Audio By Carbonatix

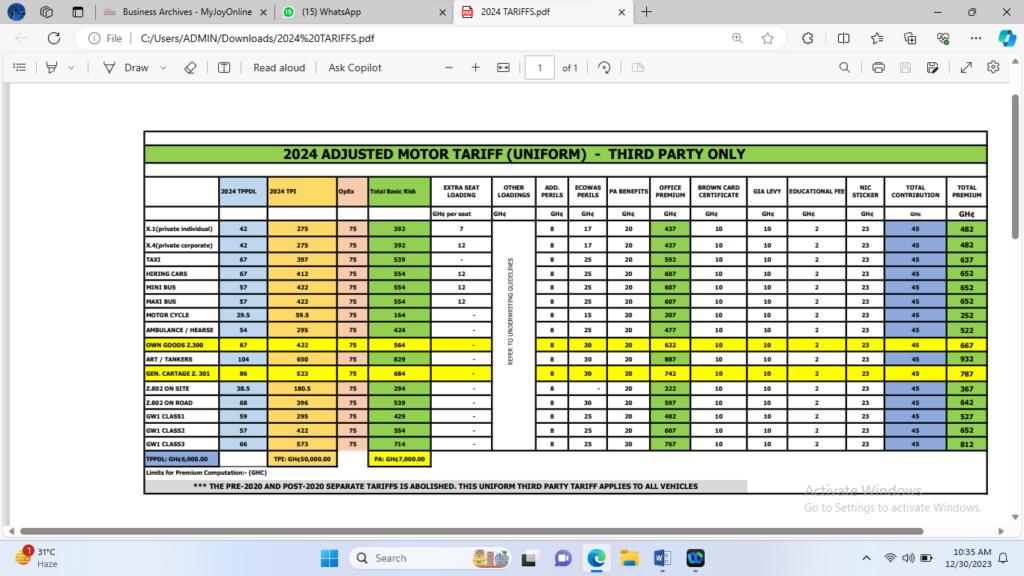

Third party insurance premiums are set to go up from January 1, 2024.

This was after the insurance companies secured approval from the National Insurance Commission to carry out these adjustments.

Private vehicles are therefore expected to pay ¢482 for third-party insurance, whilst commercial taxis will pay ¢437.

On the other hand, private corporate will be charged ¢482, while hiring vehicles will pay ¢652. Motor cycles are also expected to pay ¢252.

Complying with new tariffs and possible sanctions

A letter to the insurance companies from the Ghana Insurers Association sighted by Joy Business, advised members to strictly comply with the approved rates, as failure will attract the needed sanctions from the NIC.

The NIC also told Joy Business it is closely monitoring the new tariffs to see whether it’s in line with what have been approved.

It added it will not hesitate to sanction companies that fail to apply the approved tariffs.

The Ghana Insurers Association also advised its members there will no longer be accepting the pre and post 2020 tariffs.

Joy Business further understands that the capacity implication of ¢3000 and ¢5000 have been removed and will not make an impact on the premium collections.

Reasons behind increment

The Ghana Insurers Association in a letter to the insurance companies said the increment would help improve the financial position of the insurance companies to promote payment of legitimate claims.

Third-party insurance premium increase and VAT impact on non-life insurance products

Joy Business understands that the third party insurance premium increase did not factor in the Value Added Tax (VAT) Amendment Bill passed by Parliament last week, which may impose 21.9% VAT on all non-life insurance products. This will have resulted in insurance premiums going by more than 30%.

The Ghana Revenue Authority has yet to communicate to the public the date for implementing the five tax bills. However, the insurance companies have gone ahead to carry out these adjustments, minus the 21.9% application of the VAT on the non-life insurance products and business.

This could mean that when the GRA starts with the implementation of the VAT Amendment Bill , insurance premiums could go up again .

Latest Stories

-

Six critically injured in gruesome head-on collision near Akrade

2 hours -

Gov’t to extradite foreign national who secretly filmed Ghanaian women to face prosecution – Sam George

2 hours -

U20 WWC: Black Princesses to play Uganda in final round of qualifiers

2 hours -

‘I will never forget you’ – Kennedy Agyapong thanks supporters, NPP delegates after primaries

4 hours -

Woman found dead in boyfriend’s room at Somanya

6 hours -

Woman feared dead after being swept away in Nima drain amid heavy rain

6 hours -

Court grants GH¢10k bail to trader who posed as soldier at 37 Military Hospital

6 hours -

Tano North MP secures funding to reconstruct decades-old Yamfo Market

6 hours -

Haruna Iddrisu discharged after road traffic accident

6 hours -

Kenyans drop flowers for Valentine’s bouquets of cash. Not everyone is impressed

7 hours -

Human trafficking and cyber fraud syndicate busted at Pokuase

7 hours -

Photos: First Lady attends African First Ladies for Development meeting in Ethiopia

7 hours -

2026 U20 WWCQ: Black Princesses beat South Africa to make final round

7 hours -

World Para Athletics: UAE Ambassador applauds Ghana for medal-winning feat

8 hours -

Photos: Ghana’s path to AU Chairmanship begins with Vice Chair election

8 hours