Audio By Carbonatix

Ghana, Africa’s largest gold producer, has long relied on exporting the bulk of its gold in unrefined or semi-refined form, a practice that, while generating significant foreign exchange revenues, has systematically externalised critical portions of the mineral’s economic value. According to the Bank of Ghana’s 2024 Annual Report, gold exports totalled approximately US$11.6 billion, accounting for 57% of total merchandise export receipts.

Small-scale mining operations, as reported by the Precious Minerals Marketing Company (PMMC) and GoldBod, contributed roughly US$4.6 billion in 2024 alone. With the formalisation drive initiated by GoldBod, ASM exports rose to over US$8 billion between January and October 2025, suggesting total annual exports of around US$10–11 billion. While these figures are impressive, the majority of this gold continued to be exported unrefined, meaning that refining fees, valuation uplifts, and downstream economic benefits were largely captured abroad.

Industry benchmarks indicate that offshore refining of doré gold attracts charges ranging between 0.2% and 0.8% of the gold’s value, depending on purity and destination. Applying a conservative midpoint of 0.5% to Ghana’s 2024–2025 export volumes implies that the country effectively paid between US$55 million and US$60 million annually to foreign refineries.

In addition, unrefined exports are routinely undervalued due to conservative purity assumptions and secondary refining losses, resulting in an additional 2–5% erosion of potential export revenue. Beyond the explicit costs of refining and undervaluation, informal gold losses, including smuggling, have historically reduced the value of exports by hundreds of millions of dollars annually, with estimates indicating approximately 229 tonnes, or roughly US$11.4 billion, lost to illicit channels over five years. The formalisation efforts by GoldBod have significantly curtailed such leakages, but the persistent practice of exporting unrefined gold has continued to deprive Ghana of both immediate financial gains and long-term industrial value.

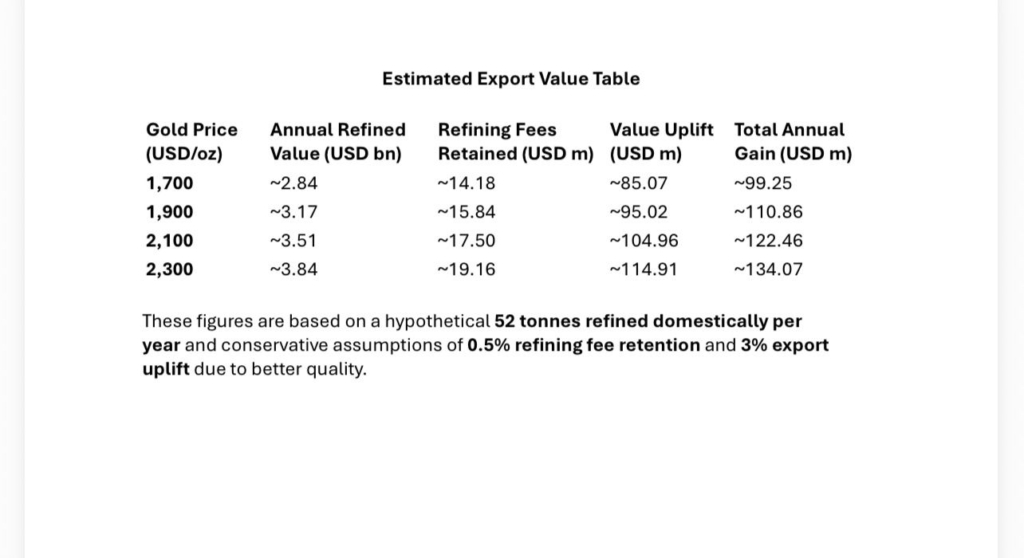

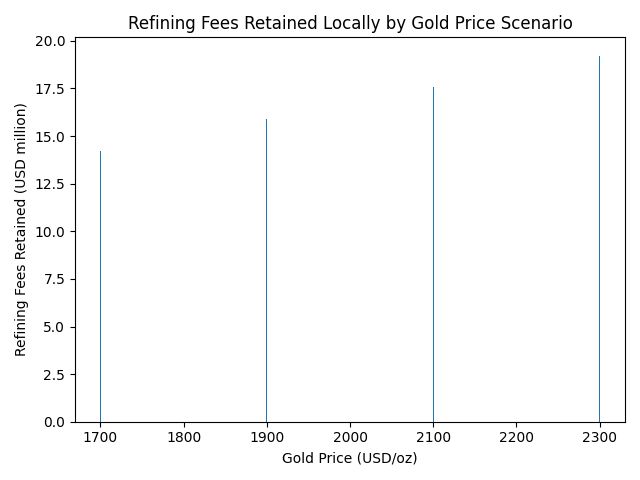

The GoldBod–Gold Coast Refinery agreement marks a pivotal shift in the national gold value chain. The refinery, which operates at a weekly capacity of one metric tonne, represents the first locally operational refining facility capable of delivering LBMA-standard gold for export while capturing value domestically. GoldBod holds a 15% free-carried interest on behalf of the Republic of Ghana, ensuring direct state participation in profits, while the refinery’s operations align with the government’s 24-Hour Economy initiative to boost industrial productivity. Conservative financial modelling of the refinery assumes retention of 0.5% of refining fees previously paid abroad, a 3% uplift in export value from refined gold, and sensitivity to gold price scenarios ranging from US$1,700 to US$2,300 per ounce.

