Audio By Carbonatix

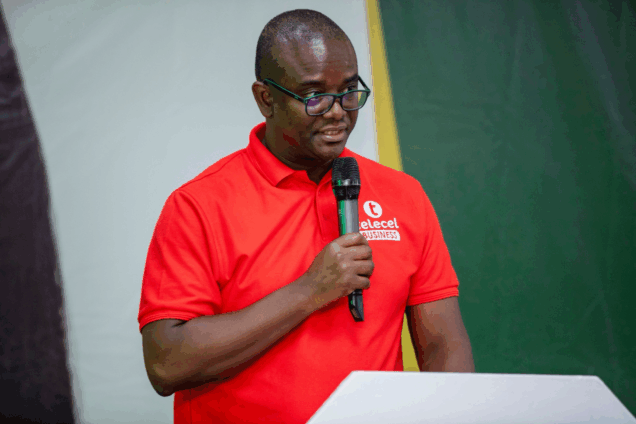

Telecel Ghana’s Head of Small and Medium Enterprises (SME), Alfred Neizer, has called for a decisive national push to translate Ghana’s gains in financial access in rural areas into more meaningful financial participation.

He praised the long-standing role of Rural and Community Banks (RCBs) in expanding financial services to underserved communities. Still, he advocated that the adoption and use of the financial tools available to them drive the next level of growth.

He was speaking at the 10th Rural Banking Week Celebration and 2nd Association of Rural Banks Women’s Conference in Ho, on the theme ‘Driving Sustainable Financial Inclusion and Good Governance through ESG Principles.’

“You are the unsung heroes bridging rural ambition with equal banking opportunity. But as we all know, financial inclusion goes beyond access. Our next goal must be ensuring people understand, trust, and benefit from the financial services you offer,” Mr Neizer said.

Citing the 2022 Composite Financial Inclusion Index, Neizer said only 53 per cent of Ghanaians actively use the financial tools available to them, despite Ghana’s overall access to formal and semi-formal financial services climbing to 96 per cent, according to the Ministry of Finance.

“Access without usage is unfinished work, and low financial literacy remains a major barrier. We must tackle this problem together by pairing rural banking with practical financial education to deepen usage and inform the masses on the financial products available and how they can benefit their lives and businesses,” Mr Neizer added.

The Association of Rural Banks (ARB) is the umbrella body for all rural and community banks in Ghana. Created in 1981 as the collective voice and coordinating institution for rural banking, it currently has a membership of 147 banks and more than 800 service outlets serving mostly locals in rural communities, including farmers, traders, cooperatives and micro-enterprises.

ARB organises Rural Banking Week every year to spotlight the critical role rural and community banks play in advancing financial inclusion, rural development, and poverty reduction across Ghana.

The celebration was graced by the Second Deputy Governor of the Bank of Ghana, Matilda Asante-Asiedu.

Mr Neizer highlighted Telecel Ghana’s SME products designed to equip rural enterprises with integrated communication tools and digital footprints to expand their reach, including the Telecel Women in Business value proposition for female entrepreneurs in underserved communities.

He reiterated that women drive most rural value chains, yet their access to credit, leadership roles and digital-enabled growth tools remains disproportionately low.

“Women, especially in rural economies, remain the backbone of micro-enterprises. From agribusiness to market trading, they dominate entire value chains.

True inclusion requires intentional investment in the full participation, growth and leadership of women in the rural banking space.”

Despite the progress, Mr Neizer argued that rural inclusion cannot be left solely to community banks, urging cross-sector collaboration to build tailored rural financial ecosystems for long-term prosperity.

“If rural banks, policymakers, development partners and private-sector players like Telecel work together, we can build a financial ecosystem where no person or community is left behind,” he added.

Latest Stories

-

South African trio charged with Bolt driver’s murder filmed on dashcam

9 seconds -

HeFRA launches investigation into alleged refusal of emergency care leading to death of road traffic accident victim

3 minutes -

Maison Yusif Fragrance showcases Africa’s organic fragrance power at BIOFACH Germany

20 minutes -

GoldBod suspends gold buying licence applications amid regulatory reforms

20 minutes -

GoldBod suspends selected gold buying licence applications ahead of regulatory reforms

22 minutes -

Student death puts French far-left under pressure

23 minutes -

One song, one voice: How ‘Aha Y3’ stole the night at Awake Experience 2026

24 minutes -

SEC flags ‘Mekanism’ as illegal investment scam promising daily returns

29 minutes -

Awake Experience 2026 ends in frenzied praise as Diana Hamilton delivers electrifying performance

31 minutes -

Attack on Ghanaian traders: West Africa must fight terrorism shoulder-to-shoulder – Bombande

31 minutes -

Kenya sets the tone as Global Tourism Resilience Conference opens in Nairobi

34 minutes -

Interior Minister’s engagement with Burkina Faso appropriate after attack – Bombande

39 minutes -

Okyere Baafi condemns Burkina Faso attack on Ghanaian traders, calls for parliamentary inquiry

44 minutes -

Five arrested over tramadol haul; attempted GH¢50k bribe

45 minutes -

Fire engulfs building at Laterbiokoshie, fire service battles blaze

1 hour