Audio By Carbonatix

The Ghana Revenue Authority (GRA) has said that comprehensive reforms to the Value Added Tax (VAT) regime are expected to lower prices, improve compliance, and support government’s GH¢225 billion revenue target for 2026.

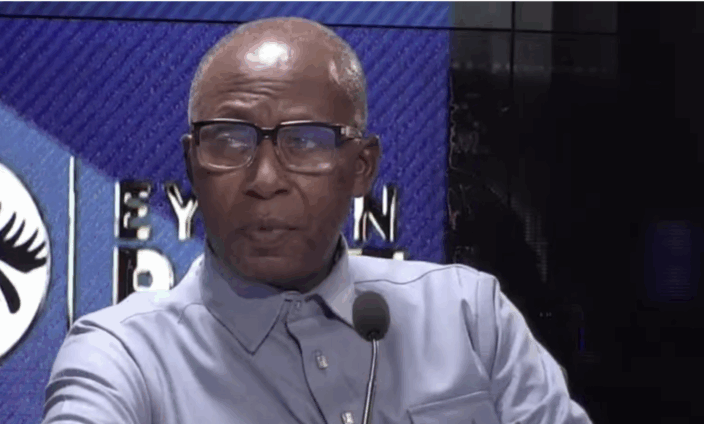

Mr Thomas T. K. Agorsor, Head of the Domestic Tax Revenue Division (DTRD) Free Zones Office, and Mr David Lartey Quarcoopome, Chief Revenue Officer and DTRD Projects Coordinator, of the GRA outlined the reforms at a media engagement powered by the Ghana Ports and Harbours Authority (GRA).

They explained that the new VAT Act 1151 of 2025 harmonised VAT, the GETFund levy, and the National Health Insurance Levy into a single standard rate of 20 per cent, restoring the traditional VAT structure.

According to them, the previous decoupling of levies had increased business costs, discouraged compliance, and contributed to a VAT compliance gap of about 60 per cent.

The abolition of the COVID-19 levy, recoupling of levies, and higher VAT registration threshold are expected to ease the cost of doing business and stabilise prices for consumers.

The officials said small businesses below the new threshold would be transitioned to the Modified Tax Scheme, while medium and large businesses would benefit from input tax credits and simplified compliance.

They added that enhanced taxpayer education, digital payment platforms, electronic invoicing, and targeted market outreach would support voluntary compliance.

“With certainty in the system and fairness in implementation, compliance is expected to rise, the tax gap narrows, and revenue targets to be met,” the officials said.

Latest Stories

-

Job scam survivors warned as over 100 youths rescued in Ho trafficking bust

41 seconds -

None of Agenda 111 hospitals were operational before Akufo-Addo gov’t left office – Kwakye Ofosu

3 minutes -

Agenda 111 was rushed and poorly thought through – Kwakye Ofosu

4 minutes -

UK-Ghana JET programme urges faster decarbonisation of Ghana’s transport sector

6 minutes -

Trump says administration ‘reviewing everything’ after shooting of Alex Pretti

7 minutes -

Trump threatens Canada with 100% tariffs if it ‘makes a deal with China’

10 minutes -

Cambridge Centre for Alternative Finance Centre engages CDABI on digital asset regulation

13 minutes -

Refrain from using ‘machomen’ on election day – Owusu-Agyeman to aspirants

16 minutes -

Gold soars beyond $5,000 an ounce, boosting prospects for Ghana

18 minutes -

Heirs Holdings announces two new non-executive board appointments

19 minutes -

Gov’t to sustain accountability series amid positive public response – Felix Kwakye Ofosu

25 minutes -

Ghana experts call for renewed focus on HIV testing, education, and retention in care

29 minutes -

Galamsey mindset is dangerous and must be stopped once and for all – Vicky Bright

35 minutes -

Call for GTEC Deputy Director-General’s resignation is unfounded – Educationist

39 minutes -

Pay GH¢1bn to retired soldiers: It’s gratuity arrears under CI 129 – President directs

45 minutes