Finance Minister, Ken Ofori-Atta, has indicated that the country is on course for the successful completion of its first review of the International Monetary Fund (IMF) Programme in November 2023 and the subsequent disbursement of an additional $600 million.

According to him, Ghana will finanlise a Memorandum of Understanding with its official bilateral creditors before the first review of the IMF Programme is completed in November 2023.

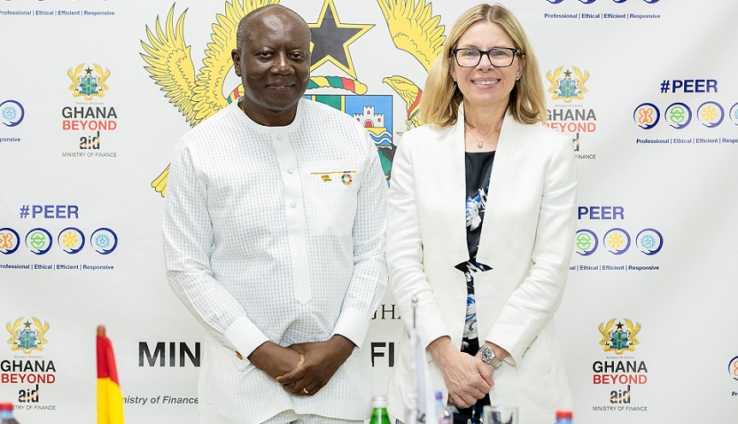

Disclosing this when the World Bank Managing Director for Operations, Anna Bjerde paid a courtesy call on him, Mr. Ofori-Atta, said Ghana is complying with all the conditions stipulated by the programme.

“We expect to finalise an MoU with our official bilateral creditors before the first review of the IMF Programme is completed in November 2023. We have also started engaging our private creditors to seek relief on external commercial debt.”

He called the World Bank to increase concessional financing to commensurate with the multiple challenges faced by developing countries, such as Ghana.

According to him, a tripling of IDA resources in upcoming replenishments is important.

Mr. Ofori-Atta alsocalled on the World Bank to be more responsive to the global crises to avert the erosion of gains made in economic growth, poverty reduction, and human development and also increase concessional financing.

“We expect the WBG Evolution process to result in increased concessional financing commensurate to the multiple challenges faced by developing countries. More importantly a tripling of IDA resources in upcoming Replenishments”.

He acknowledged the ongoing discussions between the Bank and shareholders to enhance the Bretton Wood institution’s mission and its operating model, financial model, adding, the evolution of the World Bank should enhance partnerships with other development partners and the private sector to maximize development outcomes.

“We look forward to a 21st-century Bank that will successfully mobilize resources from countries in the global north and the private sector to address poverty, inequality, and sustainability more effectively”.

Latest Stories

-

Medical Laboratory Professionals threaten to strike over conditions of service

1 hour -

Residents of Anloga, Keta express frustration over ECG billing

2 hours -

I don’t believe in praying in tongues – Strongman

2 hours -

‘After The floods’: VRA and GMet clash over cause of Akosombo Dam spillage disaster

2 hours -

‘After The Floods’: Victims suffer harsh conditions 6 months after Akosombo dam disaster

2 hours -

Akufo-Addo to unveil Otumfuo commemorative stamp

3 hours -

EduSpots distributes over 100 tablets and laptops to 30 community-led education spaces

3 hours -

Taxation is driving away investors – FABAG General Secretary

3 hours -

Effutu MP commissions office for Hepatitis B; absorbs cost of testing, vaccination and management

4 hours -

Bawumia pushes for land digitisation to tackle land guard menace

4 hours -

Faith-based institutions are instrumental in national development – Bawumia

4 hours -

Upholding the Integrity of Presidential Promises: A call to Ghanaian leaders

4 hours -

I don’t start ‘beefs’; I only reply – Strongman refutes claims

4 hours -

Vice President Bawumia promises reforms to turn Ghana’s fortunes around

4 hours -

REGSEC warns encroachers along Tema-Sakumono Ramsar site as it races to prevent flooding

4 hours