It is important to clarify the distinction between total gold export revenue and the refinery’s capacity. Although GoldBod facilitated approximately US$11 billion in gold exports in 2025, the 52 tonnes of gold to be processed annually (using a weekly target of 1 tonne) at the Gold Coast Refinery would represent only about 27% of total national exports.

The projected conservative annual refined value of this capacity at US$1,700 per ounce is roughly US$2.84 billion. This does not reflect GoldBod’s total revenue or the total value of Ghana’s gold exports, but rather the portion of gold to be processed locally through the new refinery.

The financial benefits of the refinery arise not from gross revenue, but from the incremental value retained within Ghana, including refining fees previously paid abroad (~US$14–19 million annually depending on gold price), valuation uplift from more accurate and high-purity exports (~US$85–115 million), and dividends from the 15% state-held interest in the refinery. Over time, as refinery throughput increases, a larger share of national gold exports will be processed locally, further increasing the retained value.

Analysis of one-year projections illustrates the magnitude of these potential gains. At a gold price of US$1,700 per ounce, the 52-tonne refinery throughput would generate US$14.18 million in refining fees retained locally and US$85.07 million in value uplift from refining, for a total gain of US$99.25 million. As gold prices rise to US$1,900, US$2,100, and US$2,300 per ounce, total annual gains increase to US$110.86 million, US$122.46 million, and US$134.07 million, respectively, excluding taxes, royalties, and dividends from GoldBod’s state-held equity. These figures demonstrate that even with a fraction of total exports processed locally, substantial fiscal and economic benefits are captured that were previously lost to foreign refining and undervaluation.

Comparing the pre-refinery and post-refinery scenarios highlights the transformative impact of local value addition.

With the operationalisation of the Gold Coast Refinery in 2026, Ghana is projected to retain between US$99 million and US$134 million in direct economic gains, in addition to dividends, taxes, and enhanced downstream industrial activity. The retention of refining fees alone, between US$14 million and US$19 million annually, depending on gold price, represents a clear improvement in foreign exchange management and fiscal efficiency.

Beyond the immediate financial gains, the local refinery positions Ghana strategically within global markets. Refined gold adheres to international standards, improving export credibility and creating a pathway toward LBMA certification, which can attract premium pricing and expanded market access. The initiative also facilitates downstream industrialisation, supporting local jewellery fabrication and creating employment opportunities, while reinforcing the government’s broader industrial policy agenda. From a macroeconomic perspective, retaining previously exported refining fees and capturing value uplifts enhances national income, strengthens foreign exchange reserves, and reduces reliance on external financing.

In conclusion, the GoldBod–Gold Coast Refinery initiative exemplifies a data-driven and strategically aligned policy intervention that transforms Ghana’s approach to its most critical mineral resource. By moving from unrefined exports to locally refined gold, the country is poised to capture hundreds of millions of dollars annually, strengthen fiscal and macroeconomic outcomes, support industrialisation, and enhance global market credibility. The refinery represents a decisive step toward maximising the economic potential of Ghana’s gold resources, demonstrating both immediate financial impact and long-term structural benefits for the nation

Latest Stories

-

Alisson injury not ‘a big thing’ despite missing Galatasaray

1 hour -

Scholes ‘did not intend to be offensive’ to Carrick

1 hour -

23 players sent off after mass brawl in Brazil

2 hours -

Court remands pastor over alleged child abuse images

2 hours -

Anthropic sues US government for calling it a risk

2 hours -

Live Nation reaches settlement in US monopoly case

2 hours -

G7 to take ‘necessary measures’ to support energy supplies

2 hours -

Star Assurance rewards 10 more customers in grand finale draw of “40 Reasons to Smile” promo

2 hours -

Guinea opposition leader urges ‘direct resistance’ after 40 parties dissolved

2 hours -

Suhum MP calls for sincere dialogue on labour issues, warns against politicisation

3 hours -

We have instituted measures to diversify our reserves – BoG Governor

3 hours -

Ban on pay-TV services at the Presidency in force; my office is the only place with DSTV – Kwakye Ofosu

3 hours -

Fuel prices could hit GH¢17 if the Middle East crisis persists – COMAC

3 hours -

Cedi records modest appreciation on improved liquidity, but external risks linger

3 hours -

Dr Agnes Naa Momo Lartey organises briefing meeting with Ghana’s delegation to CSW70

3 hours