Audio By Carbonatix

The Ghana Publishing Company Limited has found itself under renewed scrutiny, amid debate over whether its recent performance reflects the impact of the current administration led by Nana Boatey, or whether credit should largely go to the former managing director, David Asante.

Founded as one of Ghana’s oldest state-owned enterprises, the company’s core business is the printing and publishing of books and stationery for educational institutions, government departments and the general public.

A significant share of its revenue is derived from the publication of government gazettes, alongside occasional large-scale jobs such as the printing of ballot papers during elections, the national budget and the 1992 Constitution.

For much of its history, the company has operated far from public view. Its financial performance rarely attracted attention, and its operations seldom made headlines.

That has changed in recent years. A more visible media presence, including activity on its YouTube channel and broader public engagement efforts, has brought the company back into focus.

With that visibility has come closer scrutiny of its operations. An examination of audited financial statements, State Interests and Governance Authority (SIGA) reports, and Auditor General reports dating back to 2011 shows a mixed but improving picture.

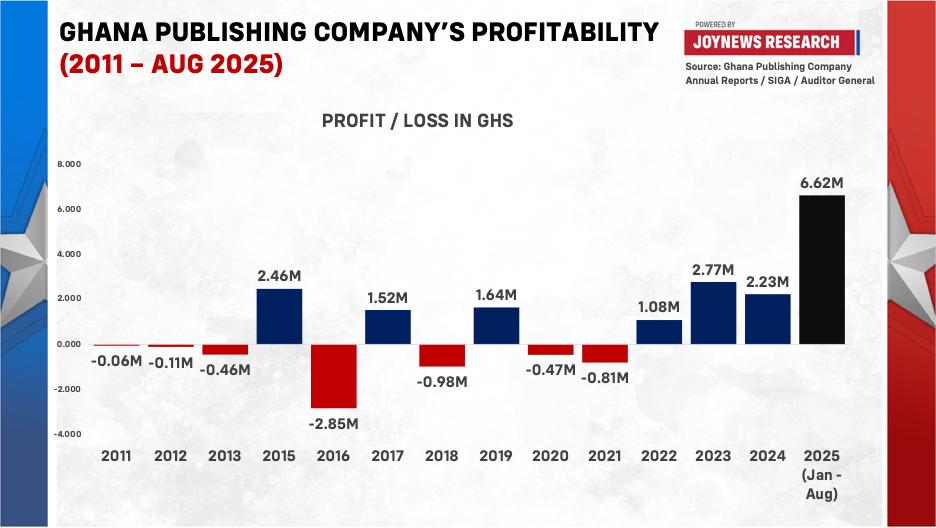

Over the past 14 years, the company has posted profits in seven of them, with recent performance in the first half of 2025 suggesting a notable turnaround.

