Audio By Carbonatix

Some commercial banks are raising concerns about the Bank of Ghana’s directive regarding the abolishment of the Over-the-Counter withdrawal charge.

The Central Bank recently issued a notice to banks and specialized deposit-taking institutions to abolish what it calls unfair fees, charges and other practices in the banking sector.

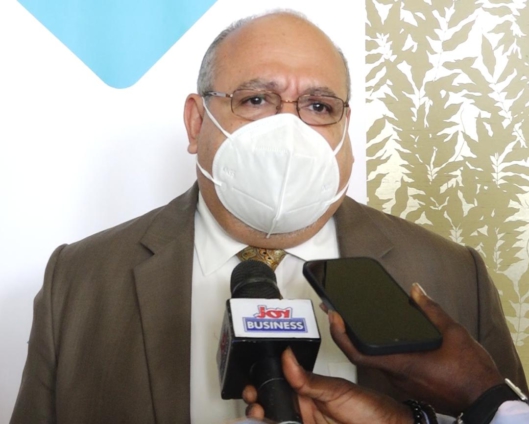

But in an interview with Joy Business at a Digital Conference organised by his outfit, Managing Director of Republic Bank Ghana, Farid Antar said the over the counter withdrawal charge was meant to serve as disincentive for customers to use the ATMs.

“The one that may be a little bit problematic for the banks is that we charge a fee for customers coming into the bank to withdraw cash when they have an avenue external to the bank so it’s not so much of a fee but a disincentive to change your behavior to use electronic which is the ultimate goal” said Mr. Antar.

History

The over-the-counter withdrawal fee is one of seven charges the central bank has warned commercial banks to do away with.

The Bank of Ghana noted that some banks and specialized deposit-taking institutions impose penal charges on customers who withdraw their own funds from banking halls and the reason the Republic Bank MD attributed to the practice was to encourage customers to use digital platforms provided to reduce congestion at the banking halls.

Digital Conference

The digital conference jointly organized by the bank and the Business and Financial Times was themed: digitization, artificial intelligence and the future of things; the impact and immense opportunities for Ghanaian Businesses.

Mr. Antar has underscored the need for Ghanaian businesses to take advantage of the opportunities provided by the African Continental Free Trade Area (AfCFTA) through the adoption of technology to expand their operations.

According to him, local businesses must begin to look beyond the country and network with other countries across the continent to reach a larger market.

The conference offered insight into how stakeholders, particularly business owners and their financiers could harness the recent gains from increased digitisation.

Latest Stories

-

Kaliedoscope of baby stealing, abortion and unexpected multiple births

31 minutes -

Fueltrade donates GH¢1m to GETFund

41 minutes -

Ghana’s reliance on Dubai for gold exports leaves cedi exposed as Iran conflict disrupts trade

57 minutes -

IMF warns Middle East tensions could disrupt trade and drive up global energy prices

1 hour -

IWD: Essikado-Ketan MP call for renewed action to improve women’s health, equality

1 hour -

Build genuine relationships beyond politics – Chief of Staff urges Ghanaians

1 hour -

Cabinet approves new round of SIM registration exercise

1 hour -

Ghana urges Commonwealth support for UN resolution on transatlantic slave trade

1 hour -

TUC urges action on women’s rights, workplace protections on International Women’s Day

1 hour -

Leadership of Cashew Watch Ghana engages TCDA CEO to advance sector growth

1 hour -

Ghana’s gold crossroads: Why global pressure is real, but a coup is still unlikely

1 hour -

24-Hour Economy Secretariat targets 160k jobs under new energy transition MoU

1 hour -

Ada West Education Directorate intensifies policies to reduce teenage pregnancy

2 hours -

We are in final stages of setting up Women’s Development Bank – Mahama

2 hours -

IWD: Invest more in women for national development – Fisheries Minister

2 hours