Audio By Carbonatix

Kenya aims to carry out a pioneering $1 billion debt-for-food security swap by March next year, a finance ministry document showed on Tuesday, as the country looks to novel solutions to ease its hefty debt burden.

The plan is expected to work in a similar way as so-called debt-for-nature swaps carried out by several countries in recent years that offered lower interest rates in exchange for nature protection.

A debt-for-food swap would likely allow a country to replace costly existing debt with lower-cost financing on condition it channels the savings towards programmes to boost food security, finance experts say.

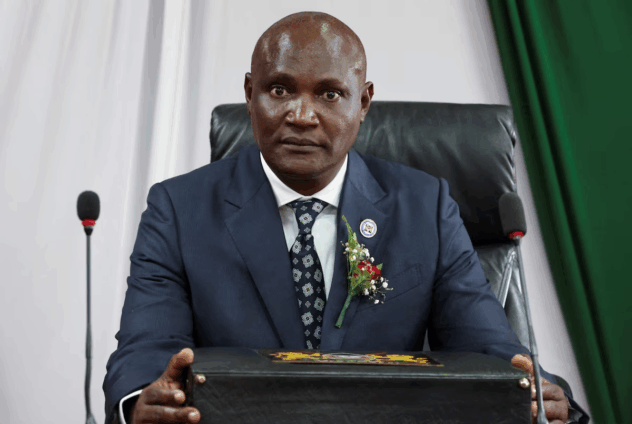

Officials at the Finance Ministry could not be reached for comment, but Finance Minister John Mbadi told a local television station earlier this year the government was in advanced discussions on a swap involving the World Food Programme's participation.

President William Ruto's government spends roughly one-third of its revenue on interest payments - one of the highest ratios in the world - and is eager to bring debt spending down.

Debt swap agreements with a focus on social or environmental benefits are becoming an increasingly popular financing tool in poorer parts of the world. Countries including Ecuador, Belize and Gabon have undertaken debt-for-nature deals in recent years.

Ivory Coast completed the first major evolution of the model last December with a debt-for-education swap with the help of a World Bank "credit guarantee". Guarantees are included to persuade creditors to lower borrowing costs.

Kenya, which is East Africa's biggest economy, had a total public debt equivalent to 67.8% of its GDP at the end of June this year, the Finance Ministry said in the document, which is called an annual borrowing plan.

The government also plans to borrow $500 million using sustainability-linked bonds by March 2026, a World Bank loan of $757 million by March next year and another loan of $457 million in June, the document showed.

It is also looking to cut its debt costs by turning to securitised debt and converting a $5 billion rail loan into the Chinese currency, it has said recently.

Latest Stories

-

Ghana’s reliance on Dubai for gold exports leaves cedi exposed as Iran conflict disrupts trade

11 minutes -

Cabinet approves new round of SIM registration exercise

25 minutes -

TUC urges action on women’s rights, workplace protections on International Women’s Day

36 minutes -

Leadership of Cashew Watch Ghana engages TCDA CEO to advance sector growth

37 minutes -

Ghana’s gold crossroads: Why global pressure is real, but a coup is still unlikely

40 minutes -

24-Hour Economy Secretariat targets 160k jobs under new energy transition MoU

42 minutes -

Ada West Education Directorate intensifies policies to reduce teenage pregnancy

46 minutes -

We are in final stages of setting up Women’s Development Bank – Mahama

51 minutes -

IWD: Invest more in women for national development – Fisheries Minister

59 minutes -

CLOGSAG begins indefinite nationwide strike over delayed conditions of service today

1 hour -

Educational orientation worsening youth unemployment in Ghana – Asiedu Nketia

1 hour -

Middle East War: Gov’t must turn oil price gains into relief for the poor

1 hour -

Iran war: Import addiction threatens Ghana’s economic stability – Economist

1 hour -

Women urged to embrace authenticity to unlock their potential

2 hours -

Nigerian army kills 45 in Katsina clash

2 hours