Audio By Carbonatix

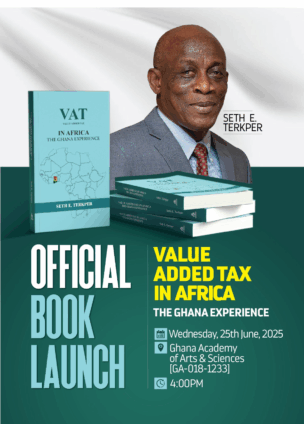

Former Finance Minister and current Presidential Adviser on the Economy, Seth E. Terkper, is set to launch his latest book, VAT in Africa: The Ghanaian Experience, on 25th June 2025.

This is Terkper’s second publication focused on VAT (Value Added Tax), and it offers a detailed and reflective account of Ghana’s complex journey in adopting VAT as a major fiscal policy tool.

The book recounts the turbulent path from the introduction of VAT in the 1990s to its evolution under the VAT Act 2013 (Act 870), chronicling both technical refinements and the political, economic, and institutional hurdles along the way.

Terkper explores the challenges that accompanied the policy’s initial rollout in 1995, which was met with fierce public resistance and mass demonstrations—famously the “Kumepreko” protests—that forced the government to suspend the tax just months after its launch.

However, the book emphasizes that the setback was temporary. A revised version of the VAT was introduced successfully in 1998, following a robust national education campaign, stakeholder consultations, and political negotiations.

This marked a turning point in Ghana’s revenue mobilisation efforts and fiscal self-reliance.

Blending legislative analysis with historical and administrative context, Terkper reflects on how VAT transformed from a failed policy into a core pillar of Ghana’s public finance system.

He also examines how subsequent policy missteps and loopholes have weakened VAT’s effectiveness—leading to overburdened taxpayers and increasing evasion and avoidance.

Through rich case studies, the book reveals how policy adaptability and institutional strength can turn an unpopular tax measure into a dependable revenue stream.

It also offers cautionary lessons for African and developing countries implementing or reforming VAT systems in their own jurisdictions.

With VAT in Africa: The Ghanaian Experience, Terkper contributes not only to Ghana’s policy literature but to the broader discourse on sustainable taxation and economic governance in Africa.

Seth Terkper to Launch Book on Ghana’s VAT Journey and Lessons for Africa.

Former Finance Minister and current Presidential Adviser on the Economy, Seth E. Terkper, is set to launch his latest book, VAT in Africa: The Ghanaian Experience, on 25th June 2025.

This is Terkper’s second publication focused on VAT (Value Added Tax), and it offers a detailed and reflective account of Ghana’s complex journey in adopting VAT as a major fiscal policy tool.

The book recounts the turbulent path from the introduction of VAT in the 1990s to its evolution under the VAT Act 2013 (Act 870), chronicling both technical refinements and the political, economic, and institutional hurdles along the way.

Terkper explores the challenges that accompanied the policy’s initial rollout in 1995, which was met with fierce public resistance and mass demonstrations—famously the “Kumepreko” protests—that forced the government to suspend the tax just months after its launch.

However, the book emphasises that the setback was temporary. A revised version of the VAT was introduced successfully in 1998, following a robust national education campaign, stakeholder consultations, and political negotiations.

This marked a turning point in Ghana’s revenue mobilisation efforts and fiscal self-reliance.

Blending legislative analysis with historical and administrative context, Terkper reflects on how VAT transformed from a failed policy into a core pillar of Ghana’s public finance system.

He also examines how subsequent policy missteps and loopholes have weakened VAT’s effectiveness—leading to overburdened taxpayers and increasing evasion and avoidance.

Through rich case studies, the book reveals how policy adaptability and institutional strength can turn an unpopular tax measure into a dependable revenue stream.

It also offers cautionary lessons for African and developing countries implementing or reforming VAT systems in their own jurisdictions.

With VAT in Africa: The Ghanaian Experience, Terkper contributes not only to Ghana’s policy literature but to the broader discourse on sustainable taxation and economic governance in Africa.

Latest Stories

-

New VAT regime aimed at simplifying tax system, not raising costs— GRA official

4 minutes -

Gas explosion kills 13 in Pakistan’s Karachi, collapsing building

15 minutes -

Ghanaian optometrist, Randolph Kwaw, wins Sigma Xi Grants-in-Aid of Research award

28 minutes -

FDA shuts down 16 Accra eateries including The Cheesecake House and Alora Beach Resort

29 minutes -

An Open letter to the Vice president of the republic of Ghana

30 minutes -

South Korea’s ex-President Yoon given life in prison for insurrection

36 minutes -

Take advantage of growing opportunities in agriculture – Deputy Agric Minister tells youth

40 minutes -

NACOC steps up K9 Operations at Kotoka International Airport to curb drug trafficking

44 minutes -

Ken Ofori-Atta bond hearing comes up today as US Judge demands extradition proof

1 hour -

NDC wishes Muslim community peaceful and blessed Ramadan

1 hour -

Today’s Front pages: Thursday, February 19, 2026

1 hour -

One year rent advance is fair – GREDA Executive Director backs new rent bill

2 hours -

What should e-commerce sellers check before expanding into new markets?

2 hours -

Minority calls for stronger human rights safeguards in Security Bill

2 hours -

Two killed, 14 injured in accident on Ho–Aflao Highway

3 hours