Audio By Carbonatix

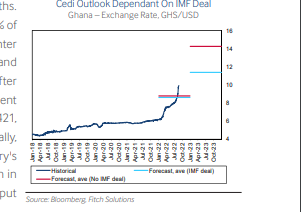

The outlook of the Ghana cedi will depend on whether Ghana reaches an agreement with the International Monetary Fund (IMF) and obtain funding in the months ahead.

According to Fitch Solutions November 2022 West Africa Monitor Report, though it expects the cedi to remain on a depreciatory trajectory in the immediate term, the outlook depends on whether Ghana reaches an agreement with the IMF for a programme.

“Although we expect that the cedi will remain on a depreciatory trajectory in the immediate term, the outlook depends on whether Ghana will reach an agreement with the International Monetary Fund (IMF) and obtain funding in the months ahead. In July 2022”.

The country announced in July 2022, it was seeking support from the IMF to address the present economic challenges.

Fitch Solutions pointed out that though it believes that the two parties will reach a deal in the first quarter of 2023, there are downside risks to this view which would have negative implications for the cedi.

It stressed that the reason the Ghana cedi has suffered rapid depreciation this year is due to downgrades of its credit rating by the international rating agencies.

This is on the back of the country’s poor fiscal economy as a result of high-interest payments, rising debt levels and large fiscal deficit, forcing foreign holders of Ghana’s bonds to sell off.

Fitch Solutions concluded that with Ghana being unable to tap international capital markets, the country's foreign exchange reserves fell to 3.4 months of import cover in June 2022, which will continue to limit the Bank of Ghana's ability to defend the exchange rate over the coming months.

“With Ghana being unable to tap international capital markets to finance the deficit, the country's foreign exchange reserves have fallen to $7.7 billion (3.4 months of import cover) in June 2022, from $9.8 billion in January 2022, which will continue to limit the Bank of Ghana (BoG)'s ability to defend the exchange rate over the coming months”.

Meanwhile, the cedi is still going for ¢14.60 to a dollar this morning, November 17, 2022. It is also still selling at ¢16. 65 pesewas to one pound.

Latest Stories

-

Zito expresses Kotoko’s interest in Lions midfielder Etse Dogli

9 minutes -

Today’s Front pages: Tuesday, February 3, 2026

9 minutes -

South Africa launches annual HPV vaccination campaign

15 minutes -

Bawumia deserves a chance – Arthur Kennedy

19 minutes -

Nine arraigned for deadly attack in Nigeria that killed over 150

24 minutes -

We have high expectations of Adjetey – Wolfsburg Sporting Director

24 minutes -

Lands Ministry charts results-oriented agenda for 2026

43 minutes -

Run an open-door policy, but be wary of the ‘Judases’ – Atik Mohammed to Bawumia

55 minutes -

Ablakwa in Latvia to probe death of Ghanaian student

1 hour -

Gideon Boako hails Bawumia’s victory as true reflection of delegates’ will

1 hour -

Pastor Edwin Dadson, Spikenard Music International donate GH¢50,000 to Little Hearts Foundation

1 hour -

Nkwanta South MCE appeals to Health Minister for renovation of health facilities in Oti Region

1 hour -

Botswana and Ghana point to a new model for African mining

1 hour -

NPP presidential primaries tougher than 2024 polls – Hassan Tampuli

1 hour -

Nana B backs Afenyo-Markin as Minority Leader amid calls for his removal

1 hour