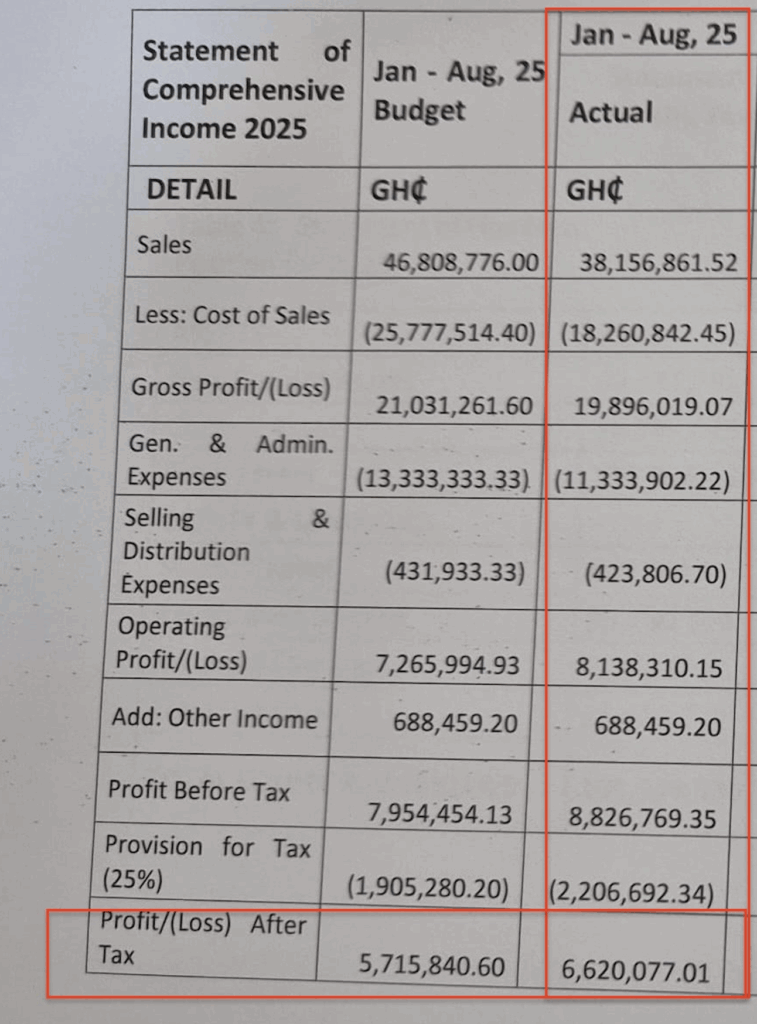

The company recorded profits in 2015, 2017, 2019, 2022, 2023 and 2024. Provisional figures from the company’s 2026 budget show that in the first eight months of 2025 alone, it generated a profit of GHS 6.6 million.

If sustained, that would mark the highest profit recorded by the company in at least 14 years.

Excluding the provisional 2025 figures, the strongest performance to date came in 2023, when the company posted a profit of GHS 2.7 million, followed by GHS 2.46 million in 2015.

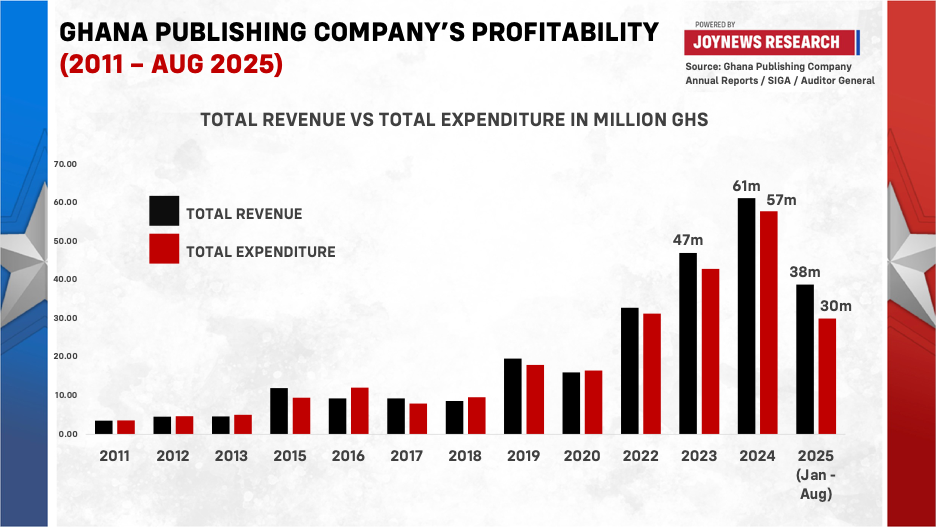

An analysis of income and expenditure trends also points to improving operational efficiency. Data show that in the first half of 2025, total expenditure was relatively lower compared with previous years when set against total income.

This marks a departure from earlier periods, when rising costs consistently eroded revenue gains.

This improvement has occurred despite notable spending in 2025, including the opening of a digital press centre, the acquisition of a new Land Cruiser for the managing director, and building renovations and upgrades.

