Audio By Carbonatix

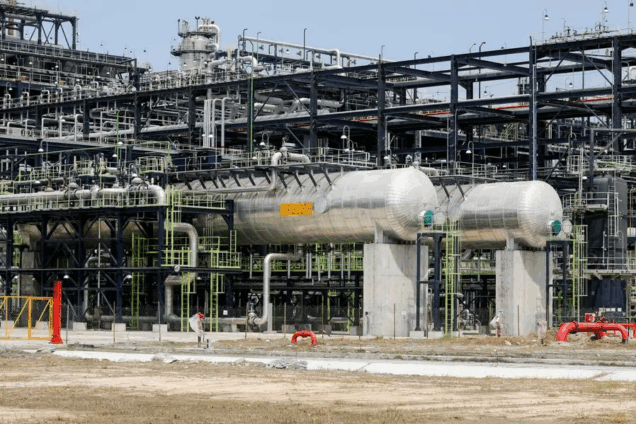

Nigeria is witnessing a significant shift in its oil and gas landscape as local companies expand their roles, driving a new phase of potential sectoral growth and innovation.

Leading the charge are companies which bought onshore and shallow water assets from oil majors planning billions of dollars of investments to develop abandoned fields.

Smaller producers are also pulling their weight; for example, Nigeria's first locally developed and operated onshore crude terminal, Otakikpo, began loading operations on Monday. Built by Green Energy Limited and located in the OML 11 block near Port Harcourt, it marks a milestone in local capacity.

Shell loaded the first crude cargo through the 360,000 bpd capacity terminal on Monday, opening up potential drilling prospects for over 40 stranded fields in the region.

Similarly, Conoil Producing Limited recently shipped the first cargo of its new Obodo crude blend from the onshore OML 150 in the Niger Delta. The cargo was lifted by Oando Trading, a subsidiary of Oando Plc, which bought ENI's divested assets.

Following this trend, Renaissance Africa Energy — after acquiring Shell's onshore assets — is committing to investing $15 billion over the next five years in its oil and gas operations. The company aims not only to balance its portfolio by increasing crude oil production but also to double its gas output once a key local gas pipeline is completed.

Similarly, Seplat Energy following its acquisition of ExxonMobil's Nigerian shallow-water assets, recently announced plans to reopen 400 previously shut-in wells. CEO Roger Brown said the company is set to invest up to $320 million this year in drilling campaigns and infrastructure, with the goal of boosting crude production to around 140,000 barrels per day.

"We are focused on reviving existing wells, expanding drilling campaigns, and increasing gas volumes," Brown said during the company's annual general meeting.

While these developments show the increasing role local producers are playing amidst government reforms, they are also grappling with challenges.

"These operators face higher costs due to security challenges, community disputes, oil theft and ageing infrastructure – a key aspect of reducing costs for operators will be addressing these challenges," said Mikolah Judson, an analyst at global risk consultancy, Control Risk.

These local players signal a new phase for Nigeria's oil and gas sector and could provide support for the government's plan to raise oil output by an additional 1 million barrels per day (bpd) next year, the head of Nigeria's oil regulator said.

They now account for over half of Nigeria's oil production from around 40% before the oil majors completed their divestment programmes, according to the regulator's data.

Latest Stories

-

Fact Check: Mahama’s claim that over one million people found employment from 2025 Q1 to Q3 is false

37 seconds -

Ghana eyes West Africa aviation hub as Ambassador Victor Smith engages US helicopter giant

15 minutes -

Lordina Mahama advocates for safer childbirth

25 minutes -

TMA begins poultry distribution to boost food security

42 minutes -

Interior Minister receives Gbenyiri Mediation Committee report on Gonja-Birifor conflict

47 minutes -

Lordina Foundation builds and hands over ultramodern maternity and children’s ward to Asukawkaw Clinic

48 minutes -

Former CJ on Dubai lesson and why Ghana must build its own gold market

58 minutes -

It’s never too late – Former CJ Sophia Akuffo backs industrial reset

1 hour -

We would be very far ahead – Ex-CJ Sophia Akuffo laments Ghana’s industrial retreat

2 hours -

Iran, the US, and a World Cup that starts in three months

2 hours -

Why is WhatsApp’s privacy policy facing a legal challenge in India?

2 hours -

Oil prices rise after ships attacked near Strait of Hormuz

2 hours -

Sophia Akuffo on Obuasi’s missed gold opportunity

6 hours -

Investment firm’s financial officer arraigned over GH¢300K dud cheque

6 hours -

Former MCE, 8 others granted GH¢800K bail over fraudulent sale of gov’t land

6 hours