Audio By Carbonatix

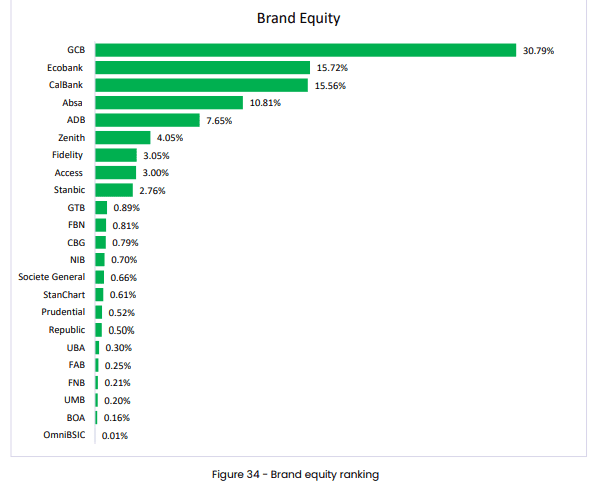

GCB has been adjudged the bank with the highest brand equity in Ghana by research firm, Global InfoAnalytics.

GCB becomes the third bank in the country to clinch the top spot this quarter after Ecobank and Fidelity Bank in the second and first quarters respectively.

The bank, per Global InfoAnalytics third-quarter Banking Sector Brand Health Check report, recorded a brand equity score of 30.79 per cent.

In second, third and fourth places are Ecobank, CAL Bank and Absa Bank with brand equity scores of 15.72 per cent, 15.56 per cent and 10.81 per cent respectively.

Banks with the least brand equity per the report are Omnibsic, Bank of Africa (BOA) and Universal Merchant Bank (UMB) with scores of 0.01 per cent, 0.16 per cent and 0.20 per cent respectively.

Meanwhile, Global InfoAnalytics has indicated that the word-of-mouth marketing or advertising is working effectively for two banks in the country; First National Bank (FNB) and United Bank of Africa (UBA).

The two banks per the survey, each scored a Net Promoter Score (NPS) of 100 percent.

The effectiveness of the word-of-mouth marketing strategy for the two banks is measured by the Net Promoter Score (NPS) metric which rates customer loyalty and how likely customers are to refer the brand, products, and services to others.

Prudential Bank and Bank of Africa (BOA) per the survey, recorded the least NPS scores of 47 percent and 45 percent respectively.

According to Global InfoAnalytics, a score of 50 percent or more suggests that the word of mouth is working for the brand.

“The result from the survey shows that whilst almost the brands recorded NPS of over 50%, suggesting that the word of mouth is working for them, Prudential and Bank of Africa, did not record NPS higher than 50%, suggesting the word of mouth isn’t working for the brands during the survey period,” said the report.

Latest Stories

-

James Owusu declares bid for NPP–USA chairman, pledges renewal and unity

10 minutes -

Trump threatens strong force if Iran continues to retaliate

25 minutes -

Lekzy DeComic gears up for Easter comedy special ‘A Fool in April’

2 hours -

Iran declares 40 days of national mourning after Ayatollah Ali Khamenei’s death

3 hours -

Family of Maamobi shooting victim makes desperate plea for Presidential intervention

3 hours -

Middle East turmoil threatens to derail Ghana’s single-digit gains

4 hours -

Free-scoring Semenyo takes burden off Haaland

5 hours -

Explainer: Why did the US attack Iran?

5 hours -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

6 hours -

Crude oil price crosses $91 as Strait of Hormuz blockade chokes 22% of global supply

6 hours -

Dr. Hilla Limann Technical University records 17% admission surge; launches region’s first cosmetology laboratory

7 hours -

Over 50 students hospitalised after horror crash ends sports tournament

7 hours -

Accra–Dubai flights cancelled as Middle East tensions deepen

8 hours -

See the areas that will be affected by ECG’s planned maintenance from March 1-5

9 hours -

Kane scores twice as Bayern beat rivals Dortmund

9 hours