Audio By Carbonatix

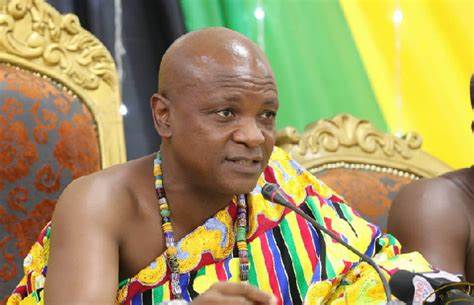

The Paramount Chief of the Asogli State, Togbe Afede XIV, has strongly criticised the recent decision made by the Bank of Ghana (BoG) to reduce the policy rate from 30% to 29%.

According to him, such a reduction will have no impact on the economy thus labelling it as nothing more than a "major mockery."

The BoG's Monetary Policy Committee (MPC) declared this reduction on January 29, 2024, with Togbe Afede expressing skepticism regarding the potential impact of this slight decrease.

In a statement issued, Togbe Afede questioned the reasoning behind the 1% reduction, stating that it is challenging to comprehend how such a minimal adjustment, transitioning from 30% to 29%, would substantially affect lending rates, inflation, exchange rates, or economic growth.

He expressed uncertainty about whether BoG officials have thoroughly evaluated the correlation between interest rates, inflation, and exchange rates within the country.

Expressing astonishment at the conservative rate adjustment, Togbe Afede criticized the Bank of Ghana's (BOG) focus on year-on-year inflation, describing their strategy as responsive; that is reacting to past price fluctuations rather than foreseeing future inflation patterns.

He contended that the policy rate reduction appears to be a response to the 3.2% decline in headline inflation observed in December 2023.

"The Bank of Ghana Monetary Policy Committee (MPC) on Monday, January 29, 2024, announced a cut in the key policy rate of 100 basis points, from 30% to 29%. This sounds like a big joke. It is hard to imagine what impact our BoG officials expect a 1% reduction from 30% to make on lending rates, inflation rate, exchange rate or economic growth, let alone what they expect to learn or observe from it. I wonder whether they have determined the correlation between interest rates, inflation, and exchange rates in our country."

"The hesitant 1% rate cut to 29% is particularly surprising given their expectation that headline inflation would “ease to 15% ± 2% by the end of 2024 and gradually trend back to within the medium-term target range of 8% ± 2% by 2025”.

"I do not see a relationship between the expected or target 15% ± 2% inflation and the high 29% monetary policy rate. It gives the impression that our top economists do not believe in themselves or their own forecasts."

Latest Stories

-

Hillary Clinton accuses Trump administration of a ‘cover-up’ over its handling of Epstein documents

32 seconds -

Project C.U.R.E begins 10-day assessment to support Ghana Medical Trust Fund’s NCD fight

9 minutes -

Government assures public of stable ‘fugu’ prices amid Wednesday-wearing policy

12 minutes -

Ghana on track for full-scale tomato production by year-end – Deputy Agric Minister

16 minutes -

Danny Addo to host Undignified 1.0 event and album launch

17 minutes -

Obaapanin Mary Adwoa Ohenewa Awuah

18 minutes -

Afia Adepa Kwarteng thanks God with ‘Oguama Mogya’ mini album after surviving life-threatening surgery

20 minutes -

Mahama consoles families after terrorist attack kills 7 Ghanaian traders in Burkina Faso

24 minutes -

John Jinapor rallies support for Gonjaland Youth Association’s Golden Jubilee Congress in Buipe

25 minutes -

‘We must use this crisis to pivot’ – Mahama urges local processing as cocoa sector reels

28 minutes -

State initiates compensation talks in Latif Iddrisu Police brutality case after eight years

41 minutes -

Gov’t engaging Burkinabe authorities to protect Ghanaian tomato traders – Dumelo

43 minutes -

Tano North residents commend MCE over infrastructure drive

1 hour -

‘I’m a cocoa farmer too’ — Mahama speaks on price cuts and farmer pain amid crises

1 hour -

Underground Mining Alliance donates Vein Finder to sickle cell unit of AngloGold Ashanti Health Foundation

1 hour