Audio By Carbonatix

Ghanaians who fail to disclose their sources of taxable income overseas risk being penalized by the Ghana Revenue Authority.

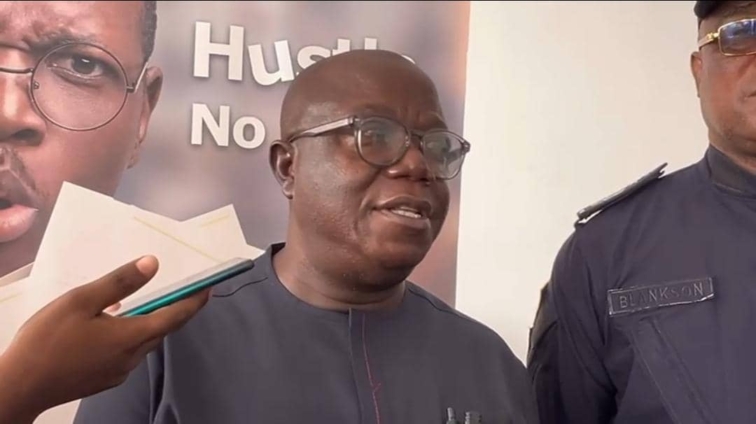

This was disclosed by the Commissioner of Domestic Tax Revenue Division, Edward Gyamerah, on the sidelines of a management retreat in Takoradi in the Western region.

The move which is part of the Authority’s strategy to increase revenue generation in the country is under the voluntary disclosure programme.

According to Mr. Gyamerah, the voluntary disclosure programme will allow residents with income abroad to disclose their earnings without payment of penalty.

He explained that in 2016 when the Income Tax Act 896 was amended, Ghana moved away from the source of jurisdiction to global.

“Over the years, this has been a big challenge where most people are not disclosing this. Now we’ve signed an arrangement with other jurisdictions. Currently, we have 145 countries that are providing us with information on resident Ghanaians having accounts elsewhere”.

“So we’ve gone through a process and come up with how individuals, persons, companies, entities, etc. have this income and have not disclosed to the Ghana Revenue Authority to use this opportunity to provide the source to GRA.

Sanctions

On sanctions to be applied to those found culpable, he said “We have the administrative sanction and we have the judicial sanctions. So for us, we first raise an assessment of you, expecting you to come [and pay up]. If you fail to pay, of course, we have the judicial aspect where we can go to court and let the judiciary help us enforce the collection of the tax”.

“We will use all enforcement procedures to ensure the collections of the tax”, he added.

The retreat was on the theme “Tax, Transparency, and Certainty, the GRA way”.

Latest Stories

-

Sustainable aviation fuels could unlock major economic opportunities for Ghana, ICAO expert says

2 minutes -

Ghana takes major step towards sustainable aviation with SAF feasibility workshop

4 minutes -

Ghana International School and Coral Reef Innovation Africa sign landmark MoU to establish innovation center of excellence

7 minutes -

Ghana poised to lead Africa’s green aviation revolution, says GCAA Director-General

8 minutes -

Chinese dance group’s tour triggers bomb threat against Australian PM

19 minutes -

Senegal PM proposes doubling prison sentence for same-sex relations

21 minutes -

Clement Apaak defends dog and cat meat consumption, rejects health and ethical criticism

23 minutes -

Minority leader Alexander Afenyo-Markin urges government to enable, not control economy

23 minutes -

Mercy to the World scales up Ramadan feeding campaign, targets over 25,000 people

25 minutes -

Four arrested for posing as security operatives in illegal anti-galamsey extortion

26 minutes -

We want perfection in officiating – Kurt Okraku tells referees

41 minutes -

We’re not opposed to development; we are against illegality — Minority

41 minutes -

Residents of Sokoban wood village protest dusty road, cite rising respiratory cases

53 minutes -

Full text: Frank Annoh-Dompreh’s speech on defending constitutional governance and ensuring accountability in DACF use

55 minutes -

Minority vows to defend constitution amid DACF allocation dispute

55 minutes