Audio By Carbonatix

MobileMoney Ltd is set to host its Annual Fintech Stakeholder Forum on Wednesday, October 15, in Accra.

This year’s event, themed “Harnessing Ghana’s Fintech Potential: Regulatory Frameworks for Digital Credit and Digital Assets,” will bring together key stakeholders from the financial, regulatory, and technology sectors to explore the evolving Fintech landscape and discuss strategies for sustainable digital finance growth in Ghana.

The 2025 Fintech Stakeholder Forum is being held in partnership with the Institute of Statistical, Social and Economic Research (ISSER) and the IMANI Centre for Policy and Education (IMANI), who will both present research findings on Ghana’s readiness for the emerging digital credit and asset guidelines.

Their presentations will provide valuable insights to enrich the national conversation on fintech regulation and innovation.

Discussing the details of the theme is a panel made up of Selorm Branttie, Vice President of IMANI Africa, Professor Peter Quartey– ISSER, Clara B. Arthur – CEO of GHIPSS, Ethel Cofie- CEO of EDEL Technologies and Sylvia Otuo Acheampong – Chief Products and Services Officer- MobileMoney Ltd.

Matilda Asante, Second Deputy Governor of the Bank of Ghana, is the Guest Speaker.

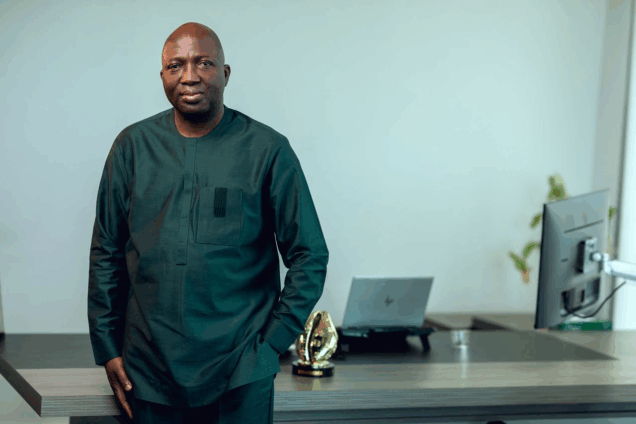

Commenting ahead of the event, Shaibu Haruna, Chief Executive Officer of MobileMoney LTD, noted that the forum provides a timely opportunity to deepen collaboration and align stakeholders on the future of digital finance in Ghana.

“The Fintech space is evolving rapidly, and innovation must be balanced with strong regulatory frameworks that safeguard consumers and drive growth.

"This year’s forum will provide an opportunity to share ideas, exchange knowledge, and strengthen partnerships that move Ghana’s digital financial ecosystem forward,” he said.

The forum serves as a flagship platform for dialogue between MobileMoney Ltd, policymakers, industry regulators, and ecosystem partners.

It provides an avenue to examine emerging opportunities and challenges shaping the Fintech industry, including mobile lending, digital asset innovation, and the policies needed to ensure customer protection, innovation, and compliance.

Over the years, the MobileMoney Ltd Fintech Stakeholder Forum has established itself as a leading thought-leadership event, shaping conversations around financial inclusion, interoperability, and digital transformation.

Latest Stories

-

Diplomatic community applauds Ghana’s economic turnaround

11 minutes -

UG graduates 153 PhDs as over 15,000 students receive degrees

13 minutes -

Africa’s mineral wealth must no longer be a paradox without prosperity , says Prof. Denton as UN body releases new Report

18 minutes -

Woman killed on church premises at Twifo Denyase

28 minutes -

2 arrested over alleged gang rape of Osino SHS student – Dept. Education Minister

42 minutes -

Haruna Iddrisu, Mohammed Sukparu survive road crash on Bolgatanga-Tumu Road

50 minutes -

#RoadOfPeril: Residents, commuters demand gov’t action on Kwabenya-Berekuso-Kitase road

55 minutes -

Intelligence opens doors; kindness decides what happens inside

1 hour -

Government to announce reforms to revamp cocoa sector, boost farmer payments

1 hour -

Court of Appeal orders retrial in Kennedy Agyapong–Kweku Baako defamation case

1 hour -

Thomas Partey charged with two new counts of rape

1 hour -

Polls close in first election since Gen Z protests ousted Bangladesh leader

2 hours -

Kim Jong Un chooses teen daughter as heir, according to reports

2 hours -

Production of ‘Goods and Services’ for November 2025 slows to 4.2% of GDP

2 hours -

Why you should think twice before buying a converted right-hand-drive vehicle

2 hours