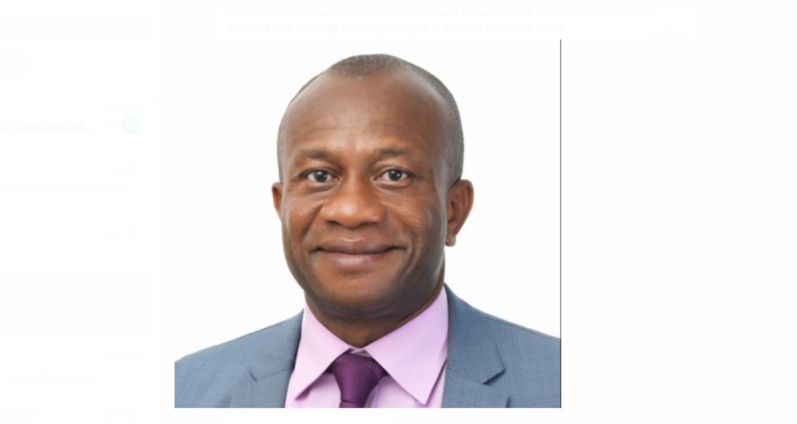

The Chief Executive Officer of the National Pensions Regulatory Authority (NPRA), Christopher Boadi-Mensah, has underscored the importance of a robust and inclusive pension system that caters to both the formal and informal sectors of the economy.

He emphasised the need for innovative micro-pension schemes and digital solutions to expand coverage and ensure financial security for all Ghanaians.

"We need a robust and effective pension system that will be responsible for the welfare of all employees. It is usually targeted at the formal sector, and this is the time to have the self-employed individuals as part of the pensions. We need to increase the coverage through digital solutions to ensure financial security," he said.

He was addressing a pivotal stakeholder engagement that brought together pension managers, fund managers, and custodians to discuss the future of Ghana’s pension sector and ways of restoring confidence in the system.

Mr Boadi-Mensah further acknowledged the challenges posed by economic fluctuations, including inflation and debt restructuring, and called for stronger governance and transparency in fund management.

He stressed the urgency of addressing delays in the payment of benefits and improving employer compliance, noting that trust in the pension system is crucial for its sustainability.

"It is obvious that the economic situation of the country, such as inflation and debt restructuring, has been a challenge for this sector. This has resulted in delays in the payment of benefits, which has reduced trust and employer compliance," Mr Boadi-Mensah stated.

He reaffirmed the Authority’s commitment to a hands-on, collaborative approach to policy implementation and regulatory oversight. Nonetheless, Mr Boadi assured stakeholders that the NPRA would not be a passive regulator but an active partner in driving reforms that benefit both industry players and pension contributors.

"This is not just about policies; it’s about people’s lives. We as stakeholders must work together in building a pension system that guarantees financial dignity in retirement. We must take steps toward a more resilient and inclusive pension framework for Ghana," he said.

Latest Stories

-

Ghana’s public debt stock falls to GH¢613bn in June 2025

38 minutes -

Cedi appreciates by 40.7% to US dollar in seven months of 2025 – BoG

46 minutes -

Silicon cannot feel: Why humans will always matter in an AI world

1 hour -

AAMUSTED students gripped by emotional lecture on Ghana’s environmental crisis

1 hour -

Trans-Sahara Project kicks off with reconnaissance visit to Bolgatanga and Tamale

1 hour -

Black Queens visit Jubilee House after WAFCON heroics; Mahama promises security service recruitment support

2 hours -

Alien: Earth to Wednesday: 10 of the best TV shows to watch this August

2 hours -

Forestry Commission condemns illegal shutdown of three district offices in Ashanti Region

2 hours -

National Security must end interference in Forestry Commission’s work – Anti-Galamsey Coalition cautions

2 hours -

Keep your eyes on us – MOBA 2015 marks inauguration with a promise to lead and serve

2 hours -

BoG warns financial institutions violating forex act; threatens to revoke remittance licenses

3 hours -

EPA engages media on land reclamation campaign; vows crackdown on non-compliant miners

3 hours -

Samini set to perform at 2025 Guinness Ghana DJ Awards

3 hours -

Beyond my wildest dreams: A journey to the White House, U.S. Capitol, and a life-changing leadership opportunity

3 hours -

Michael Bartlett‑Vanderpuye named CEO of the Year – Exporter at Ghana CEO Vision, Exhibition & Awards

3 hours