Audio By Carbonatix

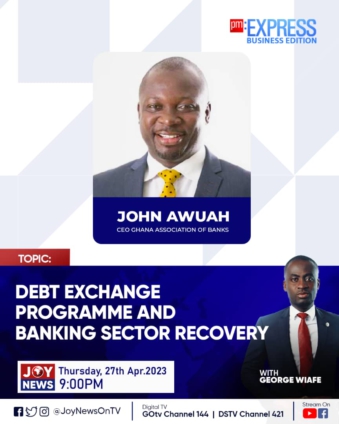

Thursday’s Business Edition of PM Express will be discussing the recovery of the banking sector after the Domestic Debt Exchange Programme (DDEP).

The conversation follows the Ghana Association of Banks (GAB) stating that banks in the country are in good standing with their financial position despite losses incurred by the lenders due to the DDEP.

A recent assessment of financial statements of banks by Dr. Richmond Atuahene and K B Frimpong revealed that banks will lose an additional ¢6 billion due to reduced coupon rates and the extension of the maturity period from five to 15 years.

Mr John Awuah stated that even though banks appear to have been negatively impacted, the situation was anticipated, hence adequate measures were put in place to protect banks in the country.

Join the conversation for more details;

Latest Stories

-

GPL 2025/26: Asante Kotoko beat Young Apostles to go fourth

18 minutes -

T-bills auction: Interest rates fell sharply to 6.4%; government exceeds target by 170%

2 hours -

Weak consumption, high unemployment rate pose greater threat to economic recovery – Databank Research

3 hours -

Godfred Arthur nets late winner as GoldStars stun Heart of Lions

4 hours -

2025/26 GPL: Chelsea hold profligate Hearts in Accra

4 hours -

Number of jobs advertised decreased by 4% to 2,614 in 2025 – BoG

4 hours -

Passenger arrivals at airport, land borders declined in 2025 – BoG

4 hours -

Total revenue and grant misses target by 6.7% to GH¢187bn in 2025

4 hours -

Africa’s top editors converge in Nairobi to tackle media’s toughest challenges

6 hours -

Specialised courts, afternoon sittings to tackle case delays- Judicial Secretary

6 hours -

Specialised high court division to be staffed with trained Judges from court of appeal — Judicial Secretary

6 hours -

Special courts will deliver faster, fairer justice — Judicial Secretary

7 hours -

A decade of dance and a bold 10K dream as Vivies Academy marks 10 years

7 hours -

GCB’s Linus Kumi: Partnership with Ghana Sports Fund focused on building enduring systems

8 hours -

Sports is preventive healthcare and a wealth engine for Ghana – Dr David Kofi Wuaku

8 hours