Audio By Carbonatix

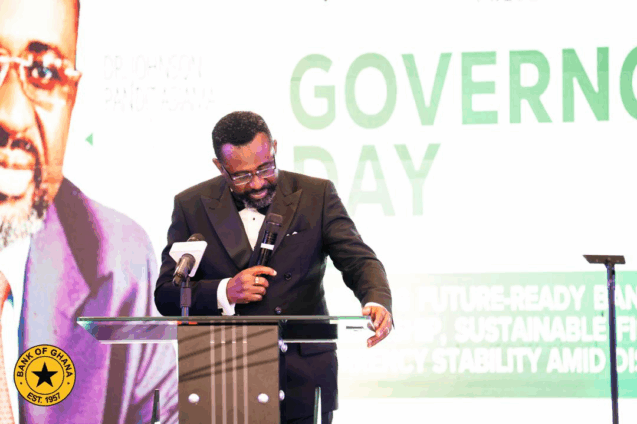

Bank of Ghana (BoG) Governor, Dr Johnson Asiama, says banking sector supervision will become more forward-looking and risk-based from 2026.

This is part of efforts to strengthen financial stability and responsible credit expansion.

He explained that the new approach will allow for more precise differentiation across banks, stronger governance, improved risk management, and rebuilt capital buffers, creating room for institutions to expand credit responsibly.

Dr Asiama was speaking at the Governor’s Day Programme organised by the Chartered Institute of Bankers.

He noted that supervision will increasingly sharpen its focus on the quality of intermediation, underwriting discipline, sectoral concentration, cash-flow analysis, and risk pricing.

“Credit growth will matter, but credit quality will matter more,” he stressed.

Governance

The Governor said expectations for boards and senior management will continue to rise, as governance is treated as a core pillar of financial stability.

“Governance will be treated as a core element of financial stability, with deeper engagement around risk appetite, internal controls, and accountability for outcomes,” he stated.

At the system level, Dr Asiama said reforms will move decisively from policy intent into routine practice, warning that tolerance for repeated weaknesses will be lower, even as regulatory engagement remains constructive.

Relationship with Banks

Dr Asiama said the central bank is also investing in how it works with regulated institutions, even as supervision tightens.

He explained that the Bank of Ghana will improve clarity of regulatory guidance, streamline internal processes, and provide more predictable timelines for approvals and regulatory engagement.

Markets and Digital Systems

On financial markets, the Governor said the focus will shift from recovery to depth and diversification, with greater mobilisation of long-term capital for a broader range of issuers and instruments, and stronger links between savings and productive investment.

He added that payments, settlement systems, data standards, and digital infrastructure will remain strategic priorities.

“Faster settlement, richer transaction data, interoperable platforms, and stronger fraud controls will increasingly define competitiveness and resilience,” he said.

Latest Stories

-

UCC to honour Veep Prof. Jane Opoku-Agyemang with Distinguished Fellow Award

2 minutes -

Rugby Africa enters a new chapter as national unions approve structural reforms at 17th AGM in Kampala

14 minutes -

Ghana falls 7 places in Global Mining Investment Attractiveness report

17 minutes -

MoFA lauds AGRA Ghana’s agriculture mechanisation interventions in Sekyere Central District

25 minutes -

MTN Ghana elevated to major subsidiary status within MTN Group

31 minutes -

Annoh-Dompreh inspects new Adoagyiri Health Centre Project, pledges full equipment support

46 minutes -

Beyond Personal Choice: Understanding the Social and Environmental Drivers of Overweight and Obesity in Ghana

50 minutes -

Political influence turned galamsey into a monster – Former CJ Sophia Akuffo

51 minutes -

ECOWAS urges restraint amid escalating tensions in Gulf region

54 minutes -

Liberia Embassy engages Ghana authorities over death of citizen in Accra

56 minutes -

Pedestrian struck by vehicle at Pokuase Interchange amid streetlight concerns

1 hour -

Fact Check: Mahama’s claim that over one million people found employment from 2025 Q1 to Q3 is false

1 hour -

Health Directorate cracks down on staff absenteeism to boost performance

1 hour -

Ghana honours 3 ex-servicemen whose death peaked anti-colonial campaign

1 hour -

Global InfoAnalytics poll tips NDC’s Baba Jamal to win Ayawaso East by-election with 75%

1 hour