment bills after fierce resistance by the Minority Members of Parliament.

Latest Stories

-

The driver’s mate conundrum

10 mins -

IMF Deputy Chief worried large chunk of Eurobonds is used to service debt

26 mins -

Otumfuo Osei Tutu II celebrates 25 years of peaceful rule on golden stool

29 mins -

We have enough funds to pay accruing benefits; we’ve never missed pension payment since 1991 – SSNIT

54 mins -

Let’s embrace shared vision and propel National Banking College – First Deputy Governor

1 hour -

Liverpool agree compensation deal with Feyenoord for Slot

2 hours -

Ejisu by-election: There’s no evidence of NPP engaging in vote-buying – Ahiagbah

2 hours -

Ejisu by-election: Independent ex-NPP MP’s campaign team warns party against dubious tactics

2 hours -

ZEN Petroleum supports Tse-Addo Future Leaders School

3 hours -

NPP must win back Adentan seat in 2024 polls – Obeng Fosu

3 hours -

PPA Clarification: The dark side of the World Bank’s ‘giveaways’ in Ghana by Bright Simons

4 hours -

Blinken says China helping fuel Russian threat to Ukraine

5 hours -

MHA declares May as Purple Month for Mental Health Awareness

5 hours -

WAEC arrests former headmaster over illegal students registration

5 hours -

MeToo founder Tarana Burke defiant after Harvey Weinstein ruling

5 hours