Audio By Carbonatix

The Ghana Association of Forex Bureaus is urging the Bank of Ghana (BoG) to reassess certain regulatory guidelines that currently govern its operations.

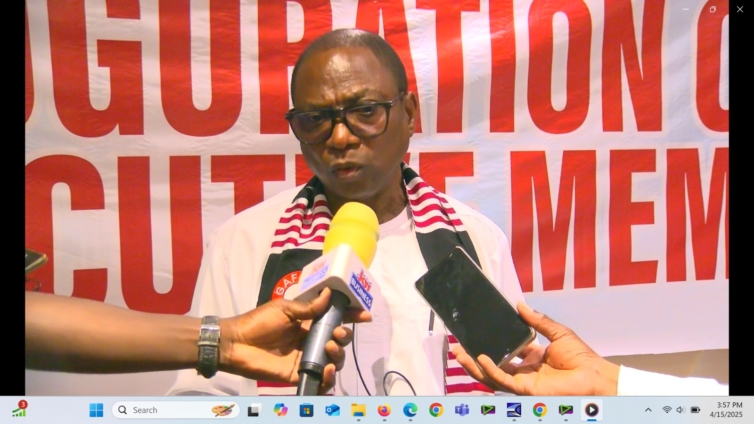

According to Dr. Alex Akpabli, the President of the Association, the central bank should introduce more flexibility into the framework to allow forex bureaus to enhance their services, adopt technological solutions, and offer more efficient and accessible foreign exchange transactions.

“We were established to provide feasible access to foreign currency for the public and businesses. Whether it’s helping parents send money to their children abroad or supporting individuals and businesses who need foreign exchange, our role is vital.”

“There should not be a situation where people are forced to go to the banks when they need foreign currency. It should be readily available through licensed forex bureaus. Therefore, we urge the regulators to reconsider the existing framework to help grow this vital industry", Dr. Akpabli said.

Negative Impact of Black Market Activities

Dr. Akpabli also raised concerns about the negative impact of black market activities on the operations of licensed forex bureaus.

He pointed out that illegal foreign exchange transactions are not only contributing to exchange rate instability but are also undermining the operations of legitimate forex bureaus, affecting the broader economy.

During the swearing-in ceremony of the Association’s new executives, Dr. Akpabli highlighted the urgent need for stricter enforcement of regulations to curb the rising influence of the black market in the country.

“The black market has been a persistent challenge. It has existed long before we came into operation, and its presence is deeply embedded in the market. It’s not an easy problem to tackle. However, if we are allowed more flexibility to trade among ourselves and gain better access to foreign exchange, we can significantly reduce the dominance of these illegal traders,” he added

Dr. Akpabli emphasised that the continued existence of black-market currency exchange operations destabilizes the economy by distorting the true value of the currency.

"Licensed forex bureaux face challenges as they are unable to compete with illegal traders who operate outside the law and offer rates that often undercut the official market. As a result, individuals and businesses seeking foreign currency may be driven to the black market, further exacerbating exchange rate fluctuations", he stressed

The association also pointed out that if forex bureaux were given the ability to facilitate more accessible, competitive, and transparent currency exchanges, it would provide an alternative to the black market, ultimately helping stabilize the currency exchange environment in the country.

Incorporating Digital Technology

Dr. Akpabli’s call for flexibility aligns with the ongoing global trend of incorporating technology in financial services.

Many forex bureaus have already started integrating digital platforms to enhance customer experiences, provide real-time exchange rates, and offer more secure transactions. However, restrictive regulations continue to limit their ability to fully leverage these technological advancements.

He expressed concerns over the increasing gap between the official exchange rate and the black market rate, which has been widening in recent years.

"The lack of access to sufficient foreign currency through legal channels is pushing more individuals and businesses to rely on illegal traders, perpetuating a cycle of instability that is detrimental to the country’s financial system", he explained.

To tackle these challenges, the association has called on the Bank of Ghana to consider introducing more dynamic regulations that would enable forex bureaux to better meet market demand, enhance competition, and contribute positively to the country’s economy.

It believes that with the right regulatory adjustments, the sector could evolve into a more robust, tech-driven, and sustainable part of Ghana’s financial landscape.

Latest Stories

-

Gov’t to extradite foreign national who secretly filmed Ghanaian women to face prosecution – Sam George

21 minutes -

U20 WWC: Black Princesses to play Uganda in final round of qualifiers

26 minutes -

‘I will never forget you’ – Kennedy Agyapong thanks supporters, NPP delegates after primaries

2 hours -

Woman found dead in boyfriend’s room at Somanya

4 hours -

Woman feared dead after being swept away in Nima drain amid heavy rain

4 hours -

Court grants GH¢10k bail to trader who posed as soldier at 37 Military Hospital

4 hours -

Tano North MP secures funding to reconstruct decades-old Yamfo Market

4 hours -

Haruna Iddrisu discharged after road traffic accident

4 hours -

Kenyans drop flowers for Valentine’s bouquets of cash. Not everyone is impressed

5 hours -

Human trafficking and cyber fraud syndicate busted at Pokuase

5 hours -

Photos: First Lady attends African First Ladies for Development meeting in Ethiopia

5 hours -

2026 U20 WWCQ: Black Princesses beat South Africa to make final round

6 hours -

World Para Athletics: UAE Ambassador applauds Ghana for medal-winning feat

6 hours -

Photos: Ghana’s path to AU Chairmanship begins with Vice Chair election

6 hours -

Chinese business leader Xu Ningquan champions lawful investment and deeper Ghana–China trade ties

7 hours