Audio By Carbonatix

Nvidia's market value has surged past $3tn (£2.3tn), lifting the chipmaker ahead of Apple to become the second most valuable publicly listed company in the world.

The firm's share price rose more than 5% on Wednesday, to more than $1,224.

It extended a breathtakingly rapid climb that started last year, powered by bets that the firm is positioned to be a major winner from a wave of investment in artificial intelligence (AI).

Its market value now sits just behind Microsoft, another key player in the industry thanks to its investments in Chat GPT-maker OpenAI.

Valued at "just" $2tn as recently as February, Nvidia sparked a new wave of share purchases after it announced plans last month for a so-called stock split.

The move will increase the number of shares by a factor of 10 and reduce their value accordingly, a change aimed at making shares more affordable to small-time investors.

Set to happen on Friday, it is expected to generate even more demand for the stock.

Founded in 1993, Nvidia was originally known for making the type of computer chips that process graphics, particularly for computer games.

Long before the AI revolution, it started adding features to its chips that it says help machine learning - all of which has helped it increase its market share.

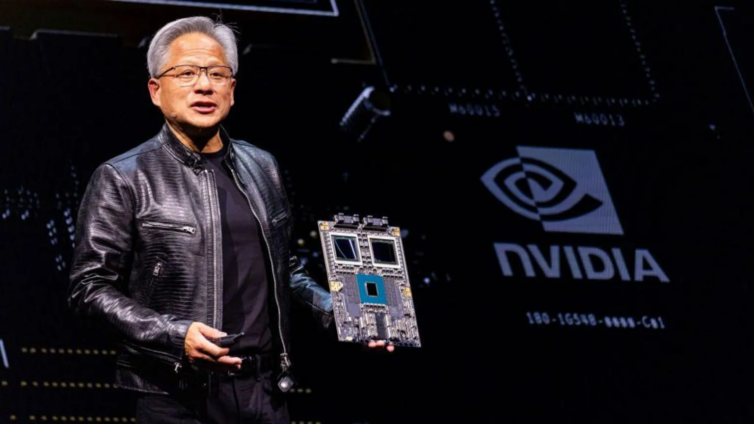

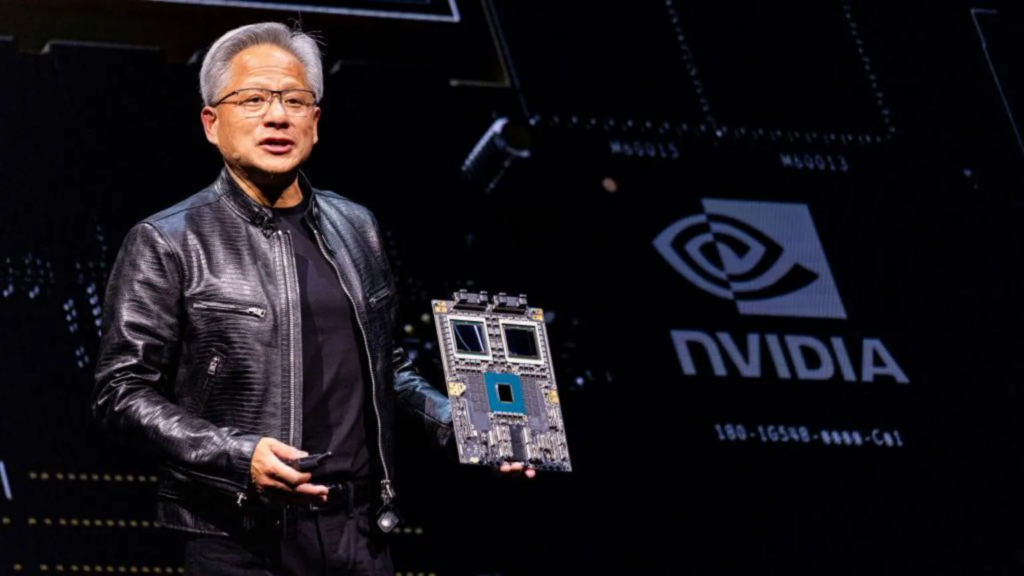

It is now seen as a key company to watch to see how fast AI-powered tech is spreading across the business world, a shift boss Jensen Huang has declared the dawn of the "next industrial revolution".

His company has seen explosive growth, reporting sales of $26bn in the three months to 28 April - more than triple the same period in 2023, and up 18% from the previous three month.

Optimism about AI is one of the forces behind a broader market rally over the last year, which pushed the S&P 500 and the Nasdaq in the United States to new records on Wednesday.

Apple had appeared to be losing out earlier this year as sales growth stalled.

But in recent weeks, its shares have been buoyed by anticipation over how it plans to incorporate AI into its own strategy.

Shares in the firm rose 0.7%, giving it a market capitalisation of roughly $3tn, which is generally calculated by multiplying the number of shares in a company by its current share price.

Latest Stories

-

24-Hour Economy not just talk — Edudzi Tamakloe confirms sector-level implementation

11 minutes -

Four arrested over robbery attack on okada rider at Fomena

12 minutes -

NDC gov’t refusing to take responsibility for anything that affects Ghanaians – Miracles Aboagye

38 minutes -

Parental Presence, Not Just Provision: Why active involvement in children’s education matters

1 hour -

24-Hour economy policy fails to create promised jobs – Dennis Miracles Aboagye

1 hour -

Ghana Embassy in Doha urges nationals to take shelter after missile attack

1 hour -

Government’s macroeconomic stability commendable, but we need focus on SME growth – Victoria Bright

2 hours -

Macro stability won’t matter without food self-sufficiency- Prof. Agyeman-Duah

2 hours -

How Virtual Security Africa is strengthening safety at Mamprobi Polyclinic

2 hours -

Ghana on right track macroeconomically, but structural gaps remain – Fred Dzanku

2 hours -

ADB MD honoured for impactful leadership at PMI Ghana engagement

2 hours -

Bringing Ofori-Atta’s photo to Parliament and displaying it was unfair – Afenyo-Markin

3 hours -

Minority leader calls 24-Hour economy policy more PR than practical solution

3 hours -

Afenyo-Markin accuses government of using anti-corruption drive to target opponents

3 hours -

GPL: Kotoko announce new board of directors

3 hours