Audio By Carbonatix

Global growth is forecast to be stable, despite higher interest rates, avoiding contraction.

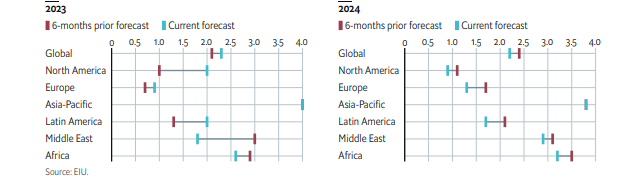

According to The Economist Intelligence Unit, the lagged impact of a broad rise in interest rates will constrain global economic activity in the remainder of 2023 and in 2024, but there are no indications of systemic strain in debt markets that could pull the world economy into a painful contraction.

“We forecast that US growth will slow significantly in 2024, but will avoid a recession, and some momentum will build in Europe as German industry normalises following energy-related disruptions. Moderate stimulus in China will inject sufficient momentum behind its economy to preserve expansion, while other emerging markets will benefit from reduced uncertainty that will come with the conclusion of global monetary tightening”.

“We forecast that global economic growth will decelerate to 2.2% (at market exchange rates) in 2024, from an estimated 2.3% in 2023. The outlook improves in subsequent years (we forecast growth of 2.7% a year on average in 2025-28) aided by the onset of monetary easing and increased funding for investment in technology and the energy transition”, it added in its latest Global Economic Outlook.

Africa is expected to grow at a rate of about 2.9% in 2023 and 3.5% in 2024.

Disinflation process to continue

It also forecasts that disinflation will continue, with risks weighted to the upside.

“The supply-side shocks that drove price increases in 2021-22 will reverse as supply-chain dislocation eases. This will drive inflation lower in most markets (we forecast that it will average 2.4% across developed economies in 2024), if not undo the rapid price gains of recent years”, it explained.

However, it said risks to the inflation outlook are skewed to the upside, adding, a widening of the Israel-Hamas war that disrupted oil supply would drive up hydrocarbon prices, and stronger than expected effects from El Niño climate conditions on agriculture production would push up food prices in 2024, especially in developing economies.

Also, there is a moderate risk that demand will prove more resilient than we expect in developed markets.

Latest Stories

-

Police conduct show of force exercise ahead of Ayawaso East by-election

2 hours -

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

2 hours -

AI to transform 49% of jobs in Africa within three years – PwC Survey

2 hours -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

2 hours -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

3 hours -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

3 hours -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

3 hours -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

3 hours -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

4 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

4 hours -

GHATOF leadership pays courtesy call on Chief of Staff, Julius Debrah

4 hours -

KiDi unleashes first single of the year ‘Babylon’

4 hours -

Ghana Boxing Federation unveils new logo at Accra Sports Stadium

4 hours -

Pink Ladies Cup: Agejipena scores debut goal as Black Queens thump Hong Kong

4 hours -

Ghana pays tribute to 1948 heroes at 78th anniversary observance

5 hours