Audio By Carbonatix

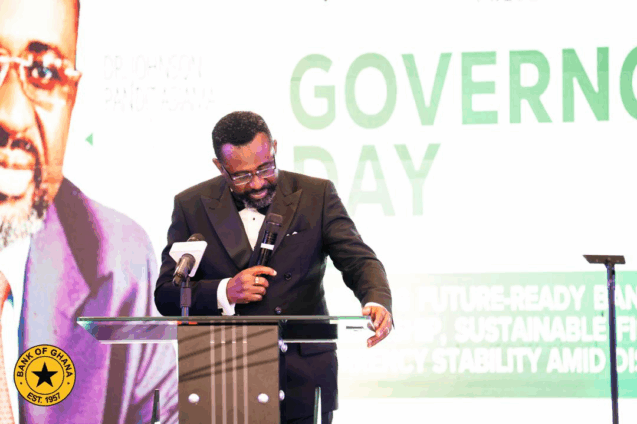

Bank of Ghana (BoG) Governor, Dr Johnson Asiama, says banking sector supervision will become more forward-looking and risk-based from 2026.

This is part of efforts to strengthen financial stability and responsible credit expansion.

He explained that the new approach will allow for more precise differentiation across banks, stronger governance, improved risk management, and rebuilt capital buffers, creating room for institutions to expand credit responsibly.

Dr Asiama was speaking at the Governor’s Day Programme organised by the Chartered Institute of Bankers.

He noted that supervision will increasingly sharpen its focus on the quality of intermediation, underwriting discipline, sectoral concentration, cash-flow analysis, and risk pricing.

“Credit growth will matter, but credit quality will matter more,” he stressed.

Governance

The Governor said expectations for boards and senior management will continue to rise, as governance is treated as a core pillar of financial stability.

“Governance will be treated as a core element of financial stability, with deeper engagement around risk appetite, internal controls, and accountability for outcomes,” he stated.

At the system level, Dr Asiama said reforms will move decisively from policy intent into routine practice, warning that tolerance for repeated weaknesses will be lower, even as regulatory engagement remains constructive.

Relationship with Banks

Dr Asiama said the central bank is also investing in how it works with regulated institutions, even as supervision tightens.

He explained that the Bank of Ghana will improve clarity of regulatory guidance, streamline internal processes, and provide more predictable timelines for approvals and regulatory engagement.

Markets and Digital Systems

On financial markets, the Governor said the focus will shift from recovery to depth and diversification, with greater mobilisation of long-term capital for a broader range of issuers and instruments, and stronger links between savings and productive investment.

He added that payments, settlement systems, data standards, and digital infrastructure will remain strategic priorities.

“Faster settlement, richer transaction data, interoperable platforms, and stronger fraud controls will increasingly define competitiveness and resilience,” he said.

Latest Stories

-

NDC committee given February 10 deadline to submit Ayawaso East vote-buying report

2 hours -

Abossey Okai spare parts dealers threaten one-week strike over new VAT regime

2 hours -

Sentencing is not a lottery -Lawyer defends Agradaa’s sentence reduction

2 hours -

Ghanaian highlife maestro Ebo Taylor dies at 90

2 hours -

Gunmen kill 3 people and abduct Catholic priest in northern Nigeria

3 hours -

Unemployed graduates with disabilities set 30-day ultimatum for employment plan or face protests

3 hours -

South Africa to withdraw its troops from UN peacekeeping mission in Congo

3 hours -

Two arrested at Osu cemetery over illegal grave digging

4 hours -

Ticket Ghana explores new aviation connectivity options as demand for travel to Ghana grows

4 hours -

Applications open for 2026 Igniting dreams fellowship in Northern Ghana

6 hours -

AI Contracts: Fast, professional, but legally risky

6 hours -

Over 1,000 youth equipped as National Apprenticeship Programme starts in Ashanti region

6 hours -

See the areas that will be affected by ECG’s planned maintenance between February 8-13

7 hours -

Police arrest 53-year-old man for threat of death, unlawful possession of firearm

7 hours -

OSP probes NPP Presidential, NDC Ayawaso East parliamentary primaries over vote buying allegations

7 hours