Banks in the country have begun releasing their 2022 Financial Statement ahead of the April 30, 2023 deadline by the Bank of Ghana.

But the Domestic Debt Exchange Programme (DDEP) has impacted negatively on their profitability position.

According to the 2022 Audited Financial Statements sighted by Joy Business, almost all the banks that have published their statements recorded losses.

Standard Chartered Bank is one of them, as it recorded a loss of ¢66.4 million in 2022, compared to a profit of ¢410.8 million in 2021.

This is despite recording a staggering ¢807.7 million interest income in 2022.

As a result of the effect of the DDEP, the tier one bank made an impairment of ¢1.18 billion in 2022.

Similarly, Republic Bank registered a loss of ¢66.8 million in 2022.

It posted a net interest income of ¢370.6 million, but a ¢237 million loss on financial assets and other costs triggered the loss.

Again, GCB Bank lost ¢568 million in 2022, despite recording net interest income of ¢2.09 billion.

FNB, Stanbic, Zenith heavily impacted by DDEP

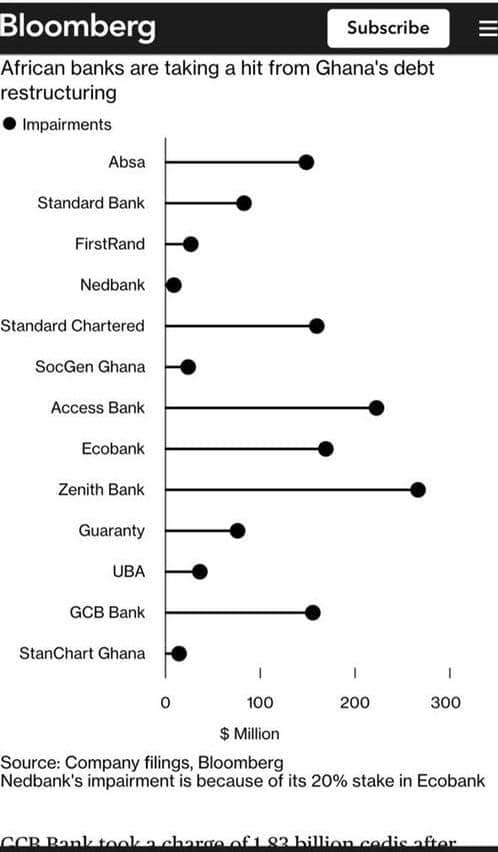

Parent companies of First National Bank, Stanbic, Zenith and Guaranty Trust Bank have already hinted of significant losses by their Ghana subsidiaries due to the impact of the DDEP on their operations. This will therefore require additional capital injection to turn things around.

For instance, Standard Bank said it was ready to re-capitalise its Ghanaian unit after making provisions to cover more than half of its holdings in the nation’s debt.

FirstRand Limited, Africa’s biggest bank by market capitalization, also hinted of writting off more than half the value of its holdings of Ghanaian bonds as the country grapples with a restructuring of its sovereign debt.

The banks had also indicated of slowing down lending until the Ghanaian economy improves.

The loss position of the banks means shareholders may not enjoy dividend for the 2022 financial year.

Societe Generale records ¢110.6m

Meanwhile, Societe Generale Bank is one of the few banks that recorded a profit in 2022.

The bank which was less exposed to the Government of Ghana bonds registered a profit of ¢110.6 million, lower than the ¢183.8 million recorded in 2021.

Joy Business had earlier reported that banks in Ghana lost about ¢15 billion in 2023 due to the DDEP

Latest Stories

-

Let’s live peacefully and shame our saboteurs – Savannah executives of NPP, NDC

28 mins -

Reconstruction of Agona-Nkwanta-Tarkwa road 80 per cent complete

35 mins -

Internet penetration: 10.7 million Ghanaians offline – LONDA Report

44 mins -

USC cancels grad ceremony as campus protests against Israel’s war in Gaza continue

48 mins -

Harvey Weinstein’s 2020 rape conviction overturned in New York

55 mins -

US Supreme Court divided on whether Trump can be prosecuted

58 mins -

There’s enough justification for Affirmative Action Bill to be passed – Minka-Premo

1 hour -

Don’t allow people to manipulate you into vaccine hesitancy – Dr Adipa-Adappoe

1 hour -

Suspend implementation of Planting for Food and Jobs 2.0 for 2024 – Stakeholders

1 hour -

Parkinson’s disease no longer confined to the elderly – Public Health Physician, Dr Momodou Cham warns

1 hour -

Persons living with Parkinson’s disease appeal for support as they face stigmatization

2 hours -

36-year-old-trader sentenced for stealing employer’s money

2 hours -

9 signs you’re falling in love with someone who thoroughly enjoys emotional manipulation

2 hours -

Catholic Diocese of Keta Akatsi hosts Parkinson’s support group meeting

2 hours -

Wa Naa appeals to Akufo-Addo to audit state lands in Wa

2 hours