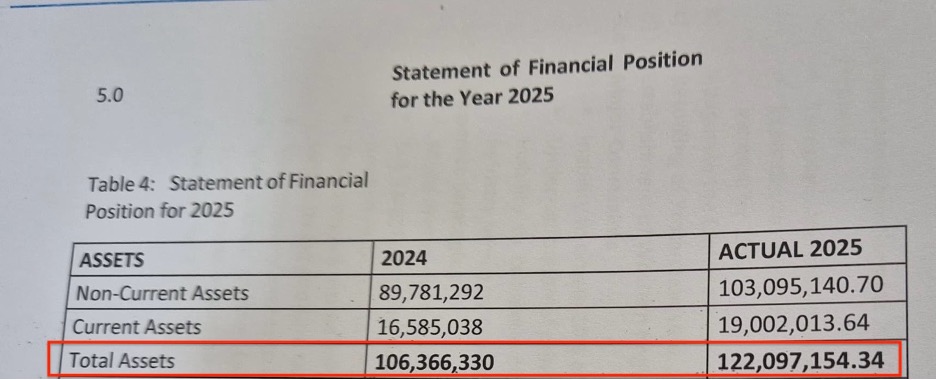

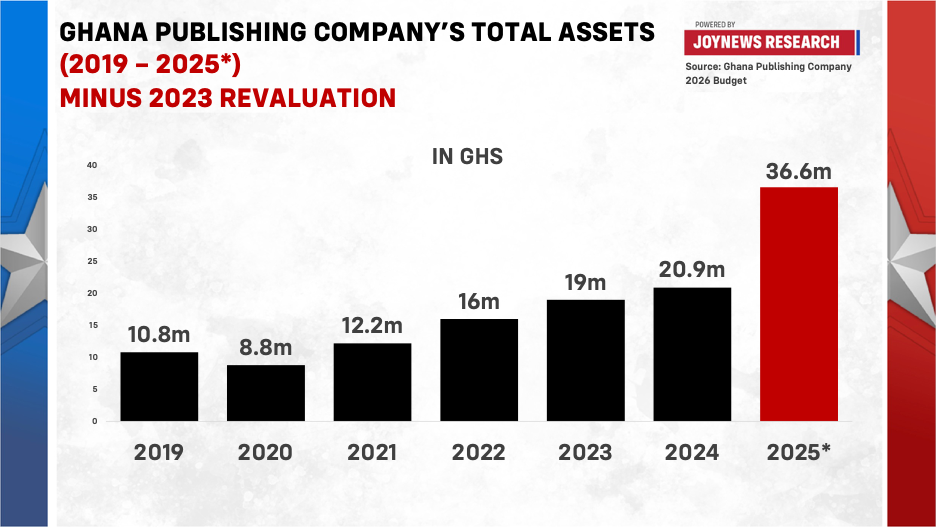

The asset position of the company also reflects this shift.

Tracking total assets from 2019 onward and excluding the impact of the 2023 revaluation surplus shows that 2025 recorded the largest single year increase in assets, at roughly GHS 15 million.

- Read also: FACT CHECK: Did Ghana Publishing Company really increase its asset base by 3,000% in 2023?

This represents the most significant addition to the company’s asset base since at least 2019.

What the data show clearly is that the Ghana Publishing Company has remained profitable since 2023, with 2025 shaping up to be its strongest year in more than a decade.

Whether this performance represents a durable turnaround will become clearer when the audited financial statements for 2025 are released, expected around June 2026.

Latest Stories

-

Leeds say boos during Ramadan pause ‘disappointing’

1 hour -

Premier League deletes Vicario social media post

2 hours -

Real Madrid beaten at home by Getafe for second successive loss

2 hours -

‘Clubs refused to look at me after my crash’ – Antonio on Qatar move

2 hours -

Mayweather to fight kickboxer before Pacquiao rematch

2 hours -

India and Canada reset ties with ‘landmark’ nuclear energy deal

2 hours -

Mahama should equally credit NPP for economic stability – Economist

2 hours -

Mbappe has knee sprain with no surgery planned

3 hours -

Interior Ministry releases funds to settle 2025 rent allowance arrears for security services

3 hours -

Ghana evacuates diplomatic staff from Iran; embassy shut indefinitely — Ablakwa

3 hours -

France to boost nuclear arsenal and extend deterrence to European allies

3 hours -

Chinese community in Ghana marks ‘Year of the Horse’ with grand new year festival

4 hours -

When regional instability becomes national risk: Ghanaian tomato traders killings

4 hours -

Photos: President Mahama meets Tanzania President Suluhu Hassan

4 hours -

Mahama calls for cessation of Iran-US-Israel conflict, urging return to dialogue

4